Specific error messages

Skip information indexThe taxpayer has no assigned administration

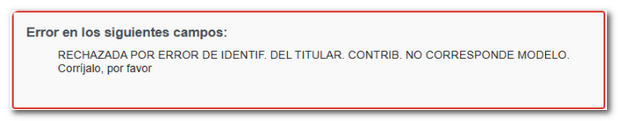

Messages "The taxpayer has no Administration assigned. You must first update the tax address" or "Rejected due to an error in the identification of the owner. Taxpayer does not correspond to the model" may occur when sending different declaration models (030, 036, 037, 100, 210, 211, etc.) if the holder is not correctly registered.

Specifically, these taxpayers do not have an address in Spain assigned in the census and, therefore, they cannot be assigned the Administration code necessary for the management applications of the AEAT (a generic code is assigned: 28952).

To resolve this situation, it is necessary to submit form 030 in person at a Branch or Administration, providing details of an address in Spain and requesting that a managing office be assigned.

The form for model 030 in PDF is available from the link "Download the model" in the procedures for model 030.

Address changes can also be made online using the reference number, Cl@ve or electronic certificate from the "Model 100" procedures. Personal Income Tax. Annual declaration", accessing "Draft processing service / declaration (Renta WEB)" and selecting "Modify tax address".