Form 211

Skip information indexForm 211 for paper submission

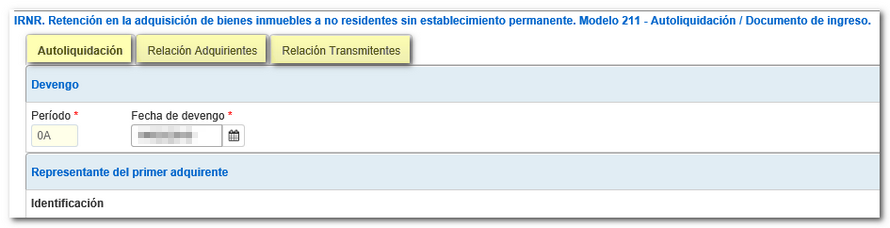

Fill in all the necessary data in the "Self-assessment" tab (data marked with an asterisk must be filled in).

If there are multiple purchasers or transferors, you can access the "Relationship of Purchasers" and "Relationship of Transferors" tabs of the form to complete it.

In the acquirers and transferors tabs you can manage the different records: create them, delete them, select them, etc.

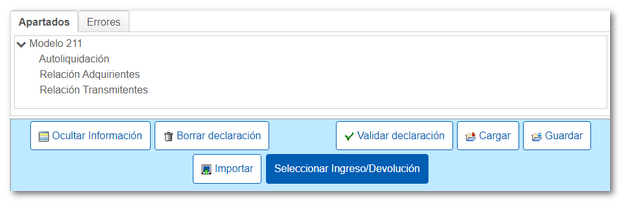

At the bottom you will find the index of sections and the button panel with the different functionalities of the form.

The option Keep allows saving the data in a file with the SES extension (dat-211-tax ID number-date and the .ses extension), to retrieve them in a later session with the button Carry.

Can Matter a statement file in the format BOE, exported from the Formalize payment / refund window of the same form or generated with an external program.

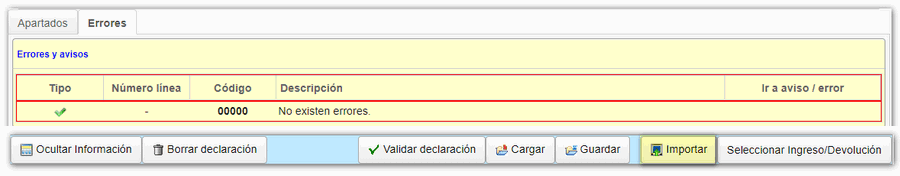

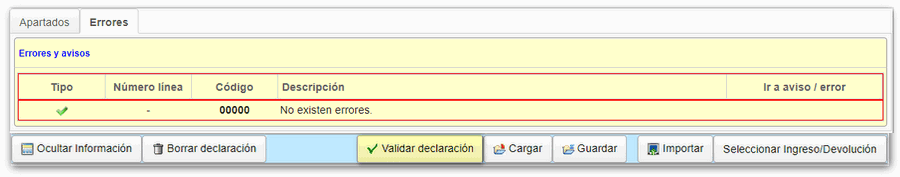

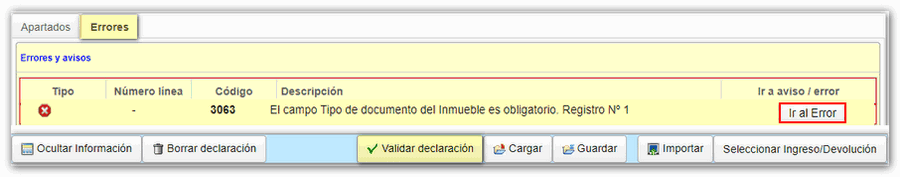

Press Validate statement to check if there are any notices or completion errors that you need to review or correct. The "Go to error" button will take you directly to the section or field that you need to review and correct.

If no errors are detected, you can submit the statement by pressing Select payment / Refund to obtain the PDF that allows you to submit a paper filing.

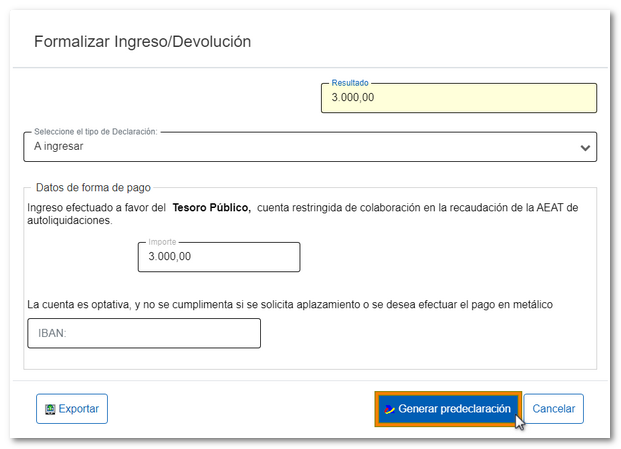

Select the type of declaration. If the result of the declaration represents an income, you can optionally enter the IBAN of the bank account from which the charge will be made, although if you are going to make the payment in cash or request a deferral, this is not completed. From this same window you can obtain a file with format BOE by clicking the "Export" button. Finally, click "Generate pre-declaration" to obtain the PDF.

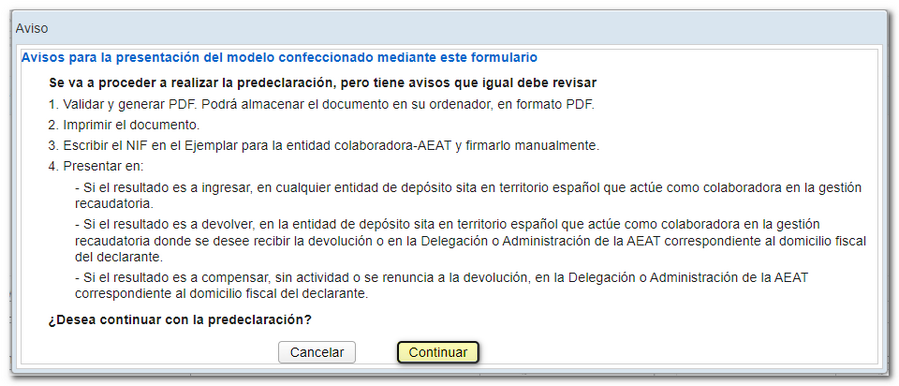

Review the notices and click "Continue."

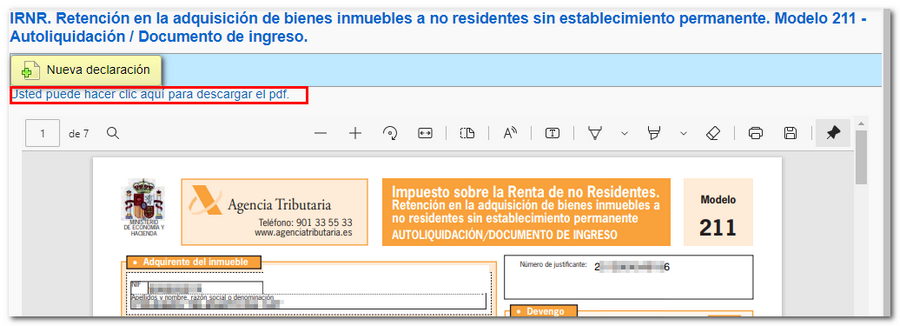

3 copies of the declaration will be generated: for the purchaser, the Collaborating Entity and the non-resident transferor. After printing the PDF you must write the NIF by hand on the Income or Refund Document and sign it to proceed with its presentation where appropriate, depending on the type of declaration selected. From the PDF generation window, click "You can click here to download the PDF " if you want to save it to your computer or "New declaration" to create a new declaration.