How to file a tax return for Wealth Tax through power of attorney

You can identify yourself with an electronic certificate, DNIe ,Key of the natural person authorized by the holder of the declaration or with the identification system for citizens of the European Union (eIDAS) using another country's ID.

To access the form you must have registered the specific power of attorney for model 714, the 714P, or the corresponding general powers of attorney. Check the list of powers of attorney on our website.

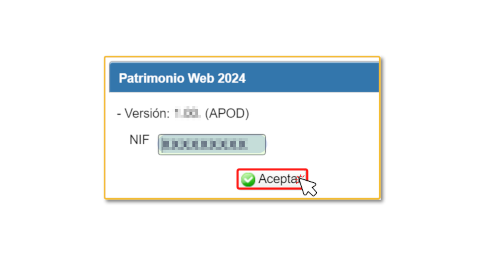

In the first window, enter the DNI or NIE of the taxpayer and click "Accept".

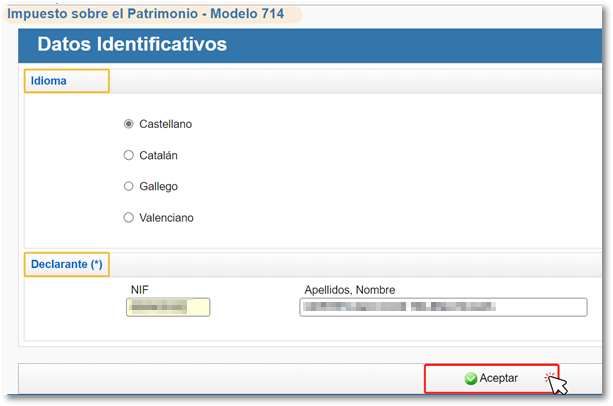

If this is your first time accessing the site, the initial page will contain identification data and the language of the declaration, which you can modify if necessary. After checking the initial screen, press "Accept" to continue.

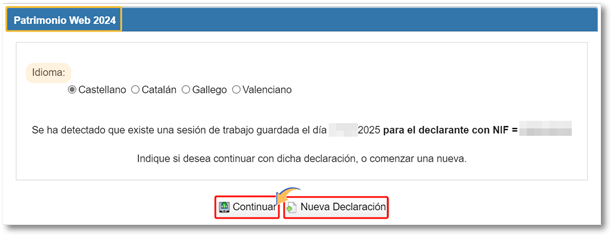

If a previous session of Patrimonio WEB is recognized, in which you have already been working, you can recover the declaration by clicking the "Continue" button or start a new one by clicking the "New Declaration" button.

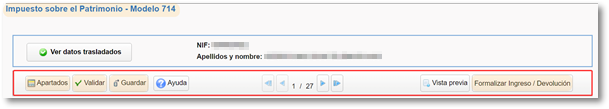

Once you're on the web form, you can complete the declaration by navigating through the different pages or using the "Sections" button to access the declaration sections. You can "Save" the statement to retrieve it later in a new session by clicking "Continue" in the initial window.

Once you have completed the form, you can "Validate" to check that there are no errors, warnings and/or notices. In the case of errors, you must resolve them to continue. Notices and warnings allow you to present, without prejudice to the implications of the message being warned about.

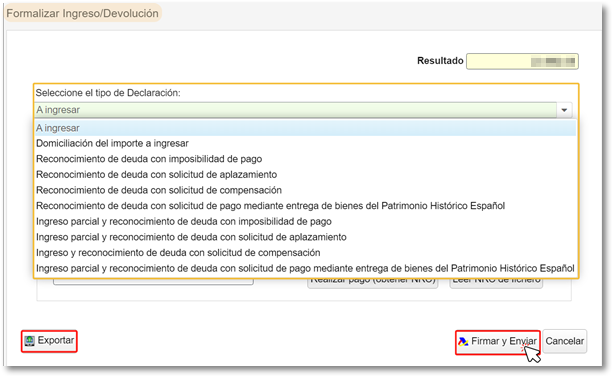

Press "Formalize Income/Refund", select the type of income.

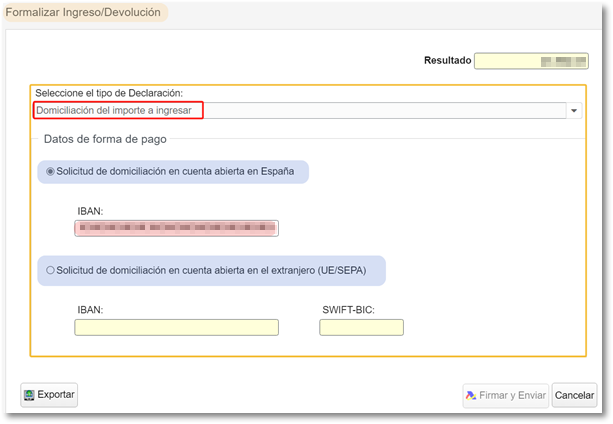

Direct debit be available if the return is filed between April and June 25, 2025. Enter the IBAN to which you wish to direct debit the declaration, which must be a bank account reported to the AEAT that allows direct debits and of which you are the owner. It can be an account opened in Spain or abroad ( EU / SEPA ).

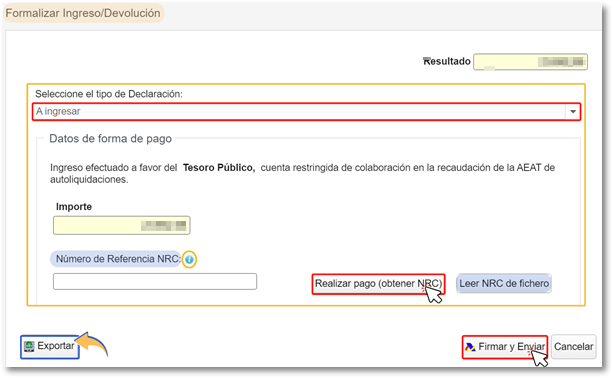

If you choose to pay using NRC or other payment methods that require a deposit, and if you access with Cl@ve , electronic certificate or DNIe , press the "Make payment (get NRC )" button to link to the payment gateway and obtain the NRC proof of payment. To use the taxpayer account, you must have received a power of attorney in procedure PAGOAPODECCC that allows you to process the payment of your representatives.

Another alternative would be debt recognition options. In these cases, a link to submit a deferral or compensation request will be displayed on the successful submission response page. Click on "Process debt" and the settlement details will appear with the debtor's details and the settlement code.

From the "Formalize Income/Refund" window you can also obtain a file in the format BOE , adjusted to the current registration design, using the "Export" button located in the lower left corner, with the name NIF of the declarant, fiscal year 0A and with extension .714.

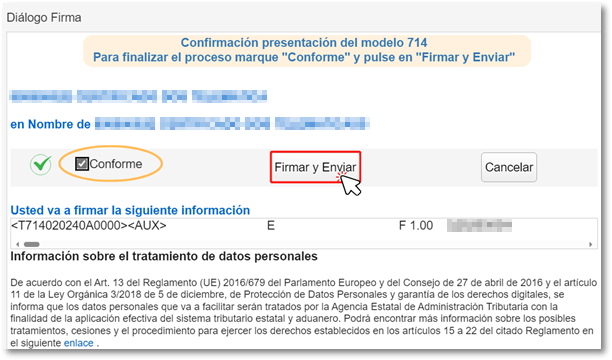

Press "Agree" and "Sign and Send" .

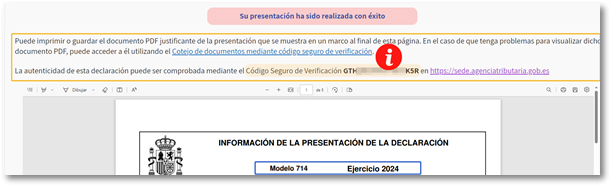

If the declaration is submitted correctly, a page will be returned with the message "Your submission has been completed successfully" and the assigned secure verification code. In addition, a PDF will be displayed containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter data) and, on the subsequent pages, the submitted declaration. Check the notice board to see if you need to make any corrections.