2021 Income Tax

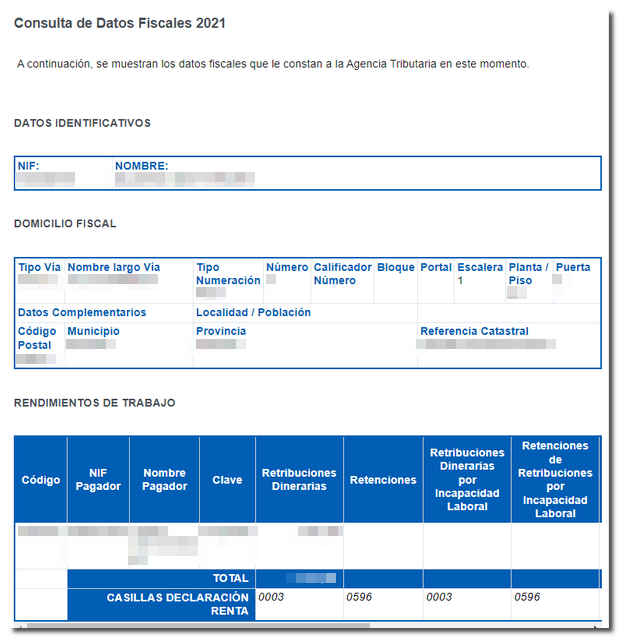

Skip information index2021 Tax Data Consultation

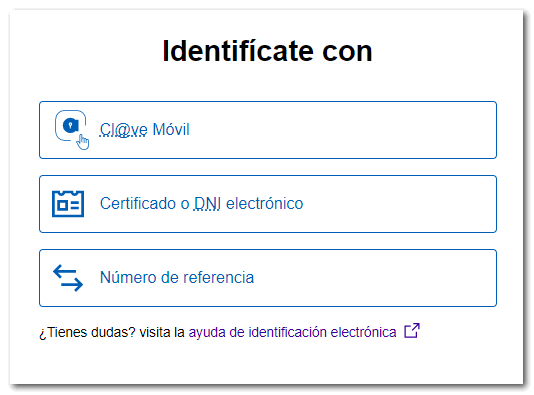

The 2021 tax data consultation is available on the Form 100 procedures page, within the "Previous years" section, identifying yourself with Cl@ve , Income reference for the current campaign, digital certificate or DNI electronic.

Select the type of identification you wish to use.

-

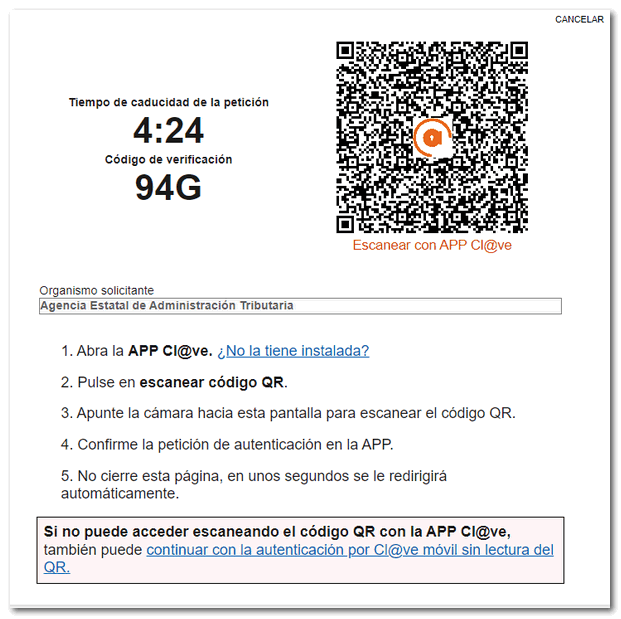

If you log in with Cl@ve Mobile (previously called Cl@ve PIN) You must scan the QR code with the APP Cl@ve, In case the option to scan the QR code fails for some reason, you will also have the alternative to access with Cl@ve mobile without QR reading, where you must enter the data of the DNI or NIE plus the contrast data, or, if you do not have activated the user in the APP Cl@ve or you have not installed it yet, wait about 60 seconds for the option "Access with Cl@ve PIN by SMS " to be activated to obtain a PIN by sending the SMS to your mobile.

-

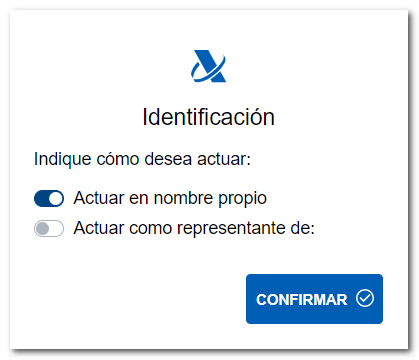

If you access with certificate or electronic DNI , the window with the certificates will be shown, select the one that corresponds to you to continue. Next, you must indicate whether you are accessing on your own behalf or as a representative. Select the appropriate option and click "Access".

-

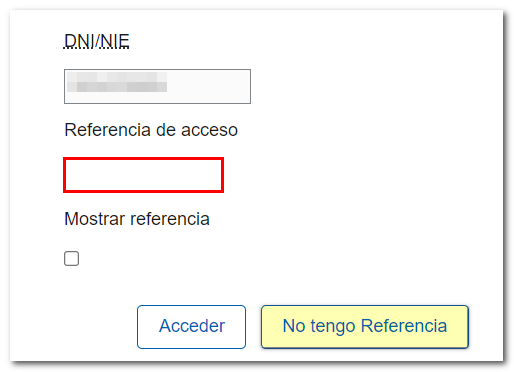

If you choose to identify yourself with Number of r eference , indicate your DNI or NIE and the access reference for the current campaign exercise or click "I do not have a Reference" to obtain a new one.

After identifying yourself through any of the three methods, you will access the tax data that the Tax Agency has for the 2021 fiscal year.