Model 303 - Technical assistance

Skip information indexHow to file a corrective return to declare a larger refund

In the event that you have submitted a self-assessment of VAT of Form 303 with a result to be refunded and you want to correct it to request a larger refund, click on the link "Form 303. Exercise 2025. Presentation and help desk Pre303".

You can access by identifying yourself with Cl@ve , certificate or DNI electronic or eIDAS .

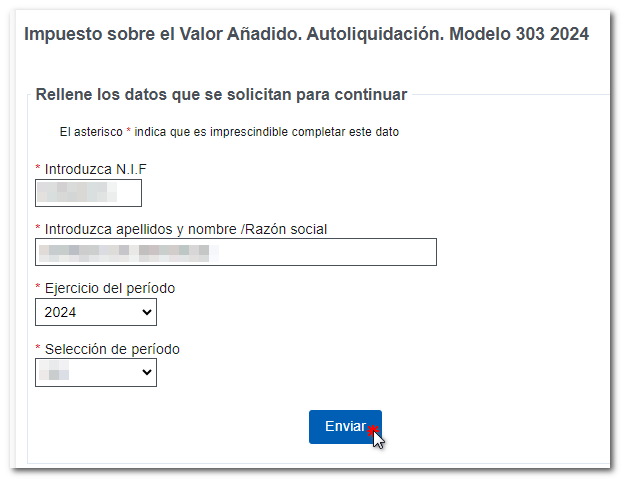

After identification, fill in the required data in the initial window: NIF , Surname and first name or company name and select the fiscal year and period for which you want to submit the corrective self-assessment. You can only file corrective returns for periods starting in September 2024 and Q3 2024. Then press "Send" .

In the next window click on "Continue with the Model 303 Presentation". Next, click on "Modify declaration" as the recommended option, although you can use the "Import", "Continue" and "New declaration" options.

Select the self-assessment you want to rectify and press "Accept".

The screen will show you the self-assessment that you submitted. Correct the data you consider necessary and then go to "Sections" to select the "Result" page.

Scroll down to the "Rectifying" section and check the "Rectifying self-assessment" box and indicate the receipt number of the self-assessment you want to rectify. In addition, you must indicate at least one of the reasons for the rectification.

In box 109, enter the amount from box 69 of the self-assessment that you are correcting, if the refund you requested has already been agreed. Otherwise, you must leave box 109 blank.

Even if box 69 of the previous self-assessment is negative, do not use the negative sign when completing box 109.

To check if there are any warnings or errors when completing the declaration, click on the " Validate " button. Remember that it is advisable to review the notices, although they do not prevent the filing of the declaration. If the declaration contains errors, these must be corrected.

If the return contains no errors, press the "Submit return" button.

In the declaration type, select "Refund Request", indicate the account number where you want to receive the refund that may be due in your case, and click "Sign and Send".

Finally, a window will appear with the information of the encoded declaration and the data of the presenter and the declarant. Check the "I agree" box and press "Sign and Send" to complete the submission.

If everything is correct, the response sheet will open with the message "Your submission has been successfully completed" and an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and, on the subsequent pages, the complete copy of the declaration. You can print or save document PDF .