Form 210

Skip information indexForm 210 for paper submission for years 2013 to 2017

To complete the pre-declaration for years prior to 2018, complete the declaration, making sure to include data in the fields marked with an asterisk, which must be completed.

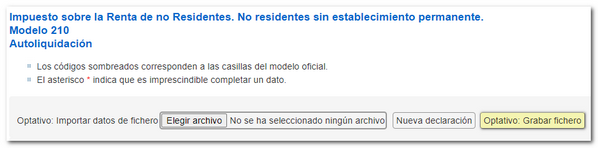

You can save the file by clicking the "Optional" button: Save file" that you can recover and upload again in the form using the "Choose file" option. The file is saved by default in the "Downloads" folder set in that browser and is named model 210_exercise_ NIF of the declarant_period and by extension the number of model 210.

If any type of error appears related to the declaration period, we recommend that you consult the instructions for the form, specifically the "Accrual" section. By placing the cursor over the question mark, the explanatory box will appear.

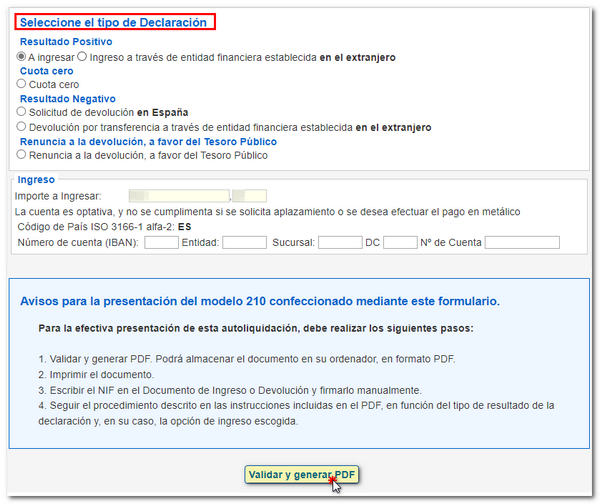

Depending on the result, you will have to select the type of declaration. If the result is a deposit, you can indicate the IBAN of the bank account into which the payment will be made. Finally, click on "Validate and generate PDF ".

The PDF will be generated with the declaration, which consists of two copies "Copy for the taxpayer/representative" and "Copy for the jointly liable party/withholder", in addition to a copy of the Income or Refund Document for the Collaborating Entity or Administration.

After printing the document, you must write the NIF on the Income or Refund Document and sign it to proceed with its presentation where appropriate, depending on the type of declaration selected.

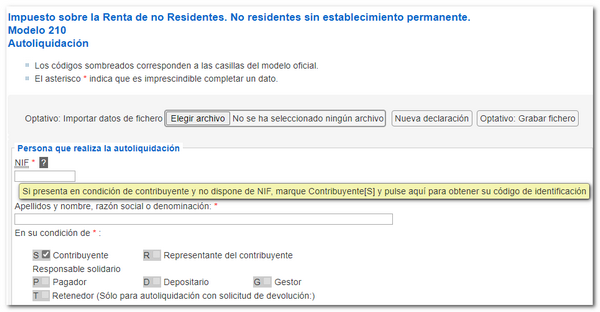

If the person who carries out the self-assessment is the taxpayer and does not have NIF , for self-assessments with a result to be paid, zero quota or to be returned, next to the field " NIF " a button will be enabled to obtain an identification code that links to a procedure that allows the self-assignment of an identification code that will be loaded in the field " NIF ".

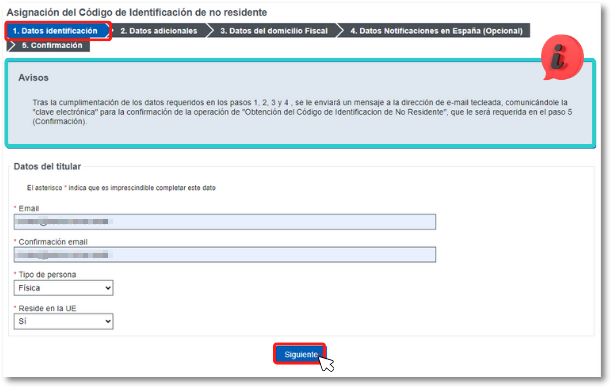

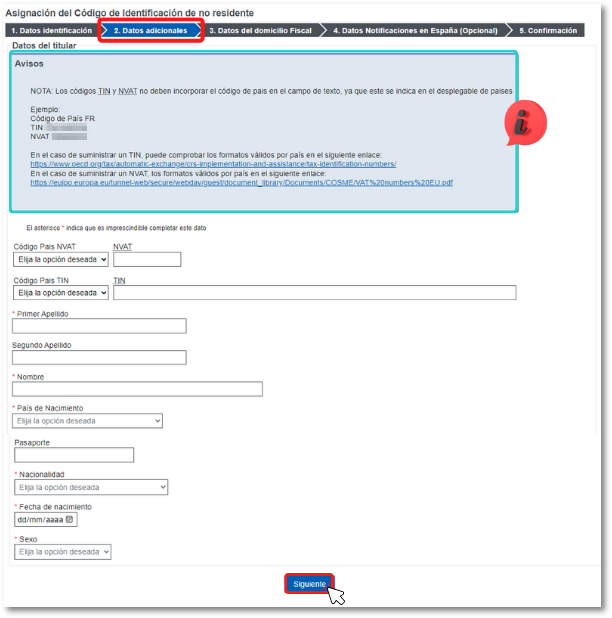

In the first step of assigning an identification code to a non-resident, you will have to indicate the identification data, one of which is the email address where you will receive the code that will allow you to complete the process of obtaining the identification code.

In the second tab, personal data and, in the last, address data.

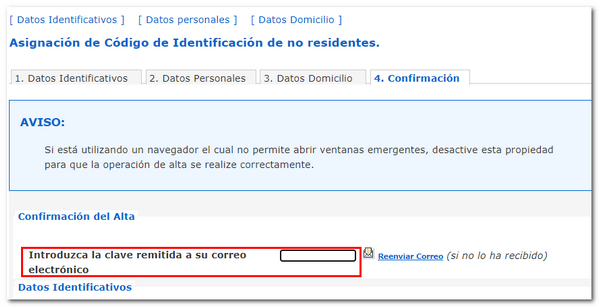

In the confirmation tab you will have to enter the password that has been sent to your email. This is an 8-character key. Please make sure you have the pop-up blocker disabled in your browser to successfully complete the ID code assignment.

The assigned Non-Resident identification code will then be displayed. You must keep the NIF M that is assigned to you since it is the one you will have to use for future submissions of model 210.

Back on the Model 210 form, complete the completion by selecting the type of declaration and click on "Validate and generate PDF ".