Forms 036 and 037

Skip information indexRequest for assignment of NIF to entity

This non-face-to-face service has been developed to facilitate the submission of the application for assignment of NIF to entities (Form 036), with the aim of maintaining the service to citizens, without the need for them to carry out the procedure in person, nor the guarantees required by the law being diminished.

The submission of the application for assignment of provisional NIF to entities without requiring their appearance at the office, will be accepted in the Electronic Registry of the Tax Agency, in procedure "Models 036 and 037 - Application for assignment of NIF to entity - non-presential ".

To do this, the presenter, who may be any person given that the presentation of Form 036 is a procedural act, must have a recognized electronic certificate that allows him/her to authenticate himself/herself in the Electronic Office of the AEAT and must follow the following steps:

-

Obtaining the validated Model 036 in PDF format

-

Additional scanned documentation

-

Submission of Form 036 in PDF and the additional documentation required in the electronic Registry of the Tax Agency in the procedure " Request for assignment of NIF to entity ".

STEP 1.- Obtaining the validated Model 036 in PDF

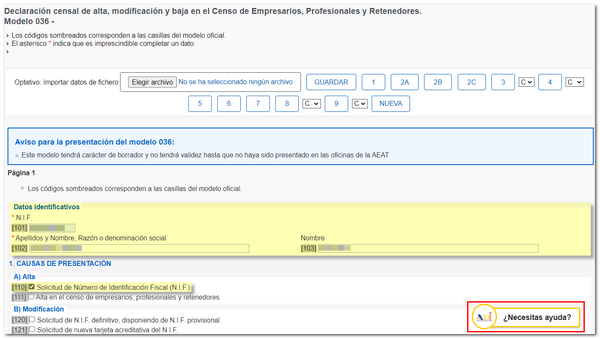

To obtain form 036, access the form "Completion, validation and obtaining in PDF for printing 036", which you will find within the list of procedures for the "Forms 036 and 037" procedure.

Access does not require identification with Cl@ve or electronic certificate.

The form is completed online and, after validation by the AEAT server, the PDF of the pre-declaration of Model 036 (draft of Model 036) is obtained to print, sign and submit to the NIF. In the form, the fields of the company name and the sections of model 036 necessary to process your request for assignment of the NIF must be completed:

Page 1 .- Reasons for filing, date and signature

- Cause box 110 “Application for tax identification number ( AEAT ) and

- Place, Date and signature of the declaration (mandatory, by the owner(s) or their representative.

Page 2 B or 2 C (if it is a permanent establishment)

- Identification data of the entity; residence/ incorporation/ NIF other countries, if applicable.

- Telephone and email address information to receive notifications from AEAT (to be completed if the presenter wants to receive information notices and especially information on the assigned NIF ).

- Assignment of tax address (mandatory).

- Assignment of tax domicile abroad (if the taxpayer is a non-resident, and marks the domicile abroad as his/her tax domicile, it will be mandatory; otherwise, it is optional if he/she has already indicated a tax domicile in Spain) (only on page 2B since EEPP, although they are not tax residents in Spain, must communicate an domicile in Spain).

- Registered office if different from the tax office (only on page 2B).

- Assignment of the address for notification purposes (always in Spain and is optional).

- Legal Form (mandatory) (only on page 2B).

Page 3. Representation

- Legal representative (always mandatory and if it is an entity, the natural person designated by the legal entity administrator must be communicated).

- Voluntary representation, where applicable.

Page 8 . Partners, members, participants

- Spanish entities must declare the identification data of the founding partners or those who promote the constitution and % of participation.

- Entities in attribution of income (communities of property, unclaimed inheritances, civil companies without commercial or professional purpose, community of owners) must declare identifying data of the participants and their percentage of participation and attribution of income.

If you have any questions about the completion, you can contact the Administration through the virtual counter " ADI ; Do you need help?" that is displayed when accessing the form.

You can also consult the "Information and Help" section of the form or call +34 91 554 87 70 /+34 901 33 55 33 for Basic Tax Information .

As indicated in the notice, model 036 in PDF is a draft and is not valid until it has been submitted to the AEAT . Therefore, the effective date of submission would be the date of its printed submission at the AEAT office or, if this non-face-to-face procedure is used, it will be the date of its submission to the electronic Registry through this extraordinary procedure.

It is important to remember that this draft (pre-declaration of Form 036) may only be used within one month of its validation. After this period has elapsed without it being submitted, it will be deleted.

With this new procedure, once the pre-declaration of Form 036 has been generated (which includes the receipt number, reference number, date and time) with the census model sheets in which some data has been recorded, it will be signed manually or electronically by the accredited representative of the entity, and must be filed in PDF format for submission to the electronic Registry following the guidelines indicated in STEP 3.

Step 2.- Scanned additional documentation

You must consult, obtain and, if applicable, scan for electronic archiving, the additional documentation that must accompany Form 036 of the request for assignment of NIF to an entity before taking the next step.

The documentation to be provided will depend on the legal form of the entity. As a general rule, you must provide a copy of the public deed or authentic document of incorporation and the bylaws or equivalent document, as well as certification of its registration, where applicable, in a public registry.

In the event that all this documentation is not provided, the NIF that is assigned will be provisional and the entity will be obliged to provide the pending documentation necessary for the assignment of the definitive tax identification number within one month from registration in the corresponding registry or from the granting of public deeds or reliable documents of its incorporation and the bylaws or equivalent documents of its incorporation, when the registration of these in a specific registry is not necessary.

- Agreement of wills/private contract of incorporation/public deed of incorporation, which includes the identification of all the partners and includes the Statutes/rules that must govern the operation of the company/entity.

- Certificate of registration of the company in the commercial or special registry (failing this, it will be sufficient to provide the public deed of incorporation in which the stamp of the registration is printed will be sufficient), where applicable.

- Copy of the NIF of the person who signs the census declaration, who must be a representative of the company.

- Document proving the capacity of representation of the person signing the census declaration (not necessary if listed as such in the creation document or in the articles of incorporation or in the bylaws).

If you do not provide a copy of the public deed or reliable document of incorporation, in order to assign the provisional NIF it will be essential that you at least provide a copy of a duly signed document in which the grantors of the document state their AGREEMENT OF WILLS for the incorporation of the legal person or entity in question and, where applicable, a valid CERTIFICATE of NON-COINCIDENCE OF NAME from the Public Registry in which the registration of the entity was mandatory.

The following data will appear in the AGREEMENT OF WILLS:

- Company name and anagram, if applicable

- legal form

- tax domicile and registered office

- coporate purpose

- closing date of the financial year

- planned share capital figure

- expected life of the entity

- intended start date of purchase of goods or services with the intention of using them in the business or profession

- public register in which, where applicable, the Entity must be registered.

- Identification of the founding partners, with NIF , and percentage of participation

- Identification of legal representatives, with NIF

- covenants and conditions

- signature of partners, directors and/or representatives

The signatory of the census application declaration must prove that he or she is acting on behalf of the group that is committed to the creation of the legal person or entity without legal personality.

When a provisional NIF is assigned, the term "IN CONSTITUTION" is automatically added to the company name. This term will appear on the NIF cards of every entity in the process of formation. This indication will be maintained until it is justified, through the corresponding documentary contribution, that the entity is fully constituted.

You can consult the documentation that must be provided in Annex I of the Practical Guide.

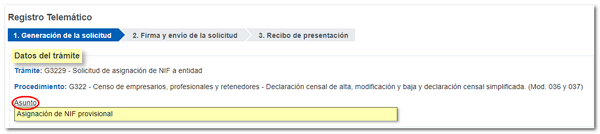

STEP 3.- Submission of Form 036 in PDF and the additional documentation required in the electronic Registry of the Tax Agency in the procedure "Forms 036 - 037. Request for assignment of NIF to entity - not in person ".

Access to the procedure requires that the person submitting the application has a NIF registered in the Census of Taxpayers and uses his or her own recognized electronic certificate to identify himself or herself.

Once the presenter has accessed the aforementioned procedure, he/she must complete the "Subject" field with the following: “Request for assignment of provisional NIF ”.

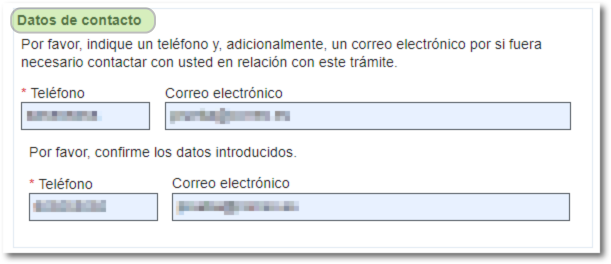

Next, you must enter your phone number (mandatory field) and additionally an email address to contact you if necessary.

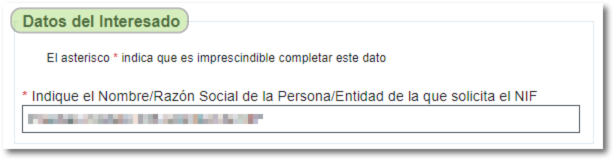

The name/business name of the person/entity for which you are requesting the NIF will then be entered.

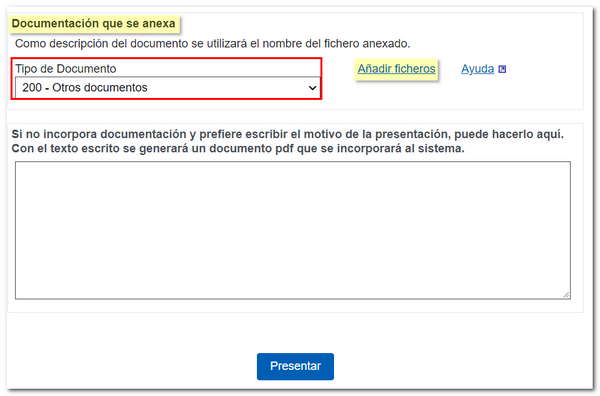

In the "Attached documentation" section, select "200 - Other documents" as the document type and click on the "Add files" link, and select the file with the documentation to be submitted:

- Pre-declaration of Form 036 (Draft of Form 036)

- The corresponding supporting documentation (Memorandum of understanding, public deed of incorporation of the entity or document proving the existence of the entity, identification of the legal representation and its accreditation).

In the "Help" link you can check the list of formats accepted for the presentation of files for this procedure, the maximum size allowed for each file being 64 MB.

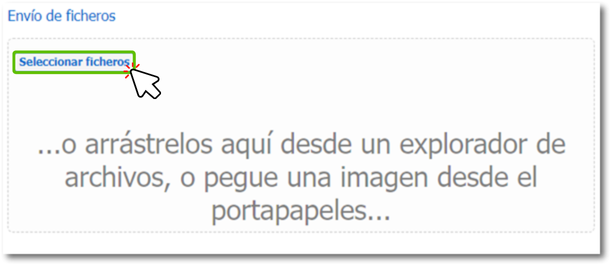

Select or drag the file. It is preferable that the file name does not have punctuation marks and is saved on your local disk, in the folder " AEAT ".

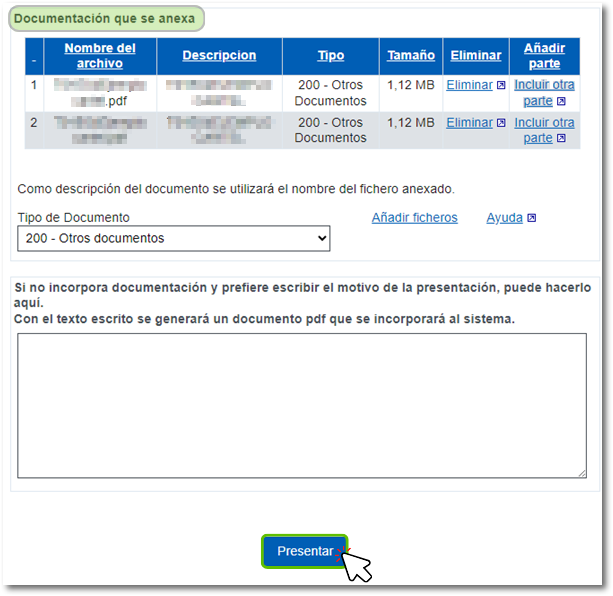

The added file will appear in the "Attached documentation" section.

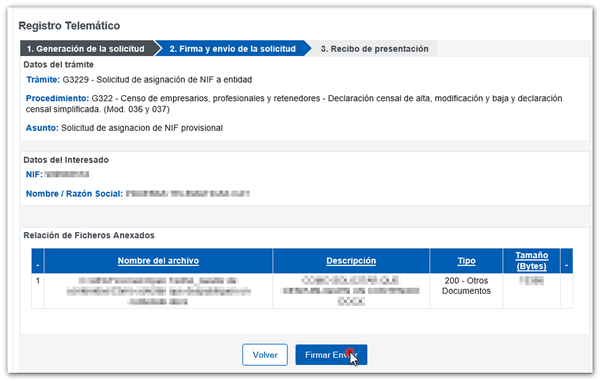

Once the files have been attached, click "Submit". The data you are going to send will be displayed. If you wish to make a change, click "Return" and if you agree, click "Sign Send".

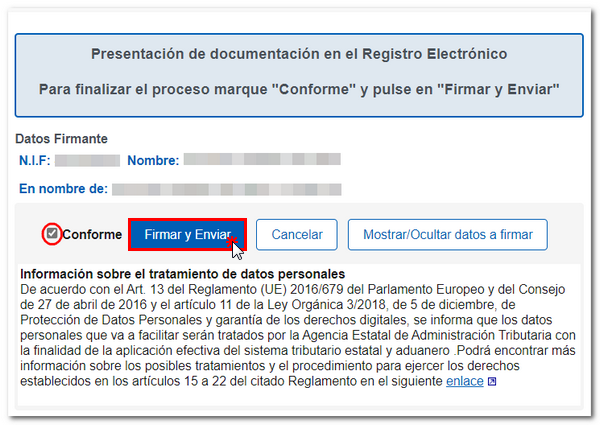

In the pop-up window, check the "I agree" box and click "Sign and Send" to complete the submission process.

Once this procedure has been carried out, an electronic Registration file is generated.

Once the NIF has been assigned, the communication of the NIF card will be sent to the tax address of the holder of the NIF assigned or, where applicable, to the preferred address for the purposes of notifications communicated in Form 036.

Please note that failure to submit the necessary supporting documentation or submitting it incompletely or inaccurately may result in your application being filed (articles 88 and 89 of the Regulations for the Application of Taxes, approved by Royal Decree 1065/2007, of July 27).