Form 650

Skip information indexWhere to find the settlement key generated when requesting deferral or recognition of debt

If you have selected "Deferment" or any of the "Debt Acknowledgement" types as your payment method, when you submit Form 650, a settlement key is generated that allows you to subsequently process the debt. The settlement key is found in the "Notices" section, once the declaration has been submitted.

If you have closed the window without having noted the settlement code, it can be recovered by accessing the self-assessment consultation electronically.

Click on "Consult self-assessments electronically. Non-residents" or "Consult self-assessments electronically. Ceuta and Melilla" as appropriate within the procedures of model 650.

To access, you must identify yourself with a certificate, electronic DNI or Cl@ve .

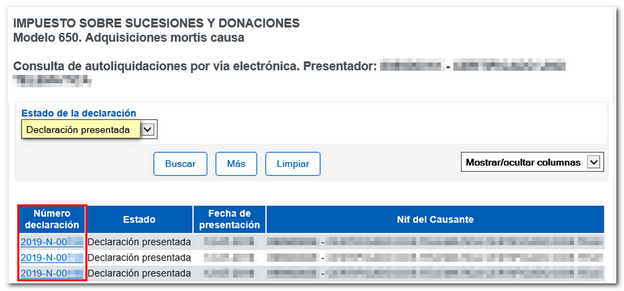

Select the "Return filed" or "Return completed" option from the "Return status" drop-down menu and click "Search." Next, access the query by clicking on the declaration number.

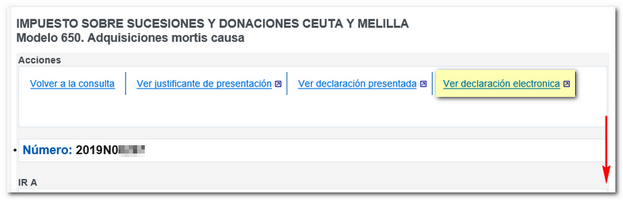

The information associated with that presentation will open, where you can consult the PDF of the presentation and all its sections. From this window, two options are available to consult the settlement key:

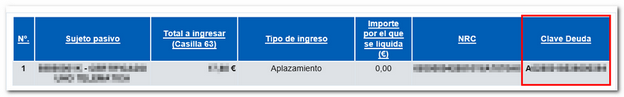

- At the bottom of the window, at the bottom of the page

- By clicking on the link "View electronic declaration"

At the bottom of window you will find the settlement key, along with the details of the taxpayer and the type of income, in the "Debt Key" column.

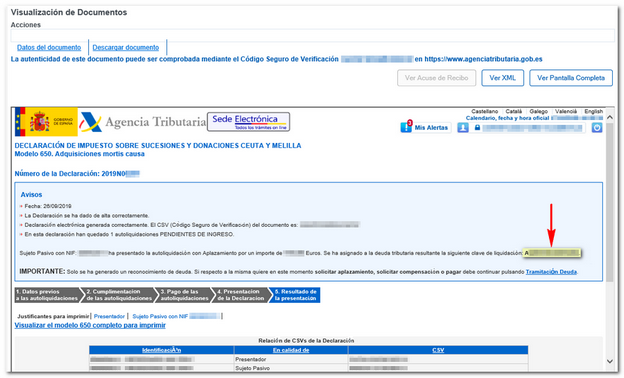

By clicking on the link " View electronic declaration " you will access the window that was obtained when you submitted it electronically.

The "Notices" section displays information about the submission and the settlement key for processing the debt.

From this same window, it is also possible to download the PDF from the link "Taxpayer with NIF XXXXX", which is the only one that contains the settlement key (this key does not appear in the PDF that is generated when clicking on "View the complete form 650 to print" or in the PDF receipt of the "Presenter").