Model 303 - Technical assistance

Skip information indexForm for paper submission of model 303 for 2022 and previous years (pre-declaration)

For paper submission, "Model 303. VAT Self-assessment" you have a form to fill out online and obtain the PDF with the declaration, previously validated by the server of the AEAT.

Since April 1, 2021, the requirements for access to the pre-declaration of model 303 have been modified.

Until now, this procedure allowed unauthenticated access, meaning that anyone could generate pre-declarations for any taxpayer eligible to file a pre-declaration.

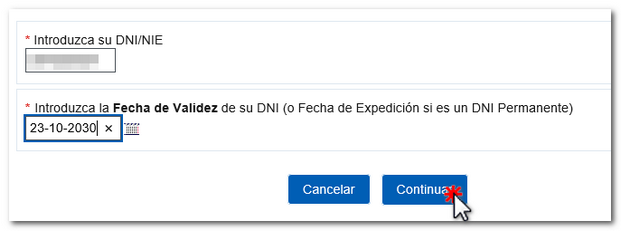

With the change implemented in the pre-declaration service of model 303, basic authentication is required: DNI + Validity date, if it is a permanent DNI the date of issue will be required, or NIE + support number.

Only NIF of natural persons will be accepted. In the case of entities, the NIF of the natural person making the declaration will be recorded.

As of May 2021, pre-declarations of natural persons may only list the authenticated holder as the holder of the pre-declaration. In the case of entities, the NIF of the natural person making the declaration will be entered and the details of the entity will subsequently be indicated on the form.

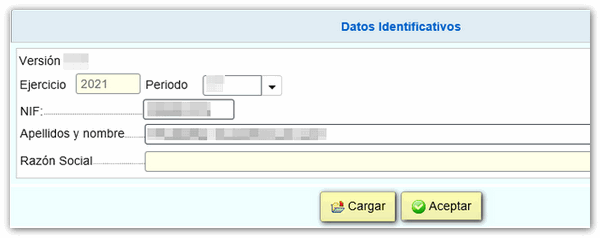

Fill in the Period, the NIF and the Surnames and first name or the Company Name. If you have a file previously generated from the form (SES extension), use the "Upload" button to retrieve the data. Otherwise, click "Accept".

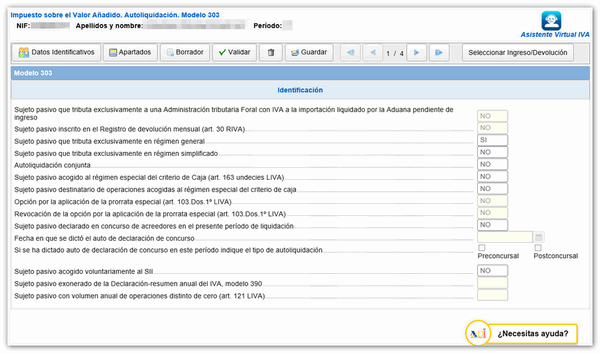

You will access the "Identification" window of model 303. Make sure you answer all the questions correctly (YES / NO).

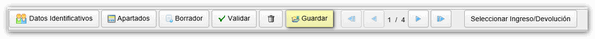

On the top button panel you will find all the functionalities of the model.

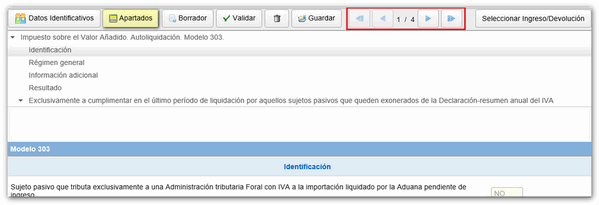

The " Identification data " button takes you to the previous window, where you can consult the data entered, modify some of them or load the data file (SES).

You can see the index of sections by clicking the " Sections " button or access the different pages with the navigation arrows.

Press " Draft " to obtain a PDF with the data entered so far. The document is not valid for presentation, but can be used for consultation.

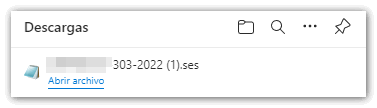

The " Save " button allows you to obtain a SES file with the declaration data, which you can later retrieve from the "Upload" option in the identification data window. The generation of the file does not require the declaration to be validated (it may contain errors or be incomplete). If you do not select a directory, this file will be automatically saved to the system "Downloads" folder or to the directory set by the browser to save downloaded files. The file will be named NIF of the declarant-303-exercise.ses

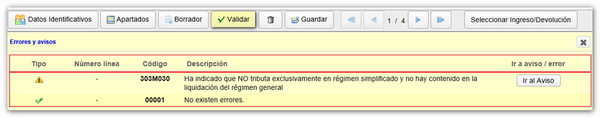

Before filing your return, use the " Validate " button to check for any warnings or errors. A list will appear with the "Errors and warnings" detected. The "Go to Notice" or "Go to Error" buttons will directly display the box or section that needs to be corrected.

Please remember that notices are for informational purposes only and do not prevent submission. On the contrary, errors must be corrected.

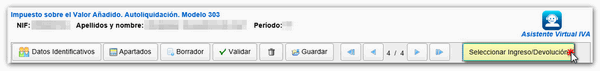

Go to the last page to check the result of the declaration. Press "Select Income/Return".

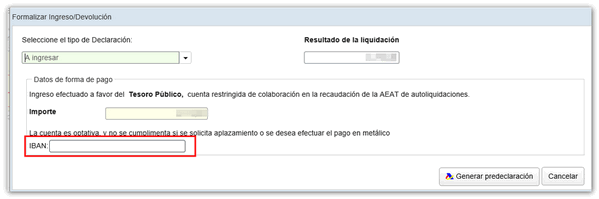

If the declaration type is "To be paid", the section to include the bank account will be enabled. It will not be necessary to complete it if payment is to be made in cash or if a deferral is to be requested.

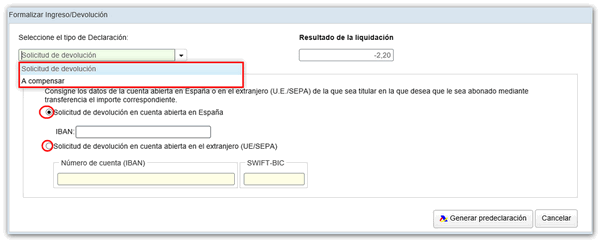

If the result is negative, select "To be offset" or "Refund request" (only for the last period). You must include an account number IBAN in which you appear as the account holder, where the refund will be made. It can be an account opened in Spain or abroad ( EU / SEPA ).

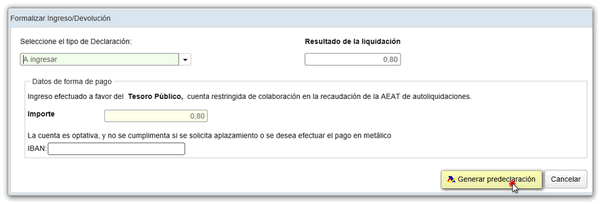

After selecting the type of declaration, and once the declaration has been validated without errors, press " Generate pre-declaration ".

A PDF will be generated with the content of the declaration in two copies, one for the taxpayer and one for the Collaborating Entity. which you must sign and deliver to the bank (if it is to be paid in or returned) or to the offices of the AEAT (to be returned and in other cases). Remember that you must write NIF on the Income or Return Document and sign it before submitting it.