How to modify the IBAN code after filing the return

Skip information indexIf the result is a payment

After filing the declaration with direct debit of the amount to be paid, if the AEAT does not recognize that the IBAN entered is yours, the link "Rectify account" will be enabled, so you can make the account modification immediately.

If it is a declaration to be entered, you have direct debited the payment and subsequently wish to modify the IBAN of the direct debit terms from your file, from "Available Services" , select "Check / Modify direct debits".

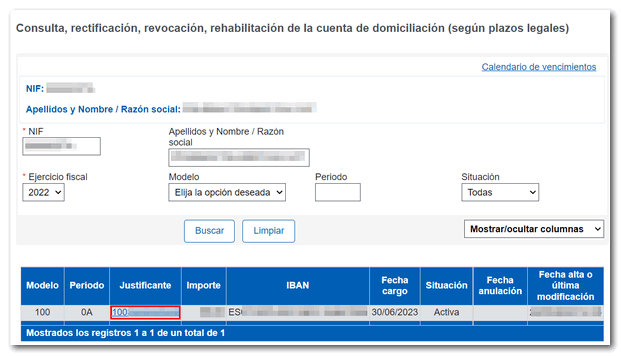

In both cases, the direct debit search page will open. By entering the NIF , the fiscal year, form 100 (form 102 if you wish to consult and modify the second term) and clicking on search, the data for the direct debits that meet the search criteria will be loaded. Click on the link receipt number to access the details and available services.

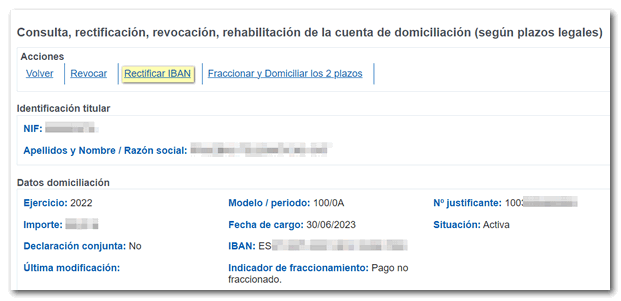

Once in the direct debit details, at the top, click on "Rectify IBAN " .

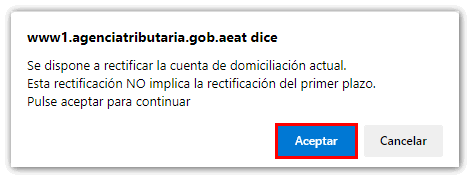

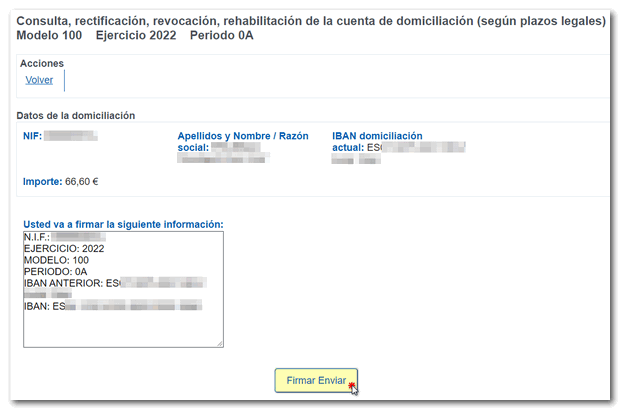

A pop-up window will then appear informing you that the direct debit account will be corrected. Accept and provide the new bank account number.

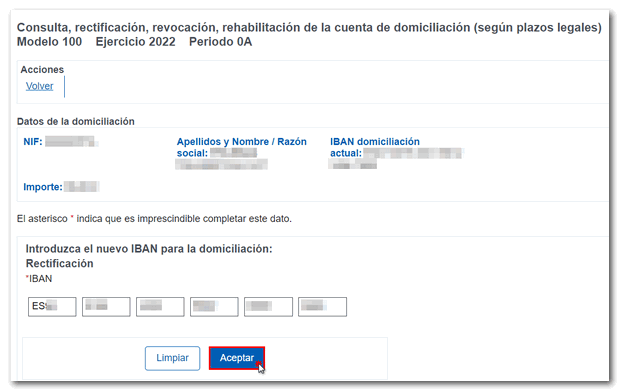

Enter the full IBAN without spaces.

If the information is correct, press "Sign and send" . Review the warnings indicated in this step.

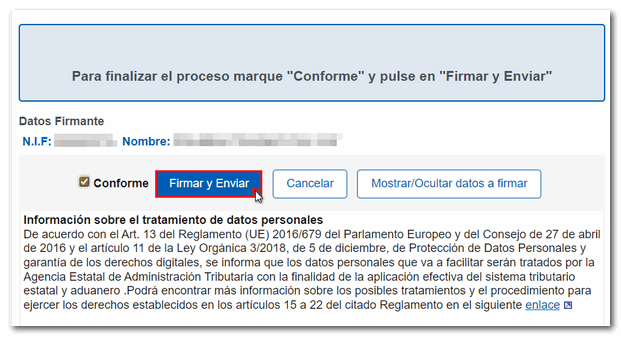

If everything is correct, click "OK" and "Sign and Send"

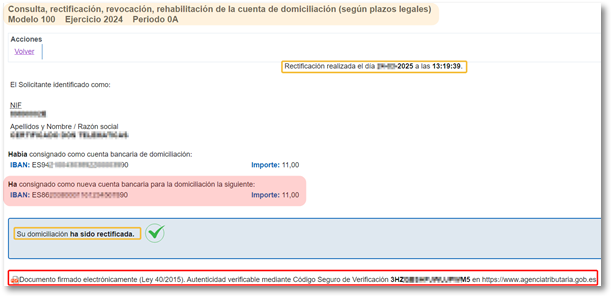

You will receive proof of the modification on screen, with the information of the previous account and the new account. At the bottom, you'll see the link to obtain the correction in PDF and CSV format.

Additionally, 2 possible actions may appear in the "Consultation, revocation, rehabilitation or rectification of the direct debit account":

-

"Split and direct debit the two installments": It appears when the taxpayer has domiciled the payment of form 100 for the total amount. With this option you can split and pay the two installments by direct debit. If you had direct debited the first one, you can direct debit the second one.

-

"Domicile the total debt in a single installment": It appears when the taxpayer has split the payment into two installments.

Modifying the IBAN code of the direct debit from the Electronic Office options

You can also make the modification from the option "Direct Debits - Consultation, revocation, rehabilitation or rectification of the direct debit account" , which you will find in the Electronic Office in the list of procedures for form 100 by clicking on "All procedures"

If after submitting the declaration with direct debit of the amount to be paid, the AEAT cannot locate the IBAN indicated, the submission receipt itself will inform you of this and the "Rectify account" link will be enabled, so that you can make the modification immediately.