Income Management offered by APP-AEAT

Skip information indexModify ratification of tax domicile

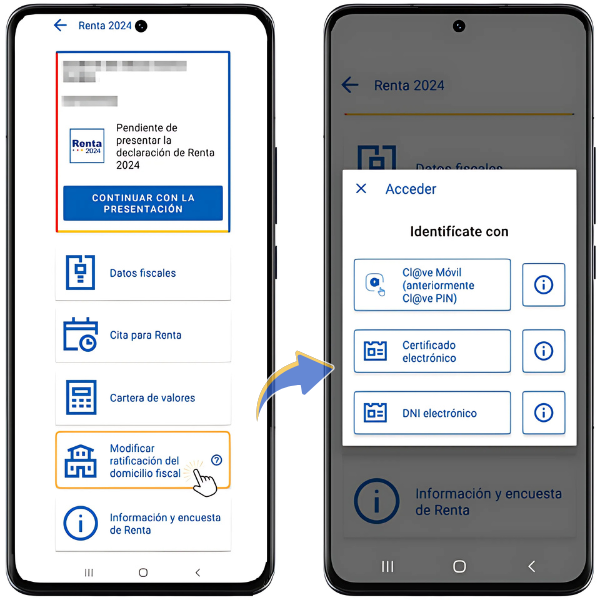

Option "Modify tax domicile ratification" allows you to consult and modify the habitual domicile that has been previously ratified when accessing an Income Tax service. Access through this independent option requires identification with Cl@ve , electronic certificate or DNIe (Android devices only).

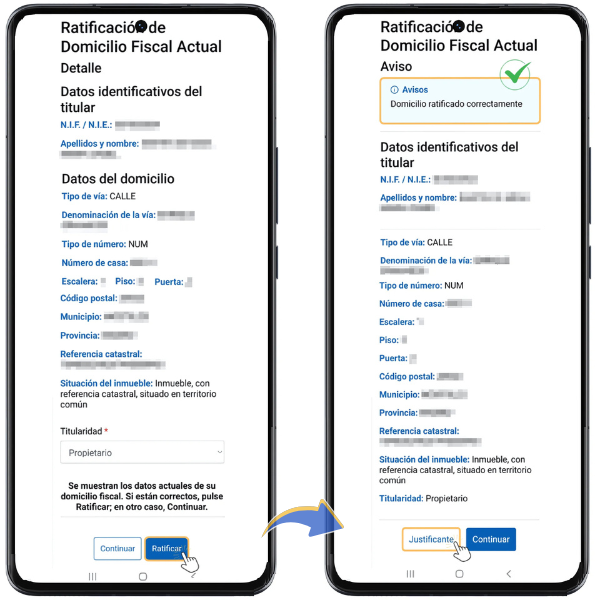

The details of the tax domicile that appears in the Tax Agency census will be displayed on the screen, including the ownership of the property, unless you have made a change of tax domicile after the ratification of the domicile of the previous year, in which case we will ask you to select it again in the "Ownership" drop-down menu.

The APP also includes the confirmation of the tax domicile of the spouse and children, if they have not yet confirmed it. Therefore, in declarations with a spouse and descendants, once the spouse and descendants have been identified, you will be connected to the Ratification application so that you can ratify their address.

At the bottom it indicates the ownership. If you select the "Tenant" key, you must indicate the NIF of the landlord. If the person does not reside in Spain and does not have NIF , indicate their identification number in their country of residence.

If you own several addresses and the one that appears is not correct, click the "Continue" button and select the address where you have your habitual residence by clicking on the address of the property.

If the data is not correct, press the "Modify" button, then enter the cadastral reference of the habitual residence to continue with the ratification.

If they are correct, click "Ratify".

Please note that this confirmation is requested when accessing the Renta services.

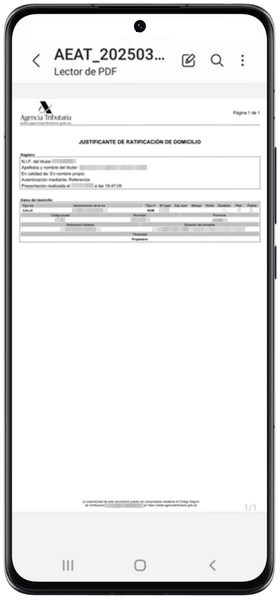

Once the address has been confirmed, you can download the proof in PDF .