Form 111

Skip information indexFiling returns using previous data

You can access this functionality from the "Model 111" option. Fiscal year 2019 and following years. "Presenting declarations using data from previous years."

You can access by identifying yourself with Cl@ve , electronic certificate or DNIe . If you have questions about how to obtain an electronic certificate, how to use one DNIe or how to register in the system Cl@veConsult the information available in the related content.

If the declarant does not have an electronic identification, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

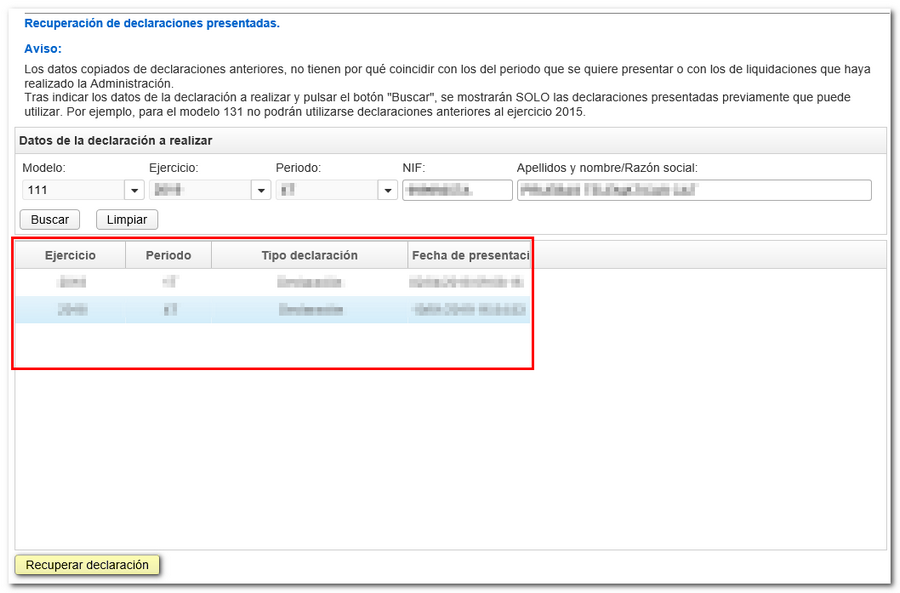

First, you must enter the details of the new declaration you are going to submit and press the "Search" button.

Previously submitted returns will be displayed that can be used depending on the fiscal year and period of the return you wish to file. If there are several declarations for the same NIF , they will all be displayed with the fiscal year, period, type of declaration and the filing date. Select the appropriate one and click "Recover declaration".

The form will then open, already filled out with the data from the previous declaration, except for those referring to the type of declaration: income, direct debit, recognition of debt, etc. It should be noted that data copied from previous declarations does not necessarily have to match the data for the period being submitted or the data from settlements made by the Administration, so if necessary, they can be modified before submission.

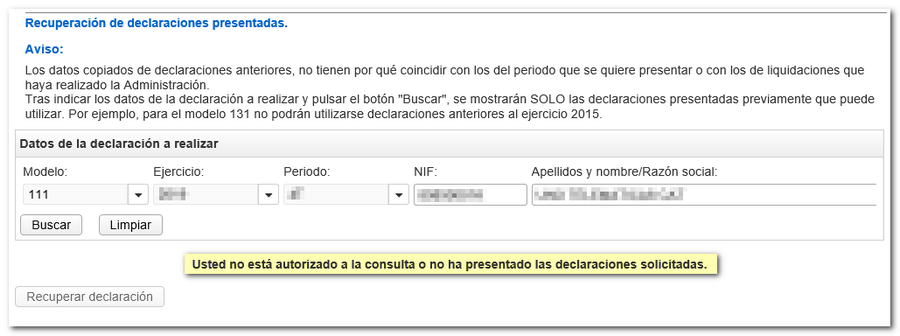

In the event that there is no electronically submitted declaration or a confirmed pre-declaration for the same NIF indicated, the following warning message will be displayed: "You are not authorized to consult or have not submitted the requested statements."

Then fill in the rest of the settlement details.

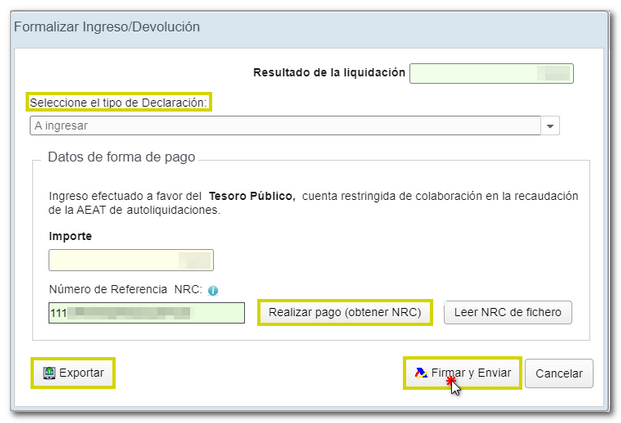

Use the " Formalize Income/Refund " button to submit the declaration once it has been completed and validated.

Select the type of declaration depending on whether it is a positive result or zero/No activity.

If the result is enter and the payment is not domiciled, it will be necessary to first obtain the NRC and then submit the self-assessment. The NRC is the Full Reference Number, a 22-character code that serves as proof of payment. From the form itself, on the "Make payment" button (NRC)" you will be able to connect to the payment gateway to automatically generate a NRC with the data contained in the declaration. If you already have a NRC provided by your bank, you can include it in the "Reference Number NRC " box.

If you direct debit the payment, select the option "Direct debit of the amount to be paid" and enter the account digits IBAN .

If you choose one of the types of debt recognition, after filing the declaration, you must process the debt from the "Process debt" button or from the specific "Pay, defer and consult" procedure.

Using the " Export " button, you will obtain a file in BOE format that is saved by default in the folder that the browser has as default. However, you can also select the directory where to save the file. It is advisable to save it on the local disk, inside the folder " AEAT ". The file name is formed by the NIF of the declarant, the fiscal year, the period and the extension .111.

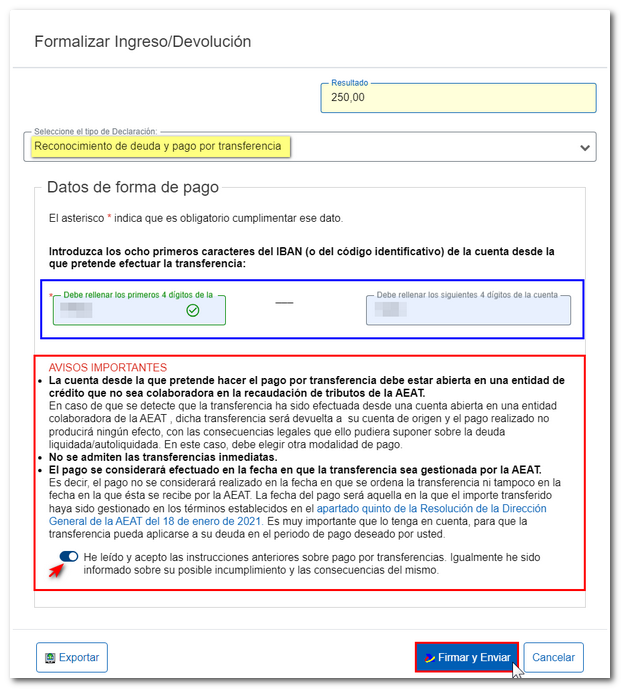

Form 111 also includes the option of debt recognition and payment by transfer from a bank account opened in a NON-COLLABORATING Credit Institution, by choosing "Debt recognition and payment by transfer" from the drop-down menu "Select the type of Declaration".

Click on "Sign and Send" and a window will appear with the encoded declaration information and the data of the filer and the declarant. Check the "I agree" box and press "Sign and Send" to complete the submission.

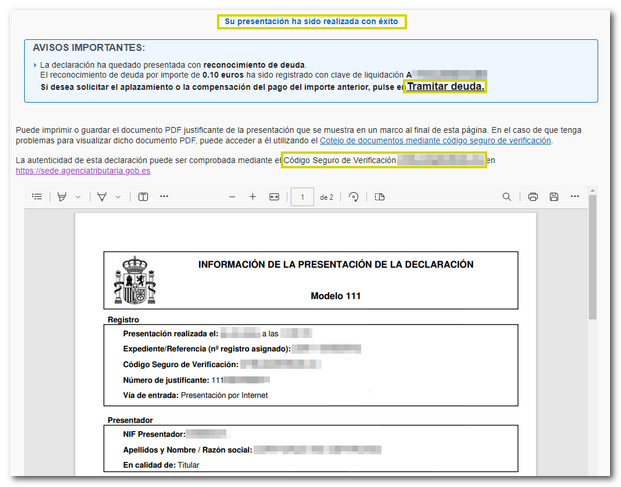

Finally, if everything is correct, the response sheet will be generated with the message "Your submission has been successfully completed" and an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter data) and, on the subsequent pages, the complete copy of the declaration.

In cases where there is recognition of debt, a link to submit the deferral or compensation request will be displayed on the response sheet for successfully submitting the request. Click "Process debt".

The settlement details will then appear with the debtor's data and the settlement key. You will have to choose between one of the available options: defer, compensate or pay.