Form 111

Skip information indexPre-declaration of model 111 for submission in paper form

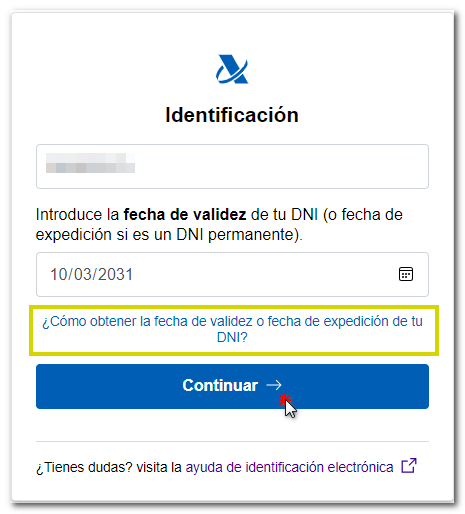

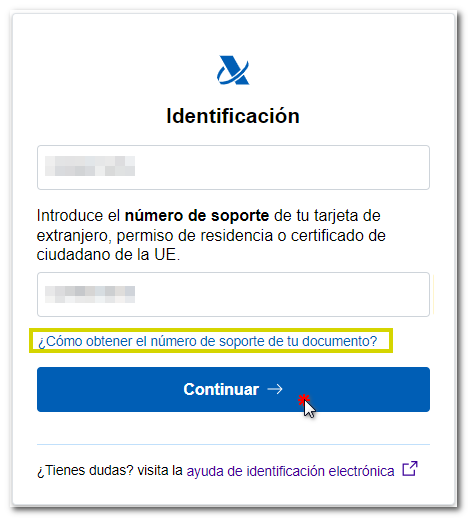

To access the Pre-declaration, click on "Form 111. Fiscal year 2019 and following years. Form for submission (pre-declaration)". It will be necessary to authenticate first, indicating the DNI / NIE and the corresponding contrast data of the declarant. In the identification window you have links to check how to enter the contrast data.

-

If it is a DNI you must indicate the validity date, if the validity date is PERMANENT (01/01/9999) then you must indicate the date of issue.

-

If it is a NIE you must indicate the support number.

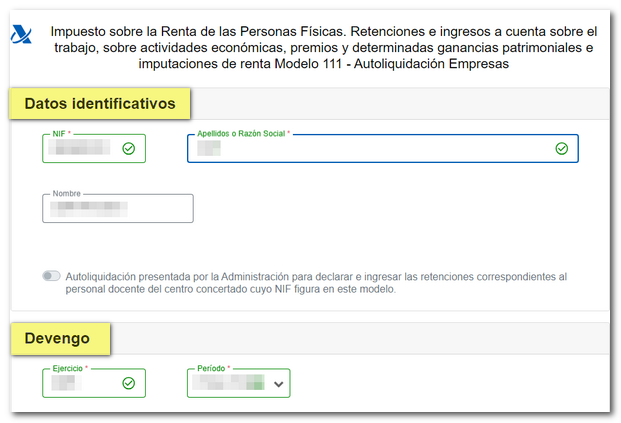

In the next window, enter the remainder of the identification details and the year/period of the tax return.

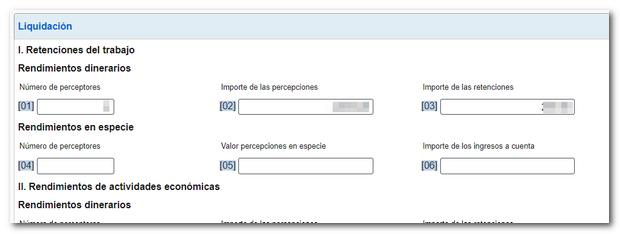

Next, fill in the various sections of the declaration with the financial data.

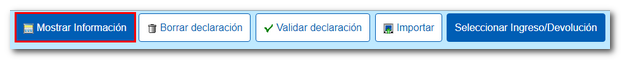

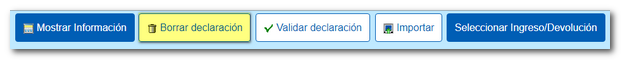

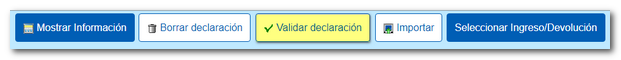

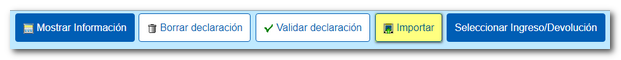

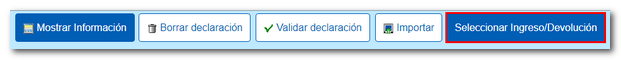

The form has a button bar with different options, located at the bottom.

-

Show or hide information about errors or completion notices.

-

"Delete Return" deletes the data from the return you are working on to start a new one.

-

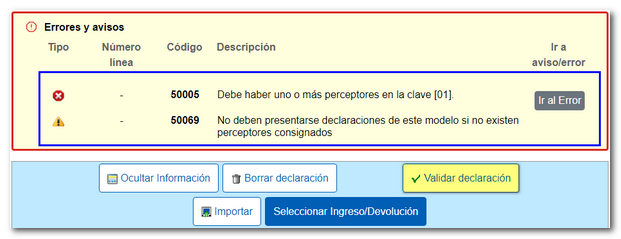

Using the "Validate declaration" button, check if you have any warnings or errors. At the top, the "Errors and warnings" section will appear with the detected warnings or errors. The notices do not prevent you from filing your return, although it is advisable to review them. But if errors appear, they will need to be corrected. Using the "Go to Error" button, you can directly access the box that needs to be checked.

Once the errors have been corrected and the warnings reviewed, the description will display "No errors" when validating the declaration.

-

From " Import ", you can recover the declaration obtained through a file created with an external program built in plain text (.txt) without any type of format that must conform to the logical design of the current model or exported from the form. Note that from this option, if there are data indicated in the form, these will be lost when the .111 file is imported. When importing a file, all boxes are unlocked, so you can modify the imported data in any field.

-

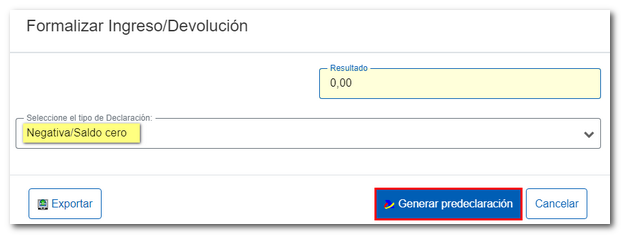

Use the " Select Income/Return " button to submit the declaration once it has been completed and validated.

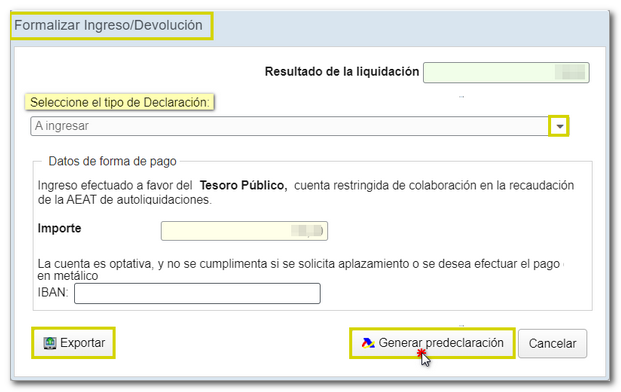

Select the type of declaration according to the result.

-

If it is a positive result, mark "To enter" . Please enter the IBAN code of the bank account; If you request a deferral of payment or make the payment in cash, this information is not mandatory. Finally, click "Generate pre-declaration".

The "Export" button allows you to obtain the declaration data in a file with BOE format, as long as it does not contain errors. The file will be named NIF of the declarant, fiscal year and period with the extension .111. The file is saved by default in the browser's default download folder; however, you can select the directory in which to save the file. It is advisable that it be in a folder within the local disk, in the AEAT folder.

-

If the result is not an income, you will find by default the option "Negative" in the "Select the type of Declaration" section.

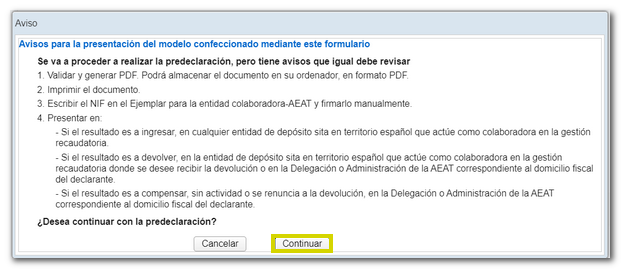

Read the notices for filing Form 111. It will be necessary to obtain the validated document PDF and print it, write the NIF on the income or return document and sign it manually. Then follow the procedure described in the instructions included in the PDF , depending on the type of declaration involved in each case.

To obtain the validated PDF document , press the "Continue" button.

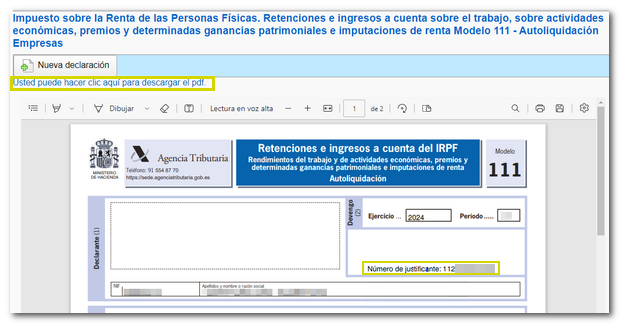

In paper submission, the receipt number that appears on the document in PDF to be submitted to the bank or the Administration, begins with 112. You can print it immediately or save it by clicking: “click here to download the PDF”. You can also start a new declaration from this window using the "New declaration" button.