Form 111

Skip information indexWithholding tax calculation service

The Withholding Calculation Service allows you to determine the withholdings on account of the PIT on work performance. You can access the Withholding calculation service from the "Help" section (located at the bottom of the page), "All help", "Download help programs", "Withholdings", also by entering the procedures of form 111, in "All procedures", "Taxes, fees and property benefits", "Payments on account".

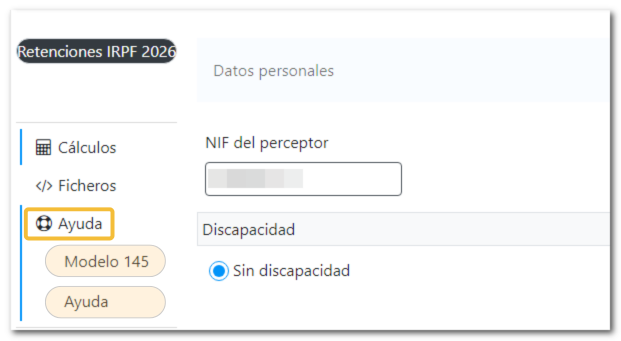

Click on the "Withholding Tax Calculation Service" link to access the online "Withholding Tax" calculation. PIT 2026".

If you need to perform the calculation of previous exercises, at the bottom of the page, click on the desired exercise.

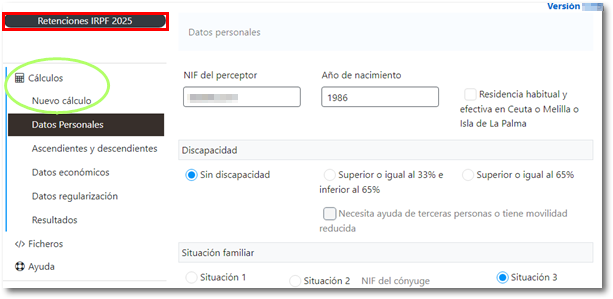

You will access the application where you must indicate the personal data, ascendants and descendants (if any), economic data and regularization of the recipient. You can perform a new calculation by clicking on "New calculation".

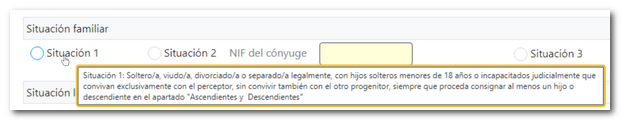

If you have any questions about the type of "Family Situation" you should select, place the cursor over each Situation (1, 2 and 3) and you will obtain the corresponding information. Also entering the "Help" section.

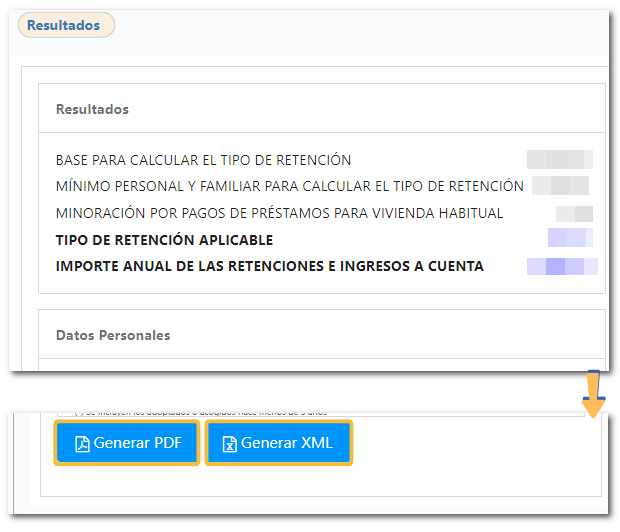

Once you have entered the data, click on "Results". At the end of the Results window you can get a PDF and generate a XML file with the information.

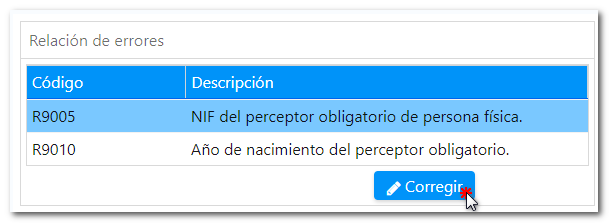

If there are errors that prevent you from obtaining the calculation result, the application will show you the list of errors; mark one of them and press the "Correct" button, which will take you to the corresponding box.

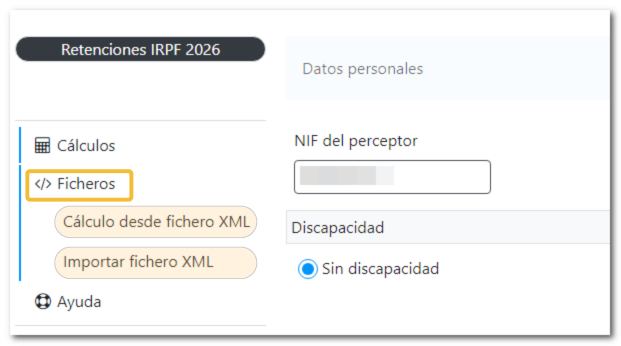

To perform the calculation from a file XML, access the option "</> Files", "Calculation from file XML To import a file, click on "Import file" XML" Please note that the file cannot exceed 50 MB

Access the "Help" section if you need information on how to complete the form or need to obtain... PDF of "Model 145 of Withholdings on employment income. Communication of data to the payer (art. 88 of the Regulation of the PIT)".