2021 Income Tax

Skip information indexModification of a submitted 2021 Income Tax return

If after filing the 2021 Income Tax return you consider that the return contains errors or omissions in the declared data, you can make a modification to your self-assessment by accessing the Income Tax file again.

This request is made to initiate a rectification procedure for a 2021 self-assessment, due to the fact that the amount to be returned is greater than that requested or the amount to be paid is less. This option will also be used if you need to report data that does not affect the result of the declaration.

On the other hand, if errors or omissions in declarations already submitted have led to a lower payment than legally required or a higher refund than appropriate, they must be regularised by submitting a supplementary declaration to the one originally submitted through Renta WEB.

You can access the option "Modification of a declaration already submitted" from the "Previous years" section within the Income procedures.

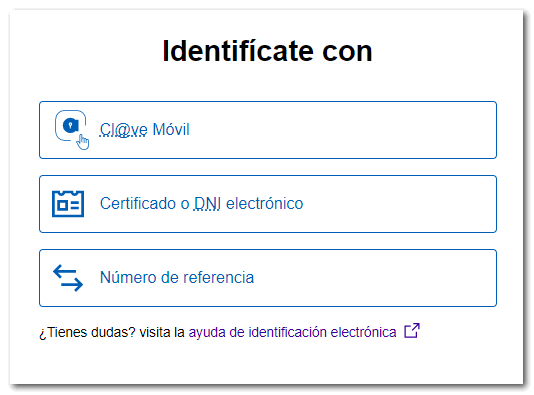

Access requires identification with a digital signature (certificate or electronic DNI ), Cl@ve or with the Income reference for the current campaign.

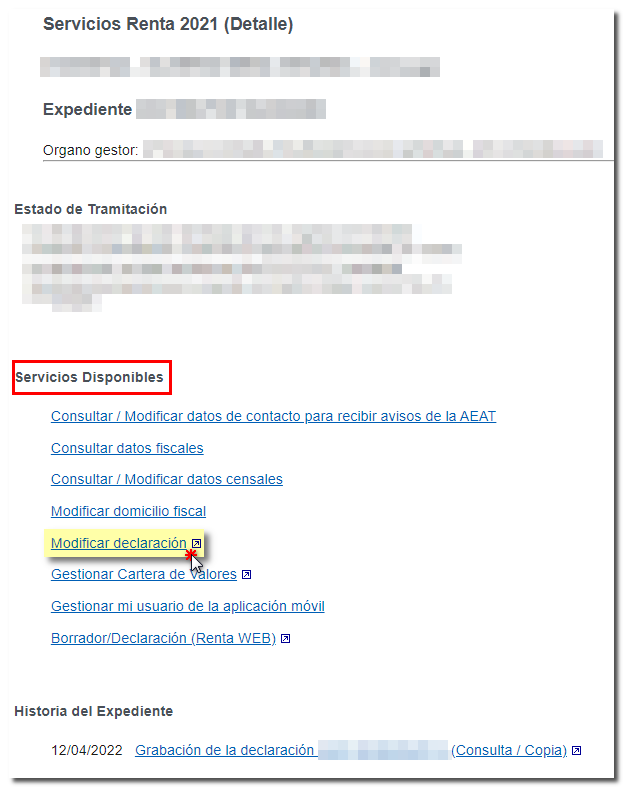

In the "Processing Status" section you will see the status of the previous declaration. Next, among the "Available Services" you will have the option "Modify declaration" .

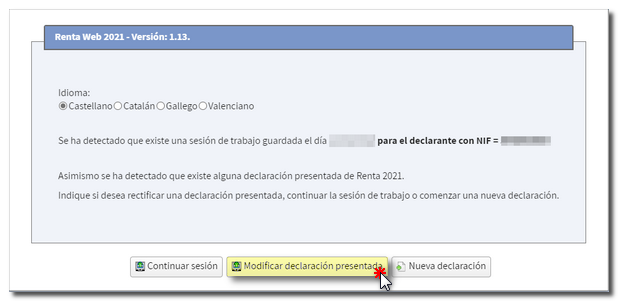

When you click on it, you will be given the option to continue with the last saved work session, modify the declaration submitted or generate a new declaration. Then, click on "Modify submitted declaration".

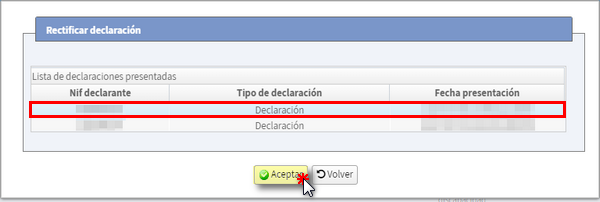

If you have made several submissions, in the next window you will have to click on the self-assessment that you want to rectify.

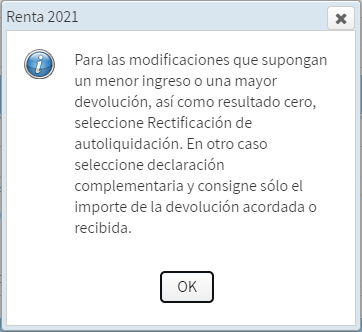

The criteria for selecting variants in the declaration modification are reported below. Modifications can be:

- Correction of self-assessment: if the changes result in lower income or higher refunds.

- Supplementary declaration: if the changes result in a higher income or a lower refund.

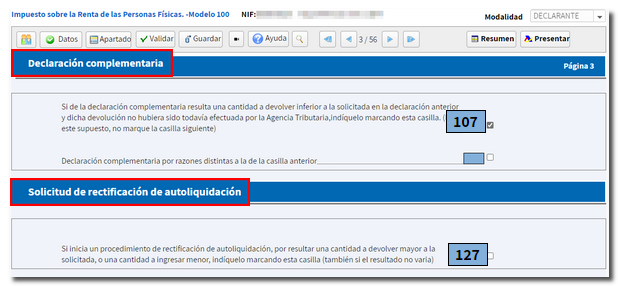

You will be taken directly to the declaration page where you must indicate the type of modification you are going to make, whether it is a correction to the self-assessment or a supplementary declaration.

The rectification of the self-assessment may be carried out:

- As long as the Tax Agency has not made the related final or provisional payment.

- It is necessary that the period of four years has not elapsed from the day following the end of the submission period, or from the day following the submission of the declaration if it was submitted outside of said period.

You can also file the rectification from external filings or using a file.

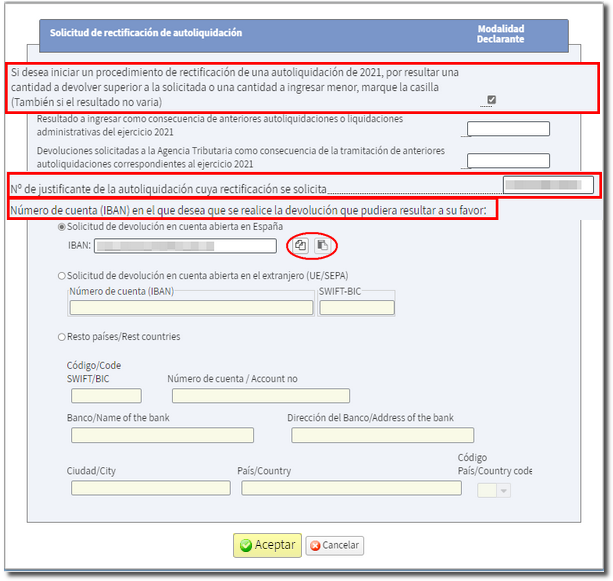

Check box 127 and, in the new window, the option "If you wish to initiate a rectification procedure...". The details of the previous self-assessment will be displayed: the result to be entered from previous self-assessments or administrative settlements corresponding to the 2021 financial year (box 670) or the result to be returned (box 695) as well as the "Self-assessment voucher number" of the self-assessment for which rectification is requested.

Please enter the account number ( IBAN ) to which you wish the refund to be made. You will also have on that screen the icon "copy IBAN" that allows you to leave it on the clipboard and paste it at any other time in the session.

When you include this information, a notice will appear informing you that if the declaration is to be submitted jointly, this information must also be entered into the declaration using this method.

In the case of a supplementary declaration , check box 107 or the alternative to indicate the reason for filing the supplementary declaration.

After checking the corresponding box, it is advisable to work on the declaration submitted, since the new one will contain, in addition to the data reflected in the original self-assessment, any newly included or modified data. To continue completing the declaration, you can navigate through the different sections using the available arrows or by accessing "Sections".

After correcting any errors or omissions in the self-assessment, remember that you can verify the changes made from "Return Summary" and also check what the result of the current return would be.

Use the "Validate" button to check that the declaration is correctly completed. If no errors are detected, you can submit the amended return by clicking the "Submit return" button.

By accessing your file again you will be able to view the declaration submitted in the first instance and the subsequent correction.