Forms 036 and 037

Skip information indexElectronic submission of form 036

The link "Completion and electronic submission of 036" is available in the list of procedures for "Models 036 and 037" in the Electronic Office.

You can access by identifying yourself with Cl@ve , certificate or DNIe . If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

When completing the form, the characters included in the following list must be used:

| CHARACTER | TEXT | DECIMAL CODE | HEX CODE. |

|---|---|---|---|

| White | 32 | 20 | |

| & | Ampersand | 38 | 26 |

| Ç | Comilla | 39 | 27 |

| ( | Stop. Dr. | 40 | 28 |

| ) | Stop. Left. | 41 | 29 |

| , | Eat | 44 | 2 C |

| - | Script | 45 | 2D |

| . | Spot | 46 | 2E |

| / | Bar | 47 | 2F |

| 0-9 | Numbers | 48-57 | 30-39 |

| : | Two points | 58 | 3A |

| ; | Semicolon | 59 | 3B |

| A-Z | Letters | 65-90 | 41-5A |

| _ | Underscore | 95 | 5F |

| Ç | Cedilla | 199 | C7 |

| " | Double quote |

The @ character can also be used in the email field.

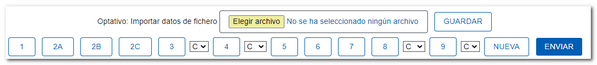

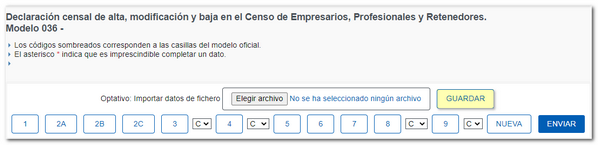

At the beginning of the form you have the option "Optional: Import data from file" if you want to import a file generated with a program other than AEAT using the "Choose file" button. This file must be constructed in plain text (.txt) without any type of formatting and conform to the logical design of the current model and taking into account the characters included in the table above. You can find the registration design for model 036 for electronic submission and the rest of the requirements in the "Information" and "Help" sections of the model.

The form for model 036 also allows you to save the declaration generated with our form to retrieve it later, by clicking on "SAVE".

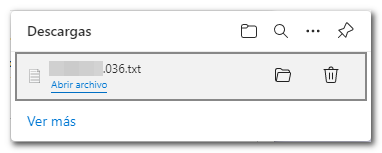

If you press "Save" a file of type NIF will be saved. 036.txt to the "Downloads" folder or to the default location in your browser.

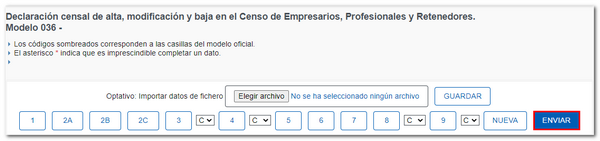

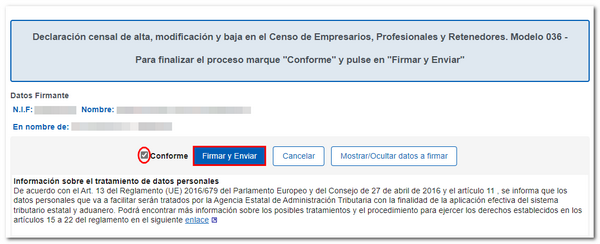

To submit the declaration, click the "Send" button. In the next window, check the "I agree" box and click "Sign and Send." If there are errors, they will be indicated so that they can be resolved.

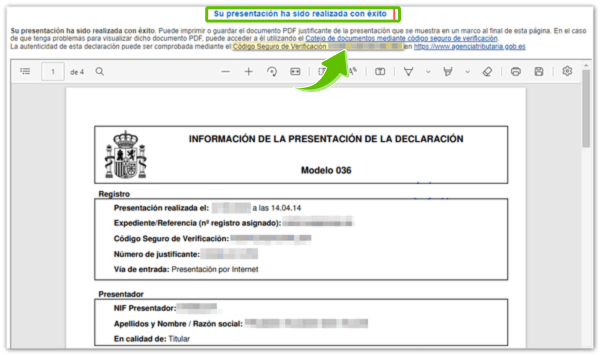

The result of a correct submission of a form 036 will be a response sheet with the text "Your submission has been made successfully" with an embedded PDF containing a first sheet with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and details of the submitter) and, on the subsequent pages, the complete copy of the declaration.

There are cases in which it will be necessary to provide supporting documentation to process the option or reason for which form 036 is submitted. In these cases, the proof of submission that the taxpayer will obtain will contain an indication warning that the submission will not take effect until the required documentation has been submitted and verified.

To submit the required documentation you can access with electronic certificate, DNIe or Cl@ve through the "Provide additional documentation" option. This application allows the transmission of documents in various formats that will be linked to the declaration by means of the file number or electronic reference.

You can also make changes to your census data if you access the "My census data" section with an electronic certificate, DNIe or Cl@ve .

If you do not have an electronic certificate, DNIe or Cl@ve , you can access the option "Completion, validation and obtaining in PDF for printing 036" (requires a PDF document viewer installed). Once the data has been completed in the form, the declaration will be generated in PDF , which you can print to present where appropriate along with the necessary documentation.