Income Management offered by APP-AEAT

Skip information indexSecurities portfolio

The Securities Portfolio application allows the automatic transfer of portfolio data to Renta WEB. Its main objective is to help taxpayers declare capital gains and losses obtained from securities transactions. These data will be obtained automatically through Informative Declarations 189 and 198 and can be edited by the taxpayer in the application.

Access to the application

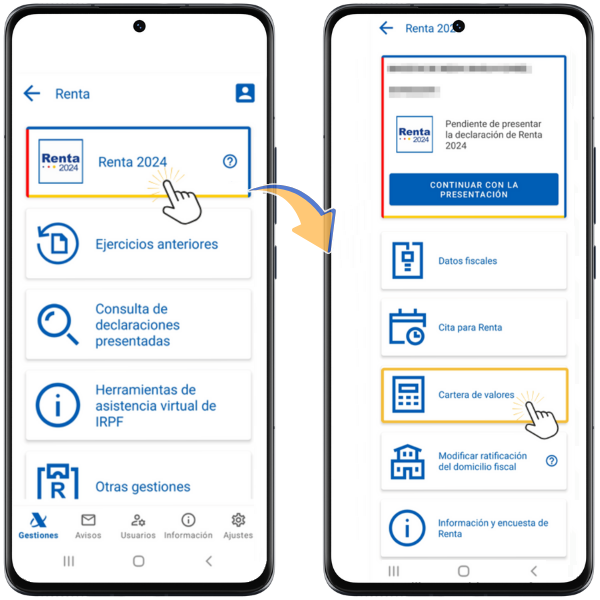

You can access the Securities Portfolio in the APP AEAT , from the "Management" section by clicking on "Income", "Income 2024", "Securities Portfolio".

Portfolio Interface

Once you have identified yourself with your active APP user AEAT by reference, with Cl@ve or with a certificate/ DNI electronic you will access the main screen of the application with these options:

-

First of all a quick view of the values pending regularization , with errors or warnings.

-

Next, a search engine that allows you to locate a value more easily by entering it and clicking on the magnifying glass icon, and a filter (icon with lines) to locate certain values according to their status: "All values", "With errors and warnings", "With warnings" and "With errors". You will also find the filter at the end of the entered values.

-

In the central part is list of values match the selected filters. Default, "All values".

-

At the bottom is the button " Results " and a button with three dots that leads to useful information , such as links to explanatory videos, help and the manual, as well as access to home, results and changing work portfolio.

Operation

To add a value, press the button "New value" , provide the NIF or ISIN of the value and a description. Press the "Save" button.

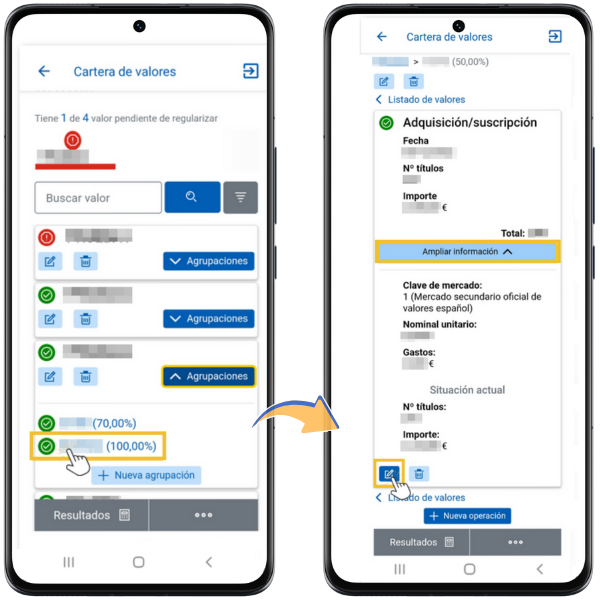

You can edit the value information by clicking the pencil icon or delete it using the trash can icon. In addition, by clicking on "Groupings" the value groupings will be displayed and from the button "New grouping" the corresponding groupings can be added, providing a description and the percentage of ownership. Then press the "Save" button.

From the detail of a "Grouping" you can add operations or modify operations that were already loaded in the application.

To create a transaction, press the button "New transaction" and fill in the type of transaction, date of the transaction, market key, number of securities, amount, nominal value per unit and expenses. Press "Save" to record the log.

To modify an operation, select it, press the button "More information" and, at the bottom of the window, "Edit" identified by the pencil icon. Modify the necessary data and press "Save". If you want to delete the operation, press the "Delete" button identified by the trash can icon.

Note: Values, groupings, and operations you delete cannot be recovered.

If you want to return to the list of your values, click on the phrase " List of values ".

Types of operations

You can identify the status of operations by the following icons:

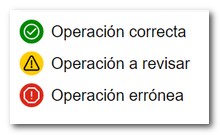

- Green circle with check mark : correct operation.

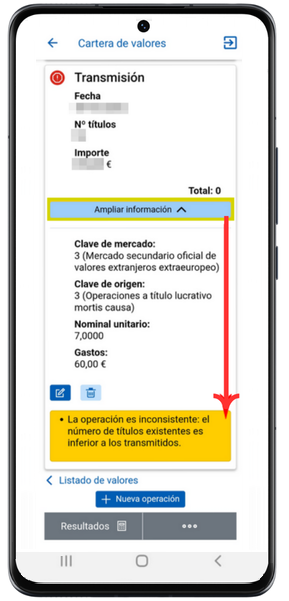

- Yellow circle with warning sign : operation that needs to be reviewed. Notices may or may not be corrected, as transfer to Renta WEB is permitted.

- Red circle with exclamation mark : erroneous operation, which needs to be corrected to make the portfolio consistent and thus be able to transfer the data to Renta WEB.

An incorrect operation also invalidates the grouping and the value to which it belongs. To make the portfolio consistent and to be able to transfer the data to Renta WEB, it is advisable to correct the first incorrect operation as it can automatically validate the rest of the operations.

By accessing the operation details from "More information" , you can check what the error detected is.

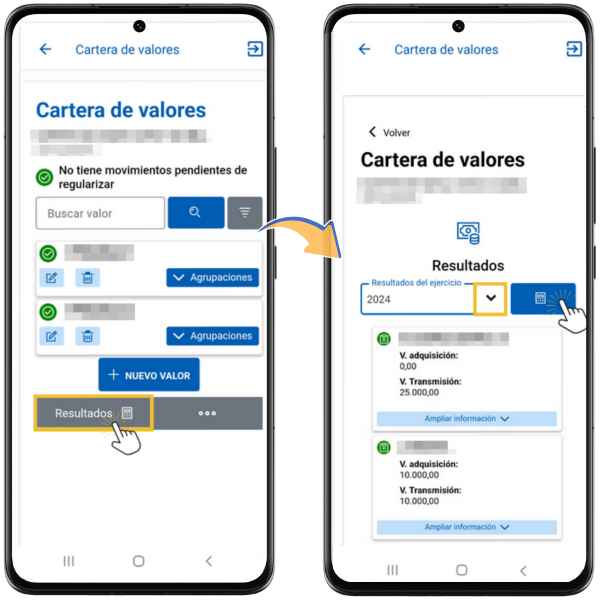

Results

Once you have completed entering and reviewing data in the portfolio, you can check the acquisition and transmission values calculated for the different years using the "Results" button. Select the exercise and press the button with the calculator icon.

The values that will be transferred to Renta WEB in each fiscal year will be reported. Only those values that have tax significance for Income will appear.

In order for the results information to be transferred to Renta WEB, all the values in the portfolio must be correct or have warnings. If there is any incorrect value, the portfolio is inconsistent and no data will be transferred.

To reset the portfolio and recover the data that was initially loaded into the portfolio (which is the data available to the Tax Agency) before making the changes, there is the option "Change work portfolio" , "Reset portfolio" which you can access from the three-dot button at the bottom.

NOTE : Please note that any changes you have made manually in this exercise and in previous exercises will be lost; only the information sent by third parties will be reflected.

Synchronization with Renta WEB

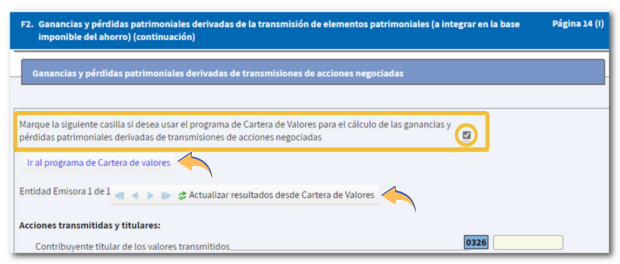

In order for the data to be transferred from the Securities Portfolio to Renta WEB, in addition to it being a consistent portfolio, it is necessary that the corresponding box is checked in section F2 of your declaration, which may be checked by default depending on the tax data or it will be the taxpayer himself who chooses to check it or not.

If it is detected that for that NIF there have been changes in the Securities Portfolio, both applications are synchronized and transfer the data to the declaration. You can update the result from the Securities Portfolio and you will have a link to said application.