Income 2018

Skip information indexWEB 2018 Income Tax Return processing service for collaborators

Social collaborators adhering to the corresponding agreement will be able to access the 2018 Income Tax files of third parties through the option "Draft/declaration processing service (Renta WEB) 2018 for collaborators".

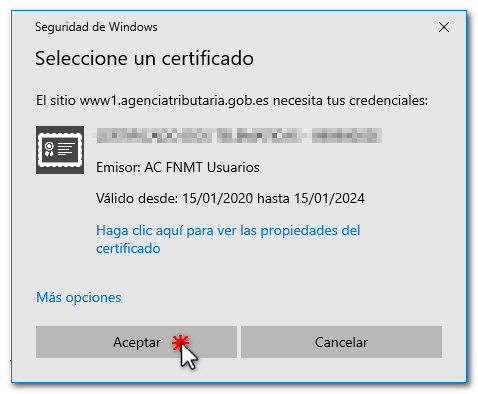

Identify yourself with your electronic certificate. If you are not registered or an error appears, please consult the information related to social collaboration.

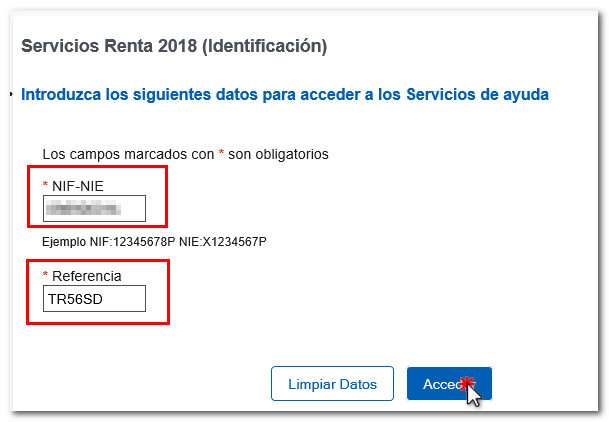

Enter the NIF and the reference of the declarant's Income Tax file. Please note that the reference you must use is the one obtained for the last Income Tax campaign. Click "Login"

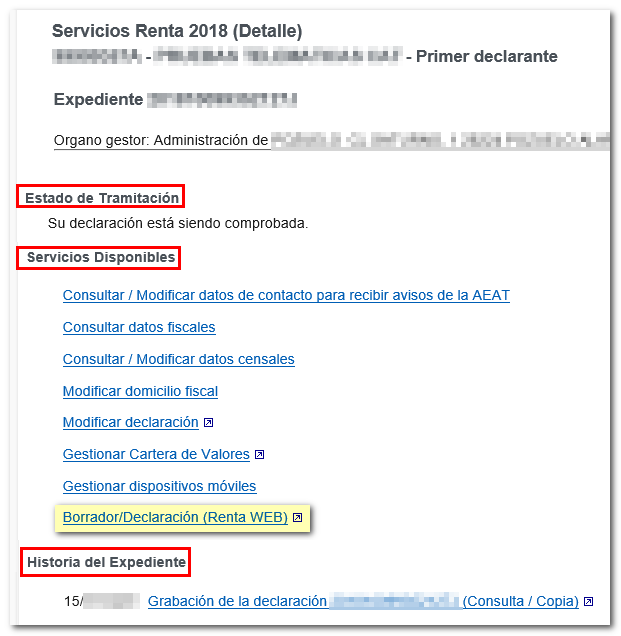

Once you access the file, you will have the following information:

-

The processing status of the declaration.

-

Available services include tax and census data queries, and the review and submission of draft tax returns or declarations (Renta WEB).

-

The history of the file where all the states of the file have been recorded and, if it has already been submitted, obtain a copy of the submitted declaration from the link "Recording of the declaration...".

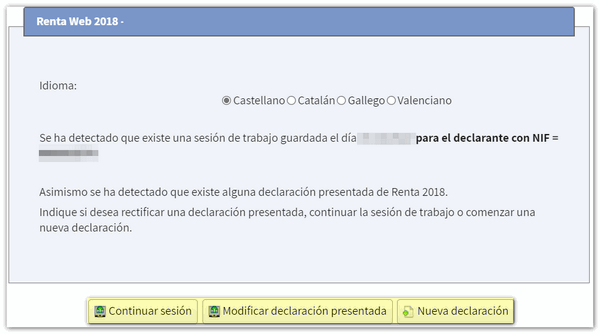

In "Available Services" click on "Draft/Declaration (Renta WEB)"; If you have already accessed Renta WEB at some other time, a pop-up window will inform you of the existence of a previous declaration, which you can recover from the option " Continue session ", modify a previously submitted declaration from " Modify submitted declaration " or start a new process from " New declaration ", incorporating the tax data again. You can also choose the co-official language in which you wish to make the declaration.

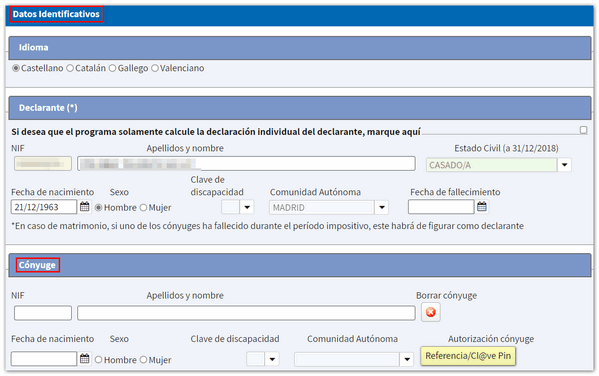

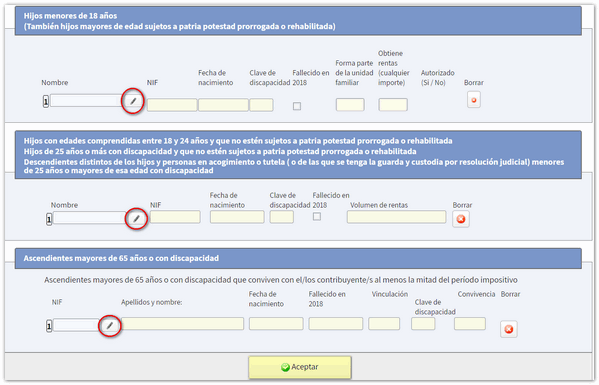

If this is your first time accessing the system, the identification data of the declarant and the other declarants of the family unit members will be displayed on the first screen. If it contains incorrect or inaccurate data or if specific information has been omitted, you must first modify it. Please note that marital status and whether you have minor children or legally incapacitated children subject to extended or rehabilitated parental authority cannot be modified later.

If there is a spouse, you must authorize the transfer of the spouse's tax data with reference or Cl@ve of the spouse. If you do not wish to enter your spouse's tax information, you must check the box for calculating the individual return.

By clicking on the icon with the pencil symbol you can modify or introduce new members into the family unit. To delete them, press the cross icon. Once you have completed the data at the bottom, click "Accept".

After accepting the identification data screen, if the application detects that additional tax data must be transferred to the declaration, follow the instructions in the following windows to incorporate this information. If you do not need to enter additional information to generate the declaration, you will directly access the summary of results from where you can check the result of the declaration for each modality and complete the declaration, if necessary.

At the top you have an additional menu from which you can view the tax data imputed for each declarant and download a PDF with the preview of the declaration of each declarant or joint declaration. Please note that in order to view documents in PDF format, you need to have a .PDF file viewer installed on your computer.

From "View transferred data" you can check which data has been incorporated in the declaration, which data has not been incorporated and the notes on the incorporation.

You also have explanatory videos and, in the question mark icon, access to the help manual for filing the Income Tax return.

From the "Return Summary" you can also save the return using the "Save" option and view the personal data from "Personal Data". By clicking the "Continue with the declaration" button, you will be able to access the different pages of the declaration to check all the data and continue completing the declaration.

Using the "Sections" button you can access the different sections of the declaration and use the arrow commands to move between the pages. Before filing the return, check if there are any errors in the completion by clicking the "Validate" button. If you need to go to a specific box or concept of the declaration, click on the magnifying glass icon.

From this same window you can access the results summary or "Submit declaration" to complete the processing of the declaration.

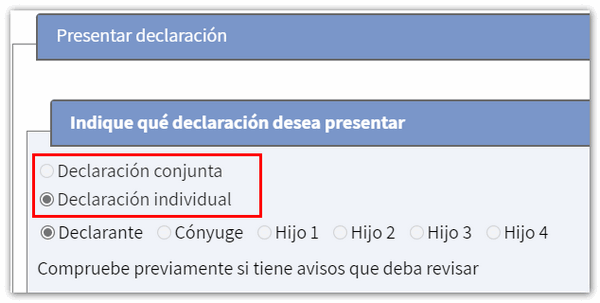

Select how you want to file your return, individually or jointly.

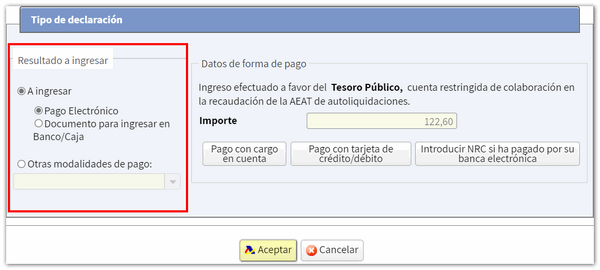

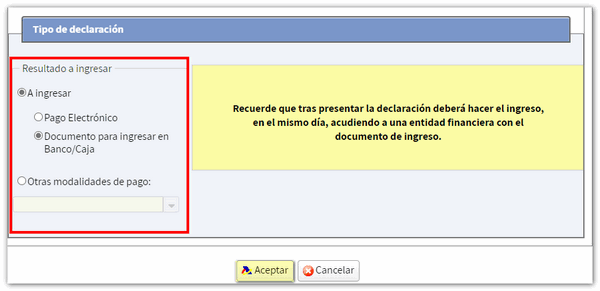

If the declaration results in a refund, you will only have to indicate the code IBAN , but if the declaration results in a deposit and you wish to pay the amount at your financial institution, click on "Document to be deposited in Bank/Box" in this way it will be submitted online but pending deposit, so you will need to go to a financial institution with the deposit document to make the payment.

If you select "To be paid" you must obtain the NRC and fill it in the corresponding box or select other payment methods such as recognition of debt with impossibility of payment or request for deferral, among others.

Finally, click "Accept" to submit the application online, then check the "I agree" box and click "Sign and send" to complete the submission process.