Form 650

Skip information indexHow to obtain the pre-submission of Form 650 for submission on paper. Non-residents

If you wish to submit the Non-Resident Form 650 on paper, you have a form available on line in the electronic headquarters to generate the pre-declaration and obtain the PDF, within the procedures of model 650.

Form 650 must be submitted in cases where taxpayers must comply with their obligations under this Tax to the State Tax Authority and, therefore, the income has not been transferred to the Autonomous Communities, pursuant to the provisions of Law 22/2009, of December 18. The deadline for submission is six months from the date of the death of the deceased or from the date on which the declaration of death becomes final.

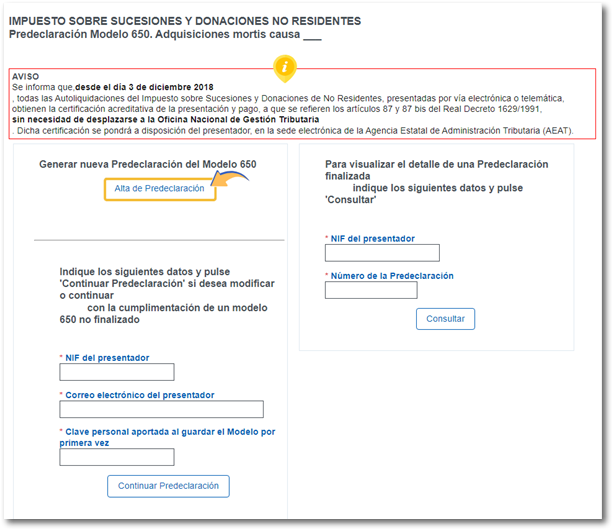

Upon access, a screen will appear with three options:

- "Pre-declaration registration": to generate a new pre-declaration.

- "Continue pre-declaration": if you need to modify or continue completing an unfinished form 650. It will be necessary to indicate the NIF of the presenter, the presenter's email and the personal key provided when saving the model for the first time.

- "Consult": to view the details of a completed pre-declaration. It will be necessary to indicate the NIF of the presenter and the number of the pre-declaration obtained. Once the requested data has been entered, the generated and completed PDF can be downloaded.

Check the "Notice" and click "Pre-declaration Registration" to start the pre-declaration.

The program consists of three sections:

1. Data prior to self-assessments

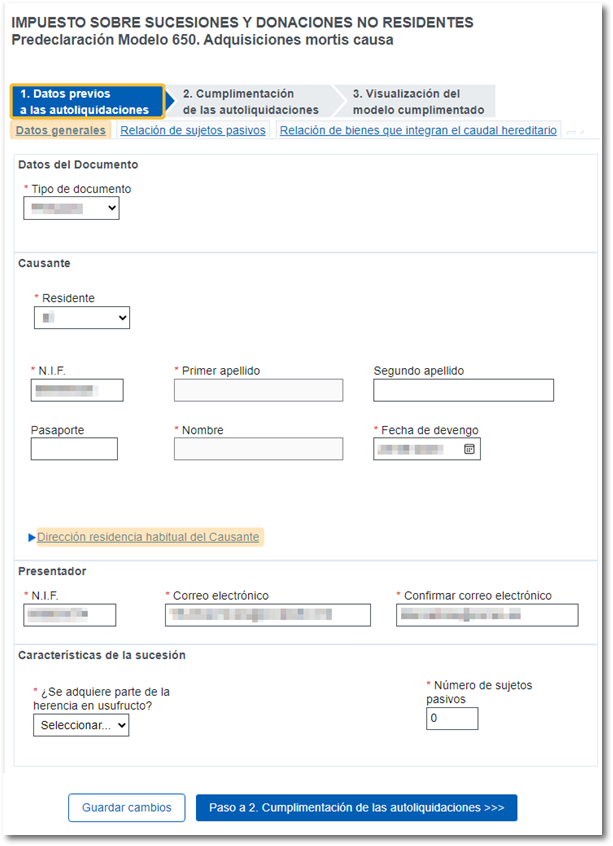

In this first step we will find three tabs: "General information", "List of taxpayers" and "List of assets comprising the estate".

Please note that fields marked with an asterisk are mandatory.

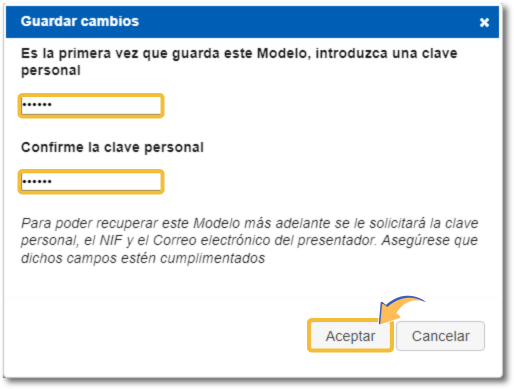

It is not necessary to enter all the data and carry out all the steps in a single session, since the "Save Changes" option allows you to recover the data entered up to that point at a later time. When saving for the first time, you must enter a personal key that will be used, together with the NIF and the presenter's email, to recover the declaration from the "Continue pre-declaration" option in the initial window. Before leaving the session, always remember to press "Save Changes".

In the first tab "General information" you must specify whether it is a public or private document, fill in the identification information of the deceased, add residence information by displaying the "Habitual residence address of the Deceased" tab and indicate the information of the presenter and the characteristics of the succession.

The submitter's details ( NIF and email) are necessary to be able to continue completing the declaration later; It is important to enter your email address correctly, as it will be requested, along with the chosen personal key, to recover the saved declaration in order to continue completing it.

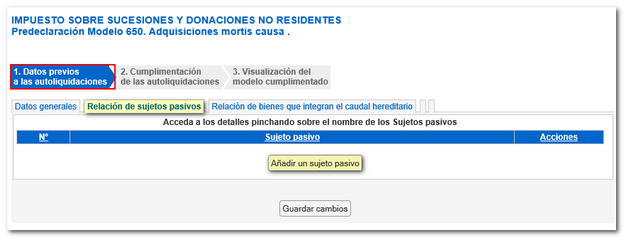

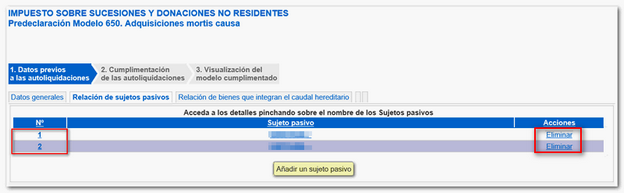

In the following tab, "List of taxpayers" , the data of each of the taxpayers of the tax (heirs) who sign the self-assessment will be completed, indicating whether or not they are residents in Spanish territory, the personal data by displaying the "Habitual residence address of the taxpayer" tab to add additional data, the title of succession (you can mark one or several cells) and the data of the settlement (if it is complementary, the proof number of the previous one must be entered). The program will only perform calculations if state regulations apply. Click the "Add a taxpayer" button.

From this same tab you can also delete and register new taxpayers.

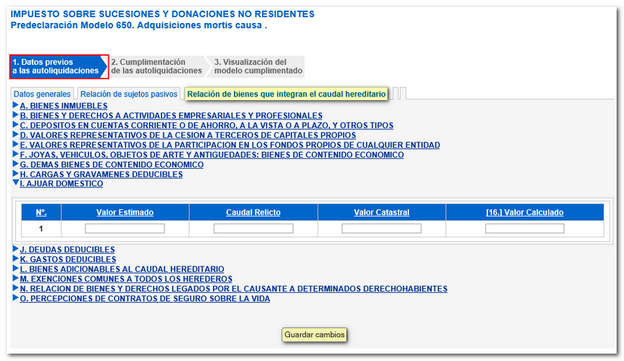

In tab "List of assets that make up the hereditary estate" , data such as the value or percentage of ownership must be indicated depending on the types of assets. Please note that some of these, such as the "Relic Flow" and "[16.] Calculated Value" boxes, are auto-calculated and cannot be edited.

If the first step is not completed correctly, a window will open with the errors detected when trying to continue.

Press "Save Changes" to save the data entered so far. If this is the first time you click on this button, you will have to enter a personal code that will be requested later, along with the NIF and email address, in case you have not completed the form and want to recover it later. Please note that it is case sensitive.

When there are no errors in step 1, you can access the next step: "Step to 2. Completion of self-assessments.

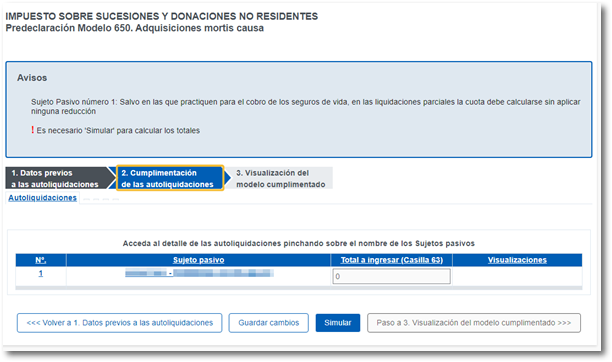

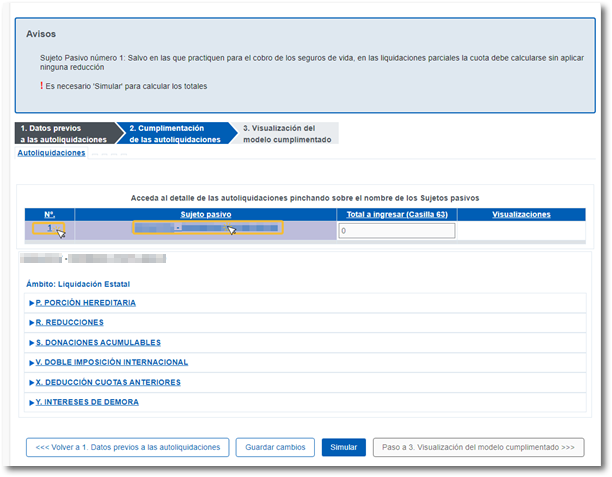

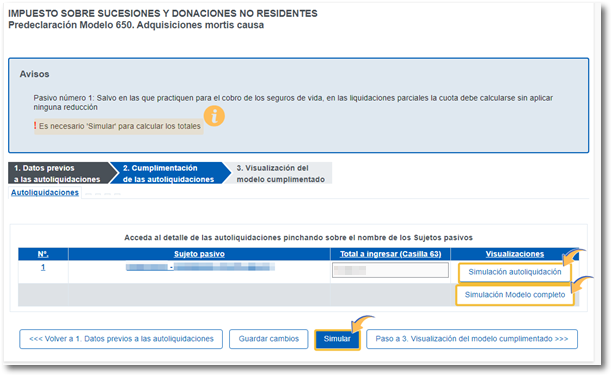

2. Completion of self-assessments

By clicking on the order number or the name of the taxpayer, you can access the details of the self-assessment to complete the completion.

In this same window, there is a "Simulate" button, with which you can obtain a PDF with the result of the self-assessment, which is not valid for filing. Both the individual self-assessments of taxpayers and the complete form can be viewed.

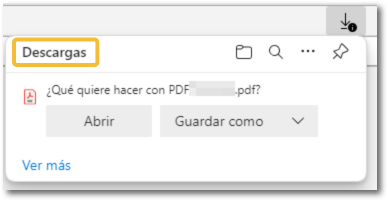

He PDF generated is saved by default in the "Downloads" folder, although you can select an alternative path.

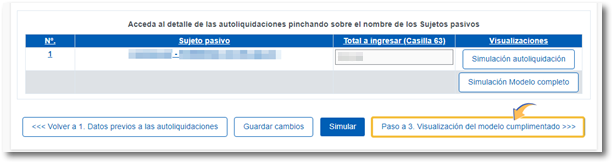

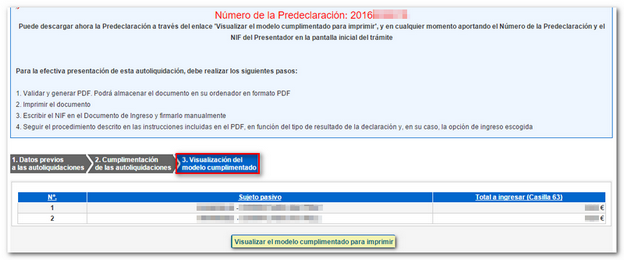

3. Viewing the completed model

Once the declaration has been verified, click on "Step 3. Viewing the completed form" to obtain the completed form in PDF and submit it on paper.

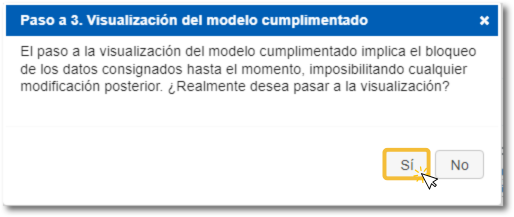

By moving on to step 3, the data entered up to this point will be blocked, preventing any subsequent modifications. Click "Yes" on the prompt.

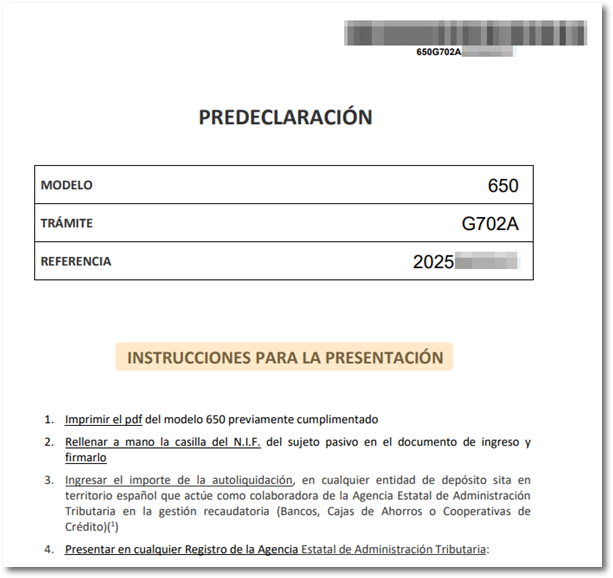

You will receive a pre-declaration number that will be used to view the document at any time from the initial window of form 650 in the "Consult" section.

The "View the completed form for printing" button allows you to obtain the already validated PDF . You can open the document PDF directly or save it to the path of your choice.

The corresponding copies are generated for the interested parties, the Administration and the entry document for the Collaborating Entity, in addition to the detailed instructions that must be followed for the effective submission of the declaration.