Form 210

Skip information indexPresentation of model 210 for previous years 2013 to 2017

Access to the presentation requires identification by means of an electronic certificate of the declarant or of a person authorized to present declarations on behalf of third parties or an agent to carry out the procedure.

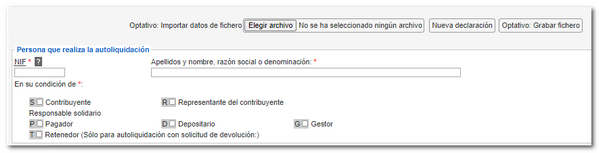

To complete the Form 210 accrual declaration for 2014 to 2017, complete the declaration making sure to include data in the fields marked with an asterisk, as they are mandatory.

If any type of error appears related to the declaration period, we recommend that you consult the instructions for the form, specifically the "Accrual" section.

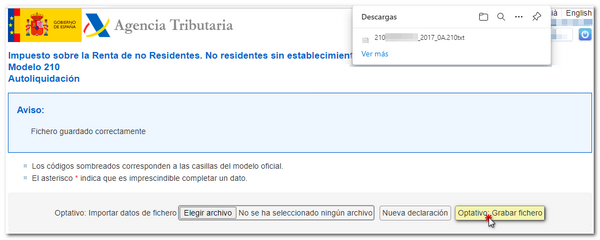

You can save the file by clicking "Optional: Save file" that you can recover and upload again in the form using the "Choose file" option. The file is saved by default in the Downloads folder that you have predefined in the browser you are using and has the name: 210 the NIF of the declarant, the fiscal year and the period and by extension the model number (210 NIF _fiscal_period.210).

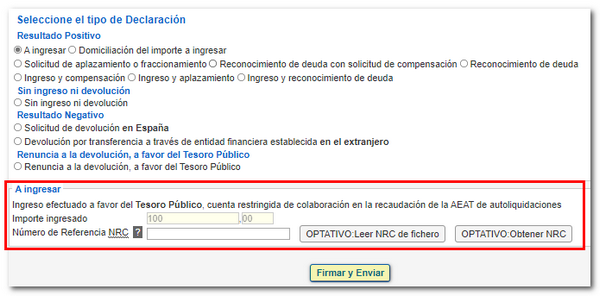

At the end of the form is the section where you select the type of declaration and the payment method.

If you choose "To be deposited" as the payment method, you will have to indicate a NRC proof of payment. The NRC is the Complete Reference Number, a 22-character code provided by banking entities that serves as proof of payment and which incorporates in an encrypted form the information of the NIF of the declarant, amount, model, fiscal year and period.

There are several ways to make the payment and obtain the NRC :

-

By contacting the Bank directly or through its website or telephone banking if it offers this service.

-

Through the Tax Agency's payment gateway, from the "Pay, defer and consult debts" option in the Electronic Office or from the "OPTIONAL" button: Get NRC " within the form.

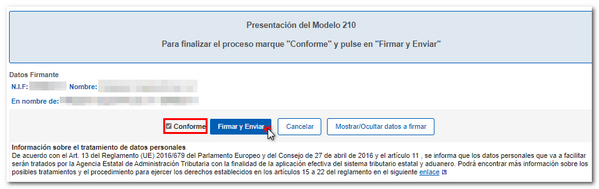

Once all the data has been entered, click "Sign and Send".

The program will request confirmation of the submission. If it is correct, check the "I agree" box and click "Sign and Send."

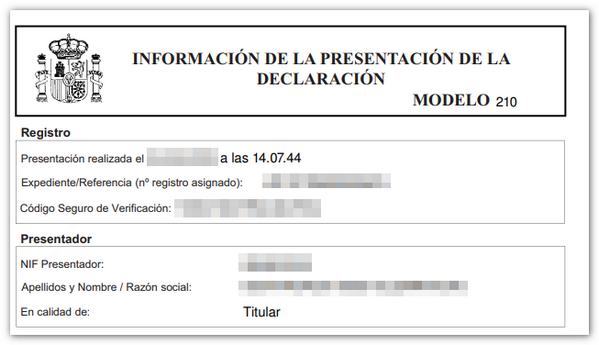

The result of a successful submission will be the response page that will say "Your submission has been successfully completed" with an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and the submitter's details) and, on subsequent pages, the complete copy of the declaration.

With the Secure Verification Code you can obtain a copy of the declaration using the "Document verification using a secure verification code" option.

You can also retrieve a copy of the submitted declaration if you access "Model 210" with the electronic certificate of the declarant or presenter. "Consultation of submitted declarations" available in the list of procedures of the model.