Model 309 - Technical assistance

Skip information indexElectronic filing of form 309

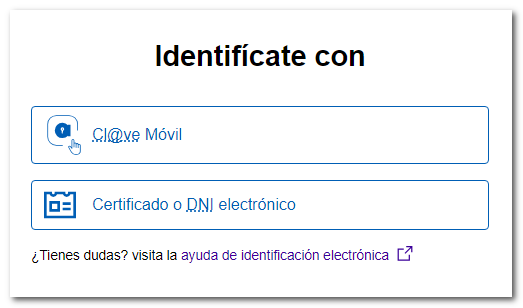

You can access by identifying yourself with Cl@ve , certificate or DNI electronic. If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

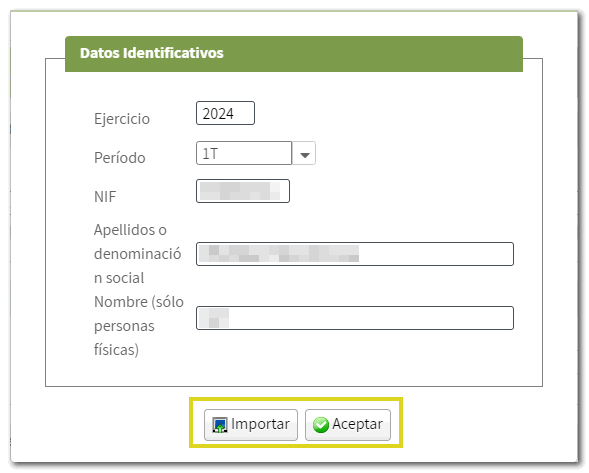

Once you have identified yourself, fill in the identification data, fiscal year and period of submission. From this window you can import a file generated with an external program or import a file generated with the form itself using the "Export" button that you will find when filing the declaration.

To complete the declaration directly in the form, click "Accept".

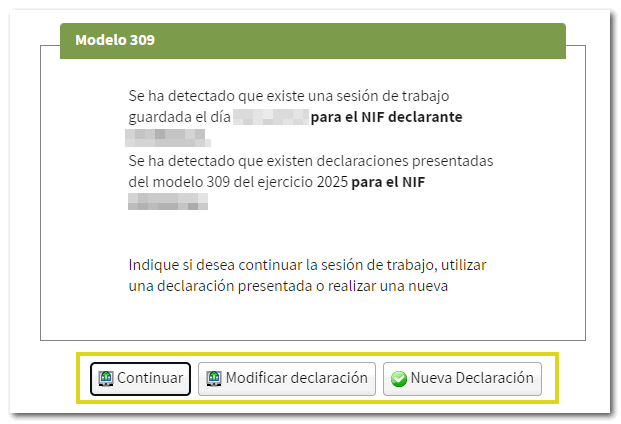

If you had a declaration previously saved in a previous session, you can recover it by clicking "Continue." If you have previously submitted a declaration for the same fiscal year and period, the application will inform you, giving you the option to modify it. Otherwise, click "New declaration."

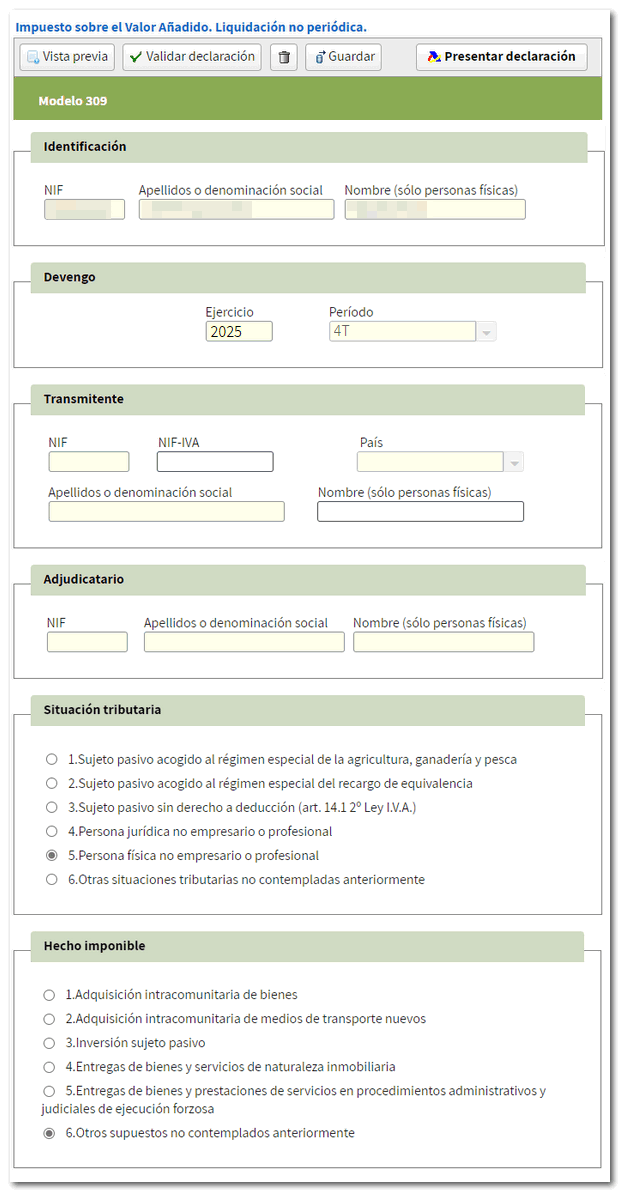

Fill in the form.

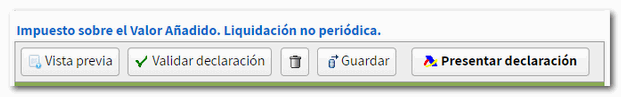

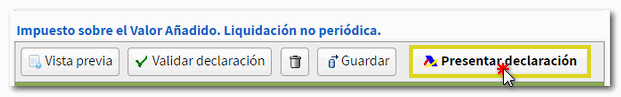

From the button bar at the top of the form, you can access the functions to obtain a draft, validate the declaration, delete data, save and submit the declaration.

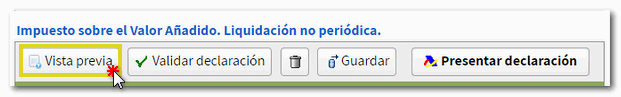

In "Preview" you get a draft in PDF with the data already filled in. Remember that it is not valid for filing the declaration but can serve as a reference.

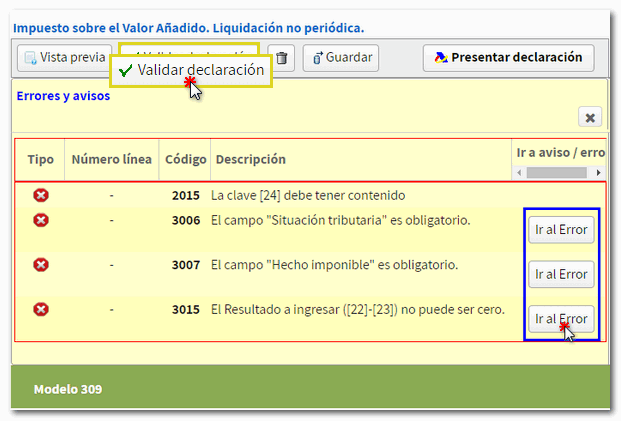

Before submitting the declaration, check if there are any warnings or errors using the " Validate declaration " button. The "Errors and Warnings" tab will appear with any detected warnings or errors. Remember that notices and warnings provide relevant information to take into account, but do not hinder the filing of the declaration. If the declaration contains errors, these must be corrected.

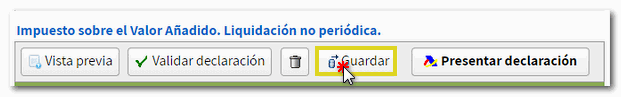

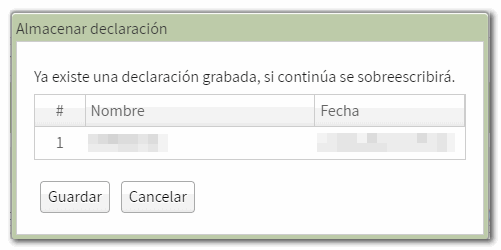

If you wish to continue at another time, you can use the " Save " option, which will store the data on the AEAT servers. If a previously saved statement already exists, it will be overwritten. You can recover the stored data by accessing the form again. After entering the identification data, you will receive a notice indicating that a saved work session has been detected, giving you the option to continue with it by clicking the "Continue" button.

Once the declaration has been completed and validated without errors, click on " Submit declaration " to proceed with sending the declaration.

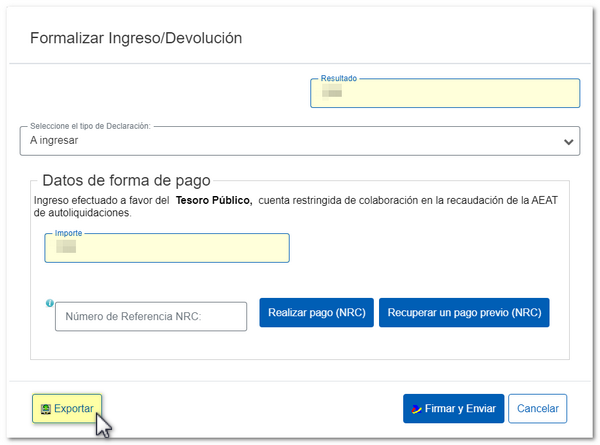

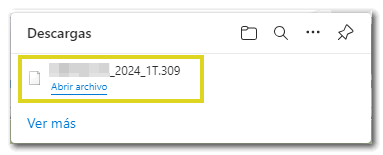

Using the "Export", you will get a file in the format BOE which you can import back into the form and which is valid for submission. The file name is made up of the NIF of the declarant, the exercise, the period and by the extension.309.

In declarations with a positive result, select the type of declaration from the available options (to be paid, direct debit, acknowledgment of debt, etc.).

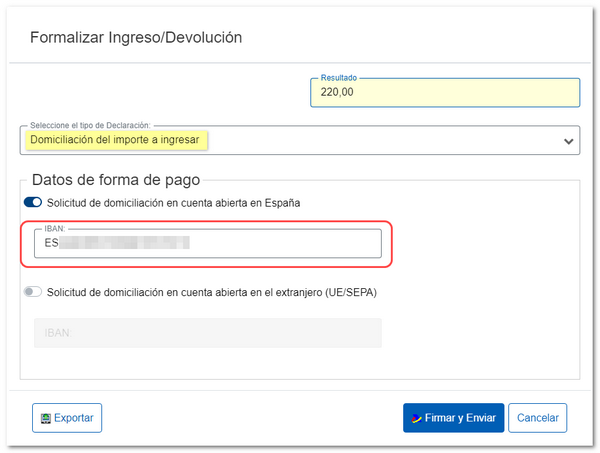

You can select the option Direct debit of the amount to be paid and indicate the IBAN of the account where you want the direct debit to be made.

NOTE : Consult the taxpayer calendar for the direct debit deadlines for each period.

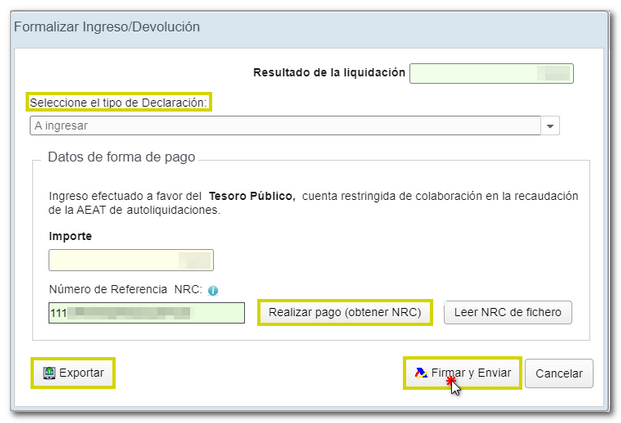

If you select the option To enter You will need to make the payment and obtain the NRC (Complete 22-character Reference Number that serves as proof of payment).

In the same window you will find the button "Make payment (NRC)", which links directly to the payment gateway to make the payment by debiting the account, or by card or Bizum.

You can also make the payment through the self-assessment payment procedures available on the Electronic Office website. AEAT or through the options offered by your bank.

The option "Recover a previous payment (NRC)" allows to recover a NRC of a payment made previously and which you wish to include for the self-assessment filing. This button will only be available for submissions made on one's own behalf and with power of attorney, not for social collaborators, and the details must match: model, exercise, period, NIF of the holder and amount to be deposited.

Once the payment has been made and the NRC by any of the aforementioned means, introduce the NRC in the corresponding box and press Sign and send.

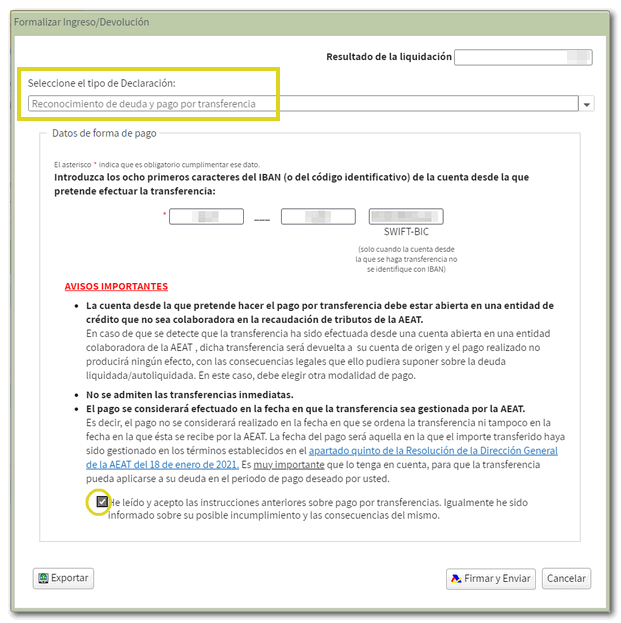

Model 309 offers different debt acknowledgment options. One of them is Acknowledgment of debt and payment by transfer which allows the use of a bank account opened in a NON-COLLABORATING Credit Institution, for example, a foreign account.

NOTE : Immediate transfers are not accepted.

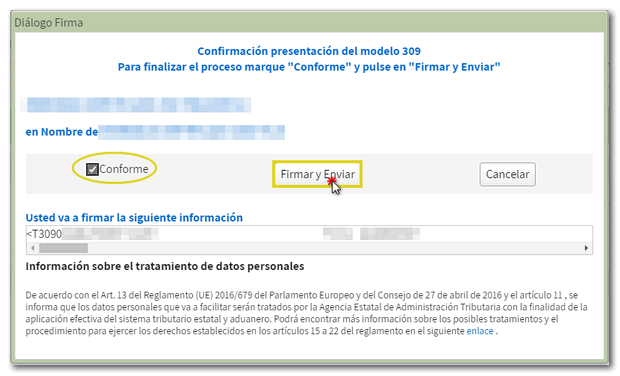

Once you have selected the appropriate income type and completed the necessary information, click on Sign and send. A window will appear with the encoded declaration information and the data of the filer and the declarant. Check the box According and press Sign and send to conclude the presentation.

If everything is correct, you will obtain the submission certificate in PDF whose first page contains the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and details of the submitter) and on subsequent pages the complete copy of the declaration.

In cases where there is recognition of debt , a link to submit the deferral or compensation request will be displayed in the report of the completed submission.

Press " Process debt " and the settlement details will appear with the debtor's data and the settlement code. Select one of the available options (defer, offset or pay) to continue.