Model 309 - Technical assistance

Skip information indexFiling of Form 309 on paper with pre-declaration

For the paper submission of model 309, you have a form to fill out online and obtain the PDF with the declaration previously validated by the AEAT server.

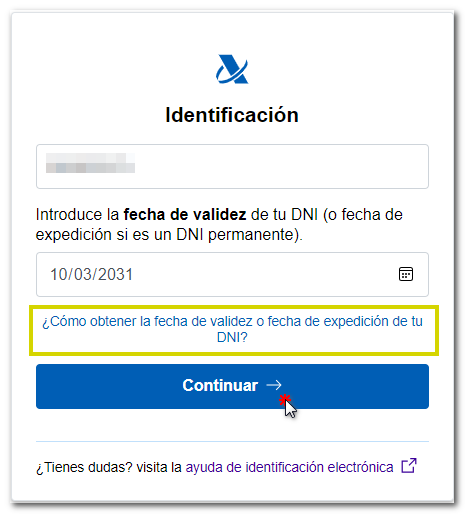

To access the pre-declaration, basic authentication will be required: DNI + Validity date (or the issue date if it is a permanent DNI ) or NIE + support number.

Pre-declarations of natural persons may only list the authenticated holder as the holder of the pre-declaration. In the case of entities, the NIF of the natural person making the declaration will be entered and the details of the entity will subsequently be indicated on the form.

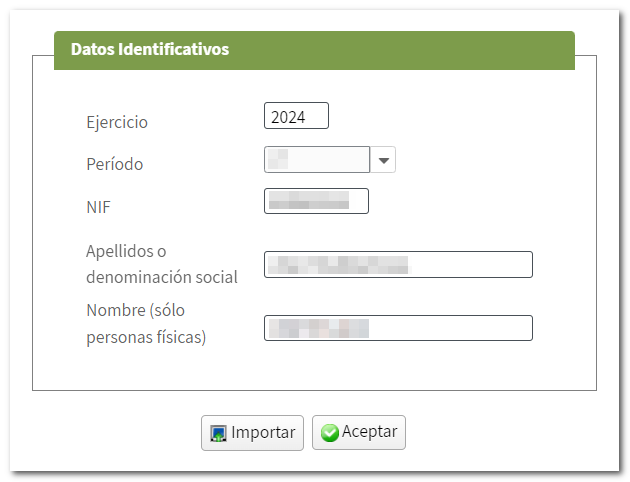

Indicate the requested identification data. From this window you can import a file that matches the current registration design generated with an external program or import a file generated with the form itself using the "Export" button that you will find when filing the declaration.

To complete the declaration directly in the form, click "Accept"

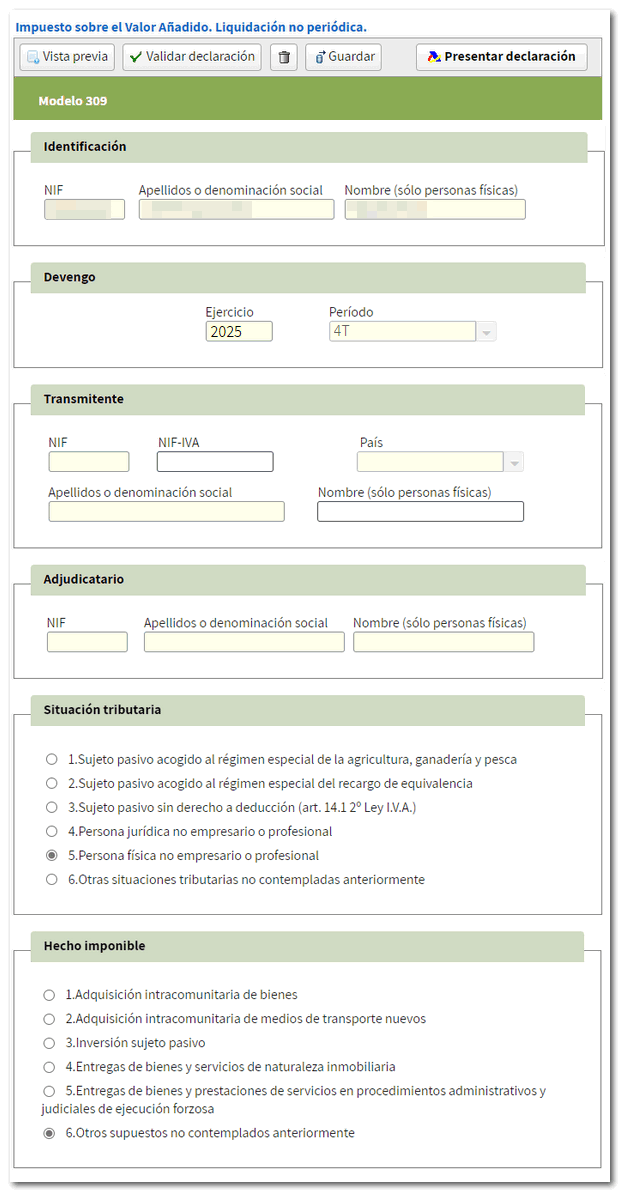

Then complete the declaration.

In the button bar located at the top of the form you have several utilities:

-

" Preview " to obtain a PDF draft of the declaration, which is not valid for filing but can be used for reference.

-

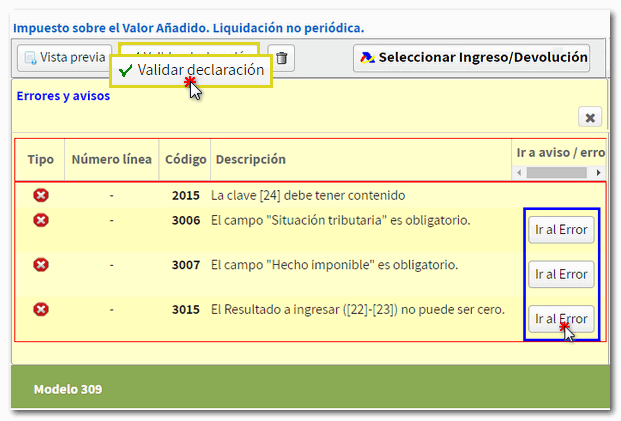

" Validate declaration " to check that the declaration has been completed correctly.

Before generating the pre-declaration, check if there are any warnings or errors by clicking on the " Validate declaration " button. A list of detected errors and warnings will open at the bottom. The "Go to Error" or "Go to Notice" buttons will take you directly to the section or box that you need to correct or review. Remember that the notices provide relevant information to take into account, but do not hinder the filing of the declaration. If the declaration contains errors, these must be corrected.

-

" Delete declaration " identified by a trash can icon, deletes all data entered in the declaration.

-

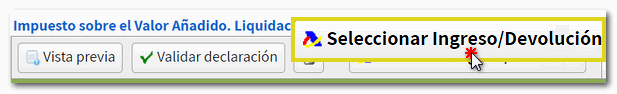

" Select Income/Return " to obtain the PDF with the content of the declaration you are going to submit.

Once completed correctly and without errors, click on the button " Select Income/Refund " located on the bottom button bar.

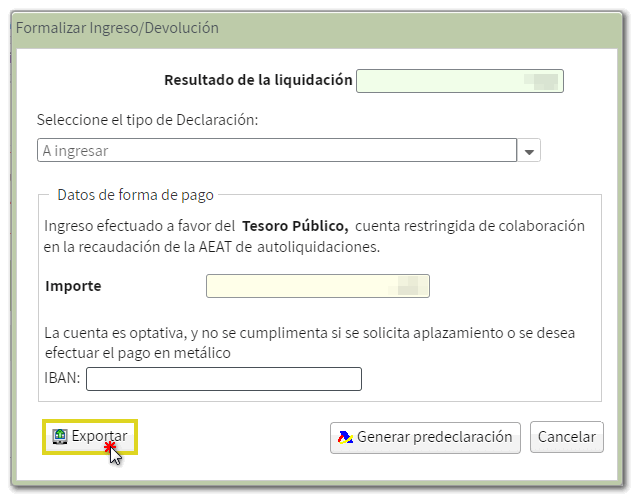

If the selected declaration type is "To be paid", the "Payment method details" section will be enabled, where you can optionally include the bank account in which the charge will be made. Field IBAN is not filled in if a deferral is requested or if payment is to be made in cash.

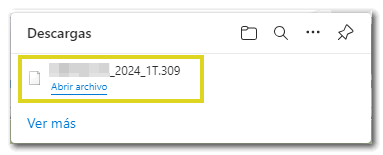

From this same window you can obtain a file with the format of the published logical design with the name NIF_ejercicio_periodo and extension .309 from the " Export " button. You can import this file in the initial "Identification data" window using the "Import" button.

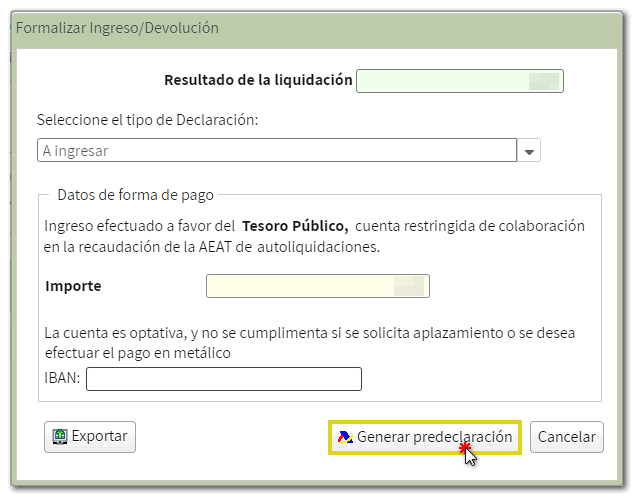

To finish, press " Generate pre-declaration ".

A PDF will be generated with the content of the declaration in two copies, one for the taxpayer and another for the Collaborating Entity, which you must sign and deliver to the Collaborating Entity if it is to be entered. Remember to write the NIF on the Income or Refund Document and sign it before submitting it.