Form 210

Skip information indexForm 210 for paper submission

The pre-declaration form allows you to obtain the declaration of model 210 in PDF .

Complete the declaration, making sure to include data in the fields marked with an asterisk, which are mandatory.

Pay special attention to the section "Accrual". If any type of error appears related to the declaration period, we recommend that you consult the instructions for the form, specifically the "Accrual" section, at the end of the document.

NOTE : Please see the information note regarding the change from quarterly to annual grouping in the case of leasing from 2024 and the instructions for completing form 210 in the related content.

In the form menu bar, using the button "Matter" You can recover the .210 file that you previously exported from the form or that you generated with an external program by following the registration design for Form 210 for the corresponding fiscal year.

After completing the declaration, check if it is correct or has any errors by clicking on the button "Validate statement". In the menu at the bottom you will find all the available utilities. If there are errors that prevent submission, you can correct them using the "Go to Error" button, which directs you to the field you need to correct.

Once the declaration has been successfully validated, the message "There are no errors" will be displayed. Press "Select Income/Return".

The window to formalize the payment or refund will open. Using the button "Export" You will get the declaration file in format BOE, which will allow you to retrieve the declaration at any time from the "Import" button. By default it will be saved in the folder you have defined for downloads in the browser you are using. You will be able to save the declaration as long as the declaration is correct and there are no errors. The file will have the default name " NIF _ejercicio_periodo.210".

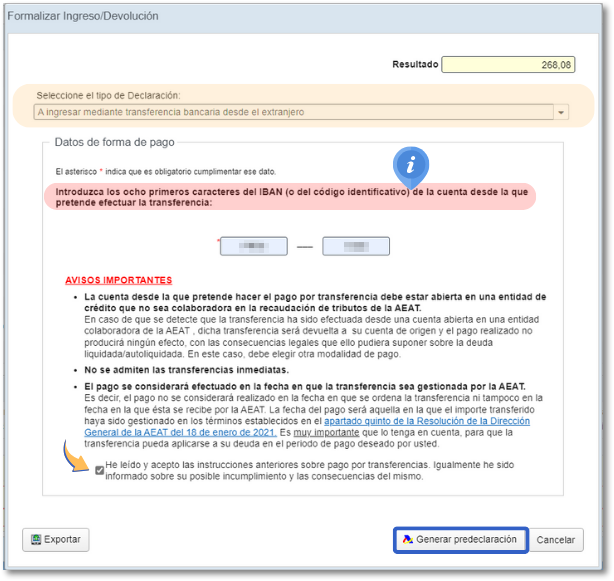

In the case of a refund, you have the option of receiving the transfer in a foreign account.

In the case of a statement "To enter", you can optionally indicate the account number IBAN from which the payment will be made; This field must be left blank if you are going to request a deferral or pay in cash.

If you select the option " To be paid by bank transfer from abroad " you must indicate a bank account opened in a NON-COLLABORATING Credit Institution. It will be necessary to indicate the first 8 characters of the IBAN from which you intend to make the payment and check the box " I have read and accept the above instructions on payment by transfer. I have also been informed of your possible non-compliance and the consequences thereof ".

Finally, whatever the payment or refund option indicated, press "Generate pre-declaration". When the pre-declaration is generated, the system provides you with the identifying data of the account held by the AEAT open at a collaborating entity to which you must make the transfer and a payment identifier that you must indicate in the "concept" field of the transfer. The validity of the payment identifier will expire within thirty calendar days from the date it was obtained.

Before obtaining the PDF a notice will be displayed with the procedure to be followed to make the pre-declaration submission effective.

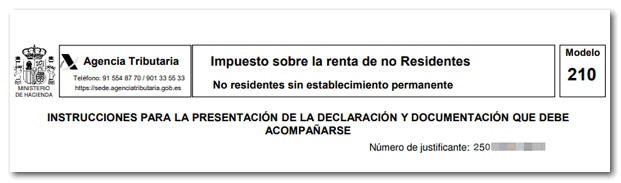

The will be generated PDF with the submission instructions, the "Copy for the taxpayer/representative" or "Copy for the jointly liable party/withholder" and a copy of the Income or Refund Document for the Collaborating Entity or Administration

To save the PDF , at the top of the web page, you have the link to download the document. For security reasons, after printing the document, you must write the NIF in all copies of the Admission or Return Document and sign manually. We recommend that you carefully read the instructions included in the pre-declaration regarding the places of submission, the method of payment and the additional documentation.

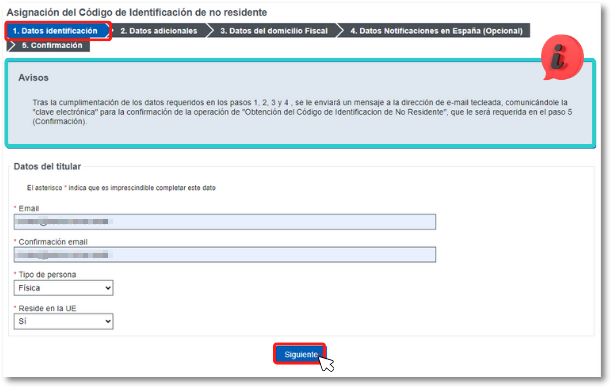

On the other hand, if the person who makes the self-assessment is the taxpayer and he does not have NIF, for self-assessments with a result to be paid, zero quota or to be refunded, next to the field "NIF"a button will be enabled to obtain a identification code which links to a procedure that allows the self-assignment of an identification code that will be loaded into the "field"NIF".

In the first step of assigning an identification code to a Non-Resident, "Identification data", you will need to enter an email address, which you must confirm, and to which you will receive the key that will allow you to complete the process of obtaining the identification code. In addition, you will need to choose between legal or natural person and then click "Next."

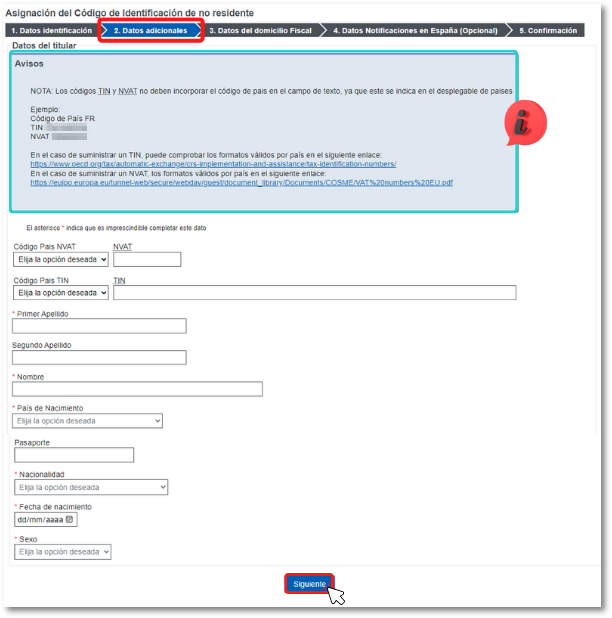

In the tab "Additional data" Enter your personal information, keeping in mind that only the boxes marked with an asterisk are mandatory. Read the notices and click "Next."

In "Tax address information" Enter your address details and click "Next".

The tab "Notification data in Spain", is optional if it is the same as the tax address provided. If you indicate your address for notifications, you must complete all the boxes marked with an asterisk.

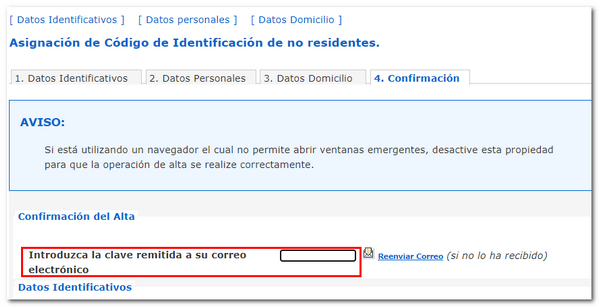

In the tab "Confirmation" You will have to enter the key that has been sent to your email. This is an 8-character key. Please make sure you have the pop-up blocker disabled in your browser to successfully complete the ID code assignment.

The assigned Non-Resident identification code will then be displayed. You must keep the NIF M that is assigned to you, since it is the one you will have to use for the next submissions of Form 210.