Model 303 - Technical assistance

Skip information indexElectronic filing of Form 303 for the years 2019 to 2020, recovering data from previously filed returns.

You can access by identifying yourself with Cl@ve , certificate or DNI electronic. If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

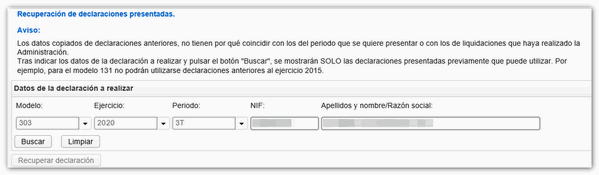

Enter the details of the declaration you are going to submit and press "Search" .

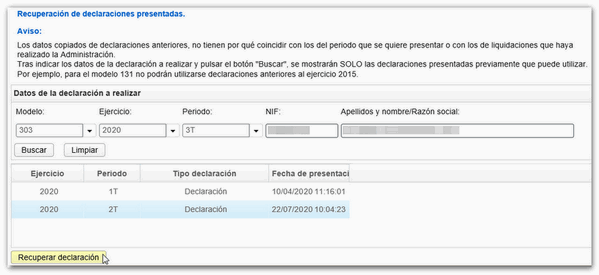

The submitted statements that can be used for data recovery will then be displayed. Select the appropriate one and press "Recover declaration".

Note: If no results are displayed, it is because there is no declaration that can be recovered with the data entered.

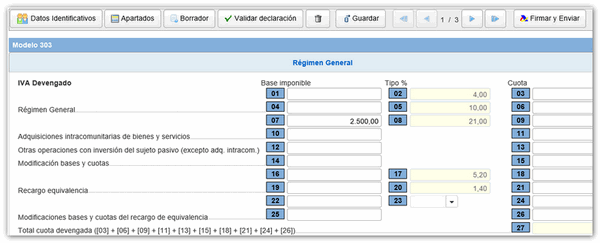

The completed form will then be displayed with the data from the previous declaration, except for those referring to the type of declaration: income, direct debit, recognition of debt, etc.

Please note that the data copied from previous declarations does not necessarily have to coincide with the data for the period to be submitted or with the data from the settlements made by the Administration. Modify the necessary data and then complete the rest of the settlement data before submitting the return.

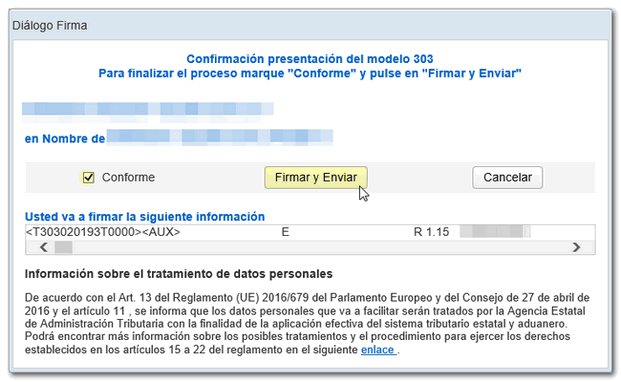

Once you have checked the result, select the type of declaration and click on " Sign and Send ". A window will appear with the encoded declaration information and the data of the filer and the declarant. Check the "I agree" box and press "Sign and Send" to complete the submission.

If everything is correct, a response sheet will be displayed with confirmation of the shipment. The embedded PDF contains a first page with the filing information (registration entry number, Secure Verification Code, receipt number, filing date and time, and filer details) and the full copy of the declaration on the subsequent pages.