How to request a deferral or compensation after filing the Income Tax return

In the event that it is not possible to complete the processing of the submission of a request for deferral, installment or compensation associated with a debt resulting from the submission of a self-assessment of PIT, you can repeat the procedure through the option "Request for deferral/compensation of income" within the Revenue Services.

Access requires identification using Cl@ve Mobile, electronic certificate, , DNIe reference number or, if you are a citizen of the EU, with the identification of another country (eIDAS).

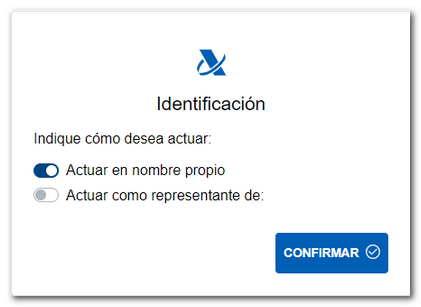

The procedure can be carried out on your own behalf or on behalf of third parties.

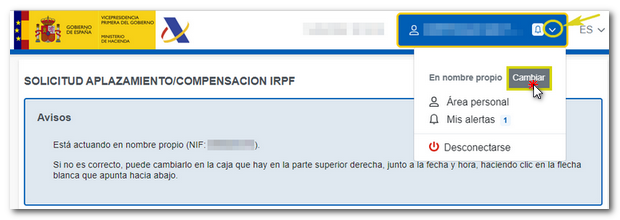

If you are accessing on your own behalf or as a representative and you want to change it, in the next window you can also modify it again in the box at the top (next to the date and time) by clicking on the white arrow pointing downwards.

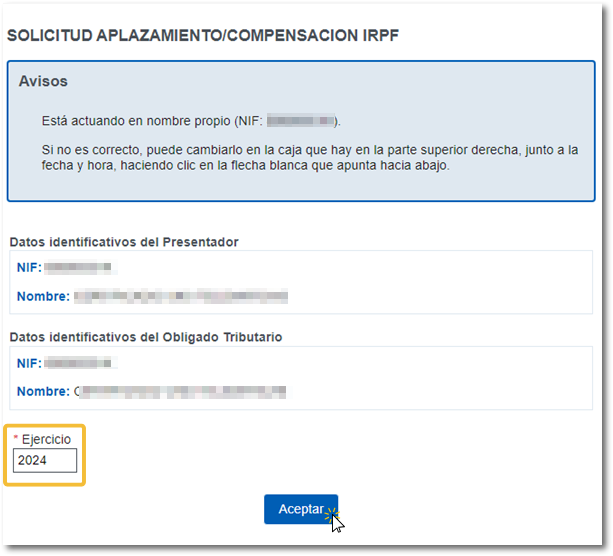

Next, select the fiscal year to which the debt corresponds. The rest of the data, both of the presenter and the taxpayer, cannot be modified. Click "Accept".

In the following window, a list of the debts of PIT of the selected fiscal year registered for the debtor and that are ready to be processed by this option.

NOTE : This option is only valid for debts PIT and that have not evolved in their management.

Click on the link in the "Settlement Key" column for each debt to access the next page.

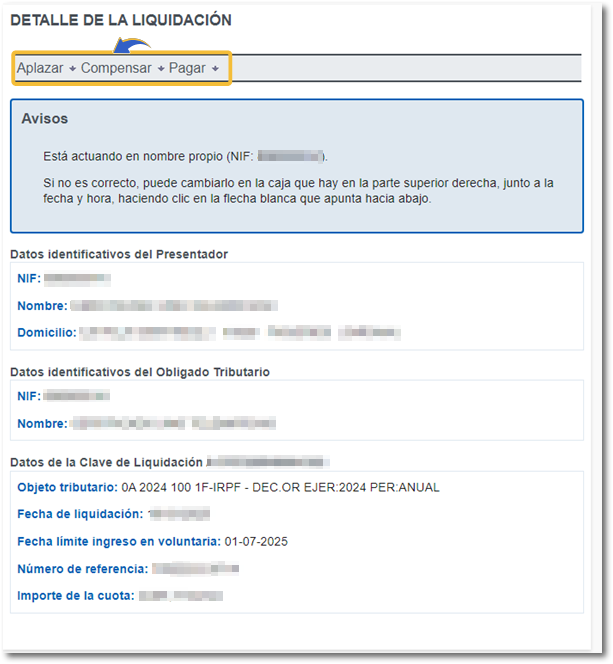

You will receive a page with the information regarding the identification data of the filer, the identification data of the taxpayer and the settlement key data.

At the top are the available options: "Defer", "Offset" and "Pay".

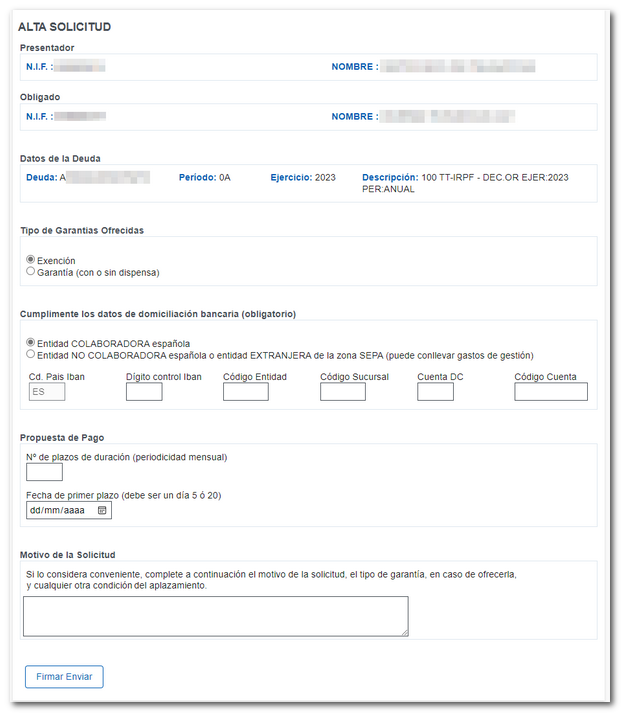

To start the deferral or installment payment request, click on " Defer ". Fill in the form details, such as the type of guarantee, the direct debit details, the number of installments and the date of the first installment (5th or 20th of each month); In addition, if you consider it appropriate, indicate the reason for the request. Then press "Sign Send".

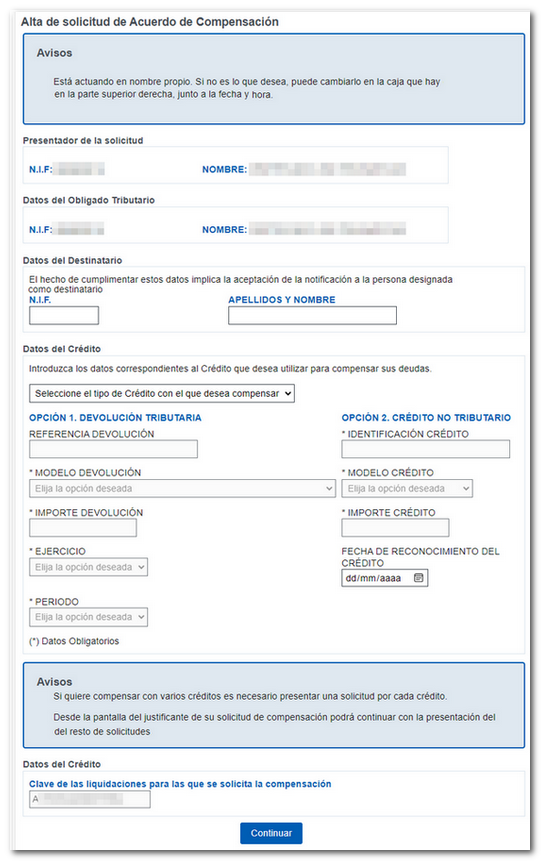

To request compensation, click on " Compensate ". Select the type of credit with which you wish to offset the debt. If you want to offset several credits, it is necessary to submit an application for each credit.

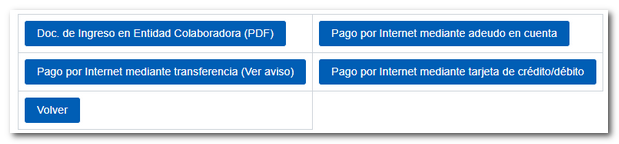

Click on " Pay " if you wish to pay the debt, either through the payment gateway of the AEAT with credit/debit card, by direct debit or by transfer or either by printing the PDF of the payment document to present it at a Collaborating Entity (Bank or Savings Bank) or using the services available to the EEFF on the Internet.

If you choose to pay online through the AEAT payment gateway by transfer , the account must be opened in a Credit Institution that IS NOT A COLLABORATOR in the collection of taxes of the AEAT .

IMPORTANT NOTES:

-

The request for deferral, installment payment or compensation of one debt at a time can only be processed . If you want to process several debts in the same deferral or installment, you must do so using the deferral, installment or compensation request site option by following the route:

-

"Home", "Debts, seizures, embargoes, auctions, and contests", "Compensations", "Presentation of compensation applications".

-

"Home", "Debts, seizures, embargoes, auctions, and contests", "Pay, Defer and Consult", "Request deferral or fractioning of debts".

-

-

If the debt has evolved , for example, the deadline for voluntary payment has expired or it has been enforced, it is no longer possible to carry out the processing through this venue option, and you must do it through the deferral request venue option following the route:

-

"Home", "Debts, seizures, embargoes, auctions, and contests", "Compensations", "Presentation of compensation applications".

-

"Home", "Debts, seizures, embargoes, auctions, and contests", "Pay, Defer and Consult", "Request deferral or fractioning of debts".

-