How to modify the IBAN code after filing the return

Skip information indexIf the result is a refund

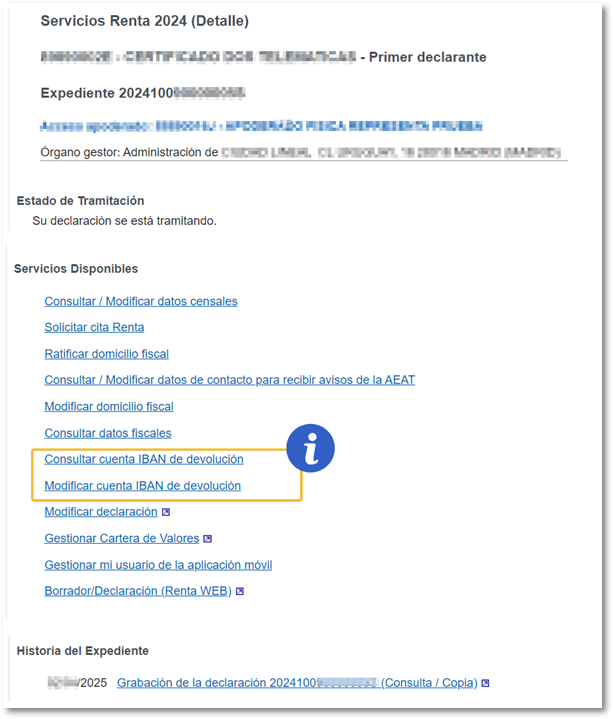

After accessing your file from " Draft/declaration processing service (Renta DIRECTA and Renta WEB) " , in the section "Available Services" you can check the refund account IBAN that you indicated in the declaration or modify it if necessary, provided that the transfer order has not yet been sent to your Bank

From option "Check refund account IBAN " you can check the account IBAN that you indicated in the declaration.

If you need to modify the account, use the option "Modify account IBAN of refund" directly. This service will be available as long as the transfer order has not yet been sent to your Bank. In joint declarations, the spouse's reference must be entered, regardless of the access method chosen by the declarant.

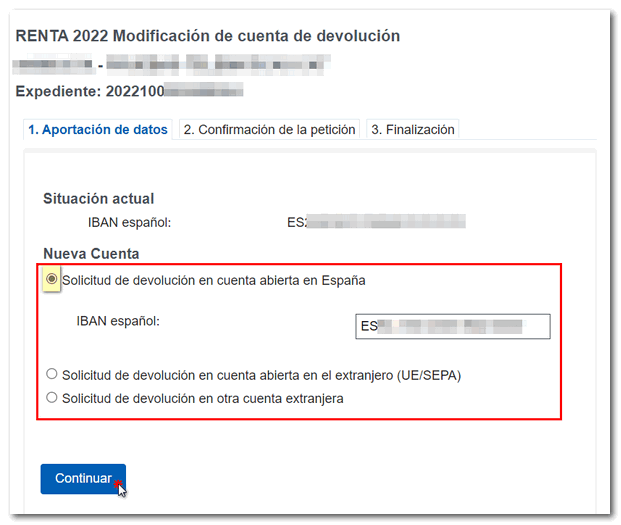

Enter the IBAN code of the new account where you want the refund to be made and click "Continue".

Confirm the change by clicking "OK".

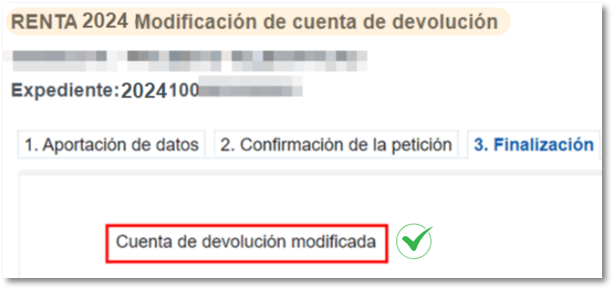

You will receive confirmation of the account modification on screen.

Note: If you access with the file reference or as a collaborator, it is essential that you verify the bank account since its ownership will be checked.

In the case of a joint declaration, it will be necessary to indicate the DNI / NIE and the spouse's reference.