Form 210

Skip information indexFiling Form 210 by recovering data from previous returns

Access to "Model 210. Fiscal year 2018 and following years. Submission using data from previous years" requires identification with a certificate or electronic ID

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

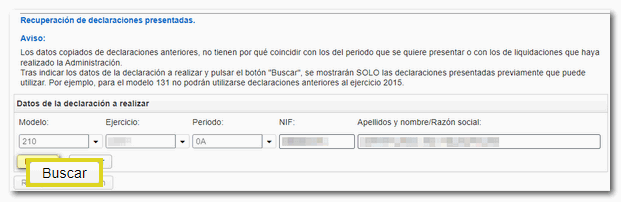

First, you must enter the details of the new declaration you are going to submit and press the button "Look for".

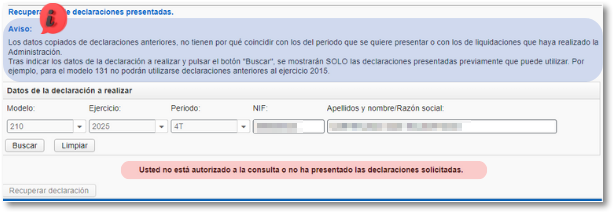

In the event that there is no electronically submitted declaration or a confirmed pre-declaration for the indicated NIF , the following warning message will be displayed: "You are not authorized to consult or have not submitted the requested statements."

Previously submitted returns will be displayed that can be used depending on the fiscal year and period of the return you wish to file. If there are several declarations for the same NIF , they will all be displayed with the fiscal year, period, type of declaration and the filing date. Select the appropriate option and press "Retrieve statement".

The form will then open, already filled out with the data from the previous declaration, except for those referring to the type of declaration: income, direct debit, recognition of debt, etc. It should be noted that the data copied from previous declarations does not necessarily have to coincide with that of the period to be submitted or with the settlements made by the Administration, so if necessary, they can be modified before submission.

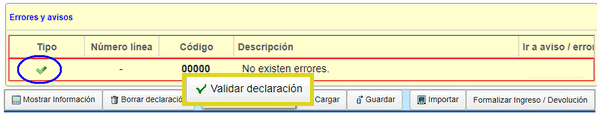

Fill in the missing data. Then click on "Validate declaration" to see if the declaration is correct or contains any errors.

NOTE : Please see the information note regarding the change from quarterly to annual grouping in the case of leasing from 2024 and the instructions for completing form 210 in the related content.

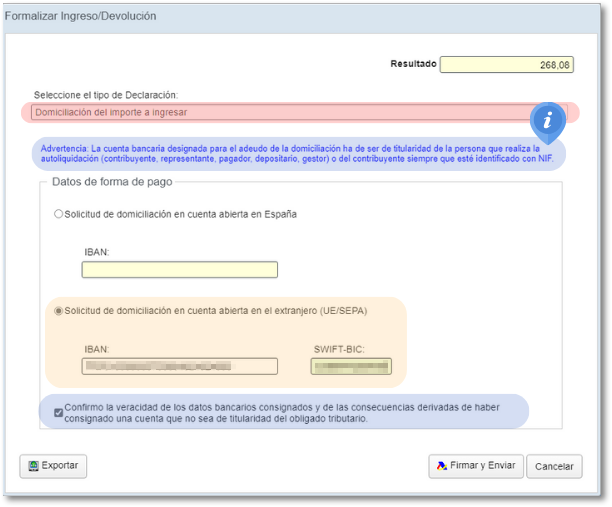

Use the " Formalize Income/Refund " button to submit the declaration once it has been validated.

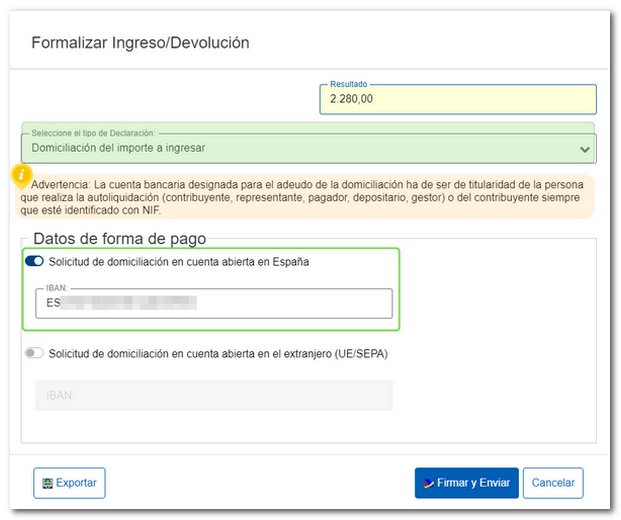

Select the type of declaration depending on whether it is a positive result or zero/No activity.

If you choose direct debit, select the option "Direct debit of the amount to be paid" and enter the account digits IBAN.

From the dayFebruary 1, 2024they canorder direct debitsin accounts opened innon-collaborative entities of the Zone SEPA. The Zone SEPA It is made up of the twenty-seven member states of the European Union plus Iceland, Liechtenstein, Norway, Andorra, Monaco, San Marino, Switzerland, the United Kingdom and Vatican City State.

You must tick the box to confirm the information provided.

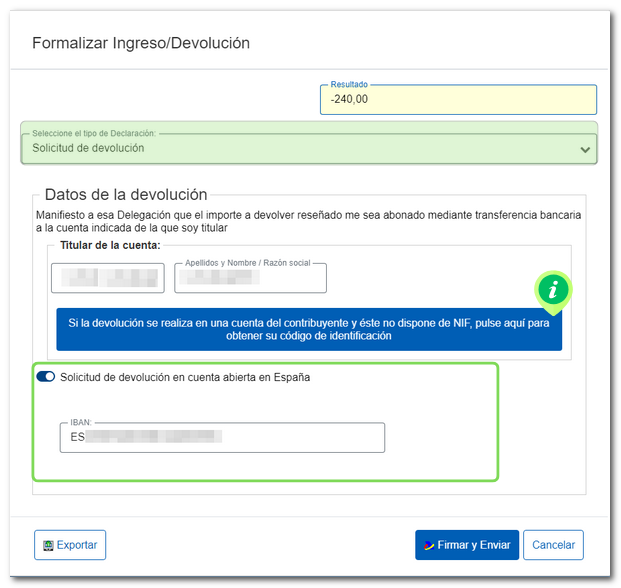

If it is a ReturnYou can choose a Spanish account that you own. It offers the option to indicate payment to the account of a taxpayer who does not have NIFsending him an activation code.

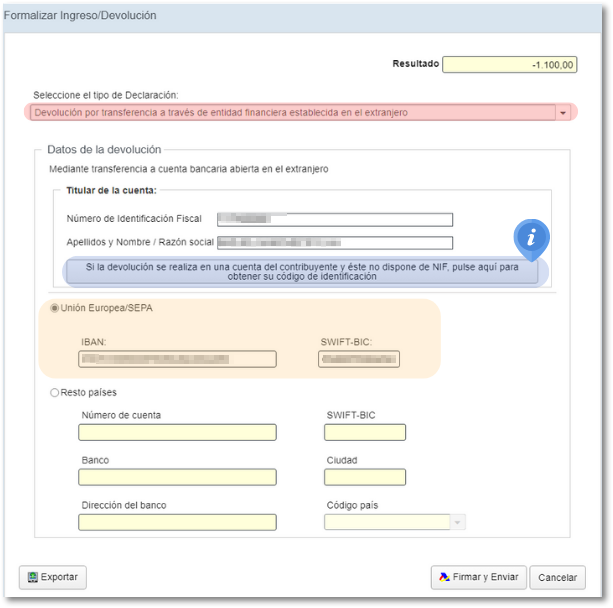

You can request the refund to a foreign account, whether from countries within the zone. SEPAor the rest of the countries.

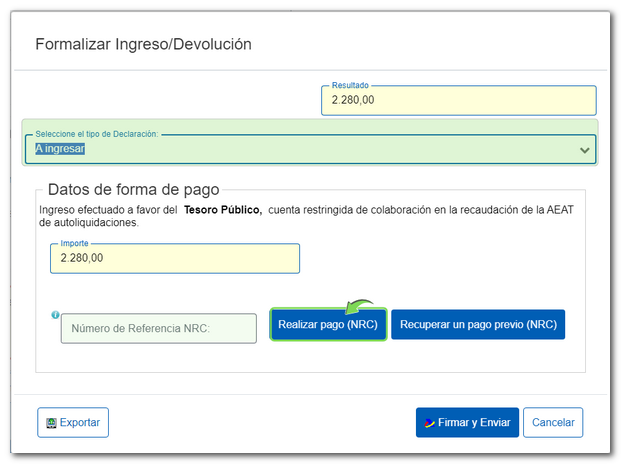

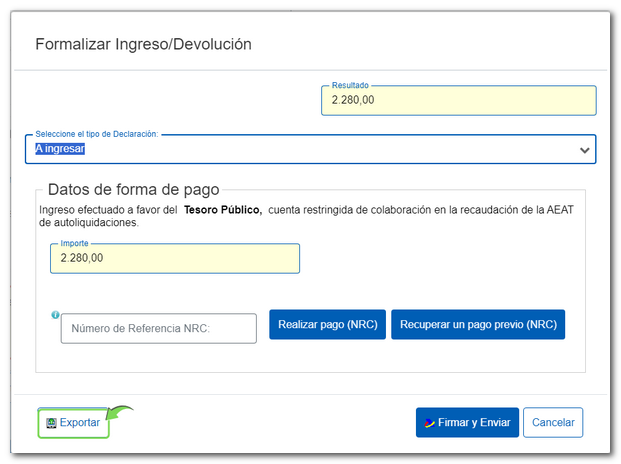

If the result is enter and the payment is not domiciled, it will be necessary to first obtain the NRC and then submit the self-assessment. The NRC is the Full Reference Number, a 22-character code that serves as proof of payment. From the form itself, in the "Make payment (get NRC )" button you can connect to the payment gateway to automatically generate a NRC with the data contained in the declaration. If you already have a NRC provided by your bank, you can include it in the "Reference Number NRC " box.

Using the " Export " button located in the lower corner of this window, you will obtain a file with BOE format that is saved by default in the folder that the browser has as default.

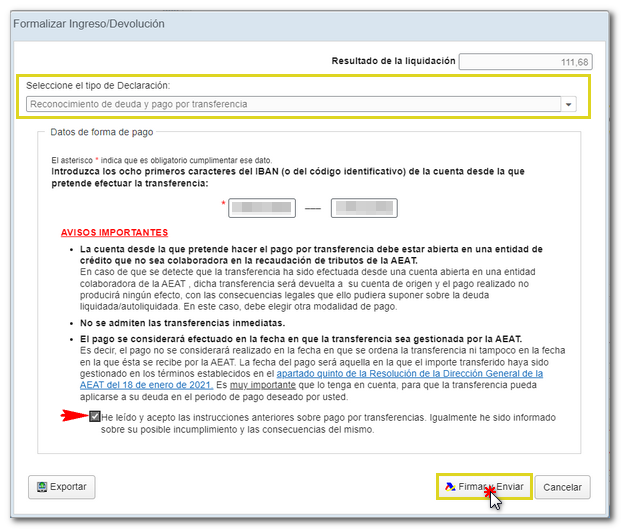

Form 210 also includes the option of acknowledging debt and paying by transfer from a bank account opened in a NON-COLLABORATING Credit Institution, by choosing in the drop-down menu "Select the type of Declaration", "Acknowledgment of debt and payment by transfer". If you choose one of the types of debt recognition, after filing the declaration, you must process the debt from the "Process debt" button or from the specific "Pay, defer and consult" procedure.

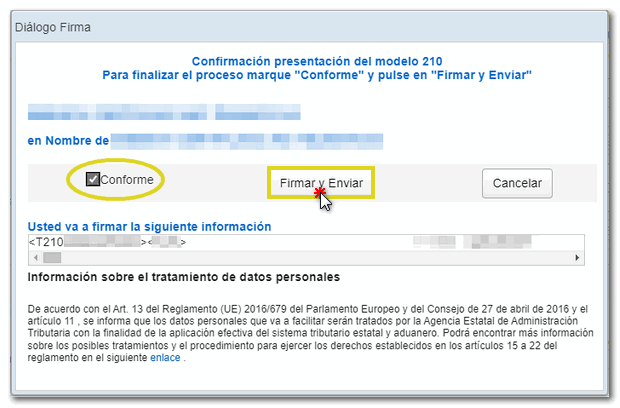

To submit the declaration, click on "Sign and Send"A window will appear with the coded declaration information and the presenter and declarant's data. Check the box "According" and press "Sign and Send" to finalize the presentation.

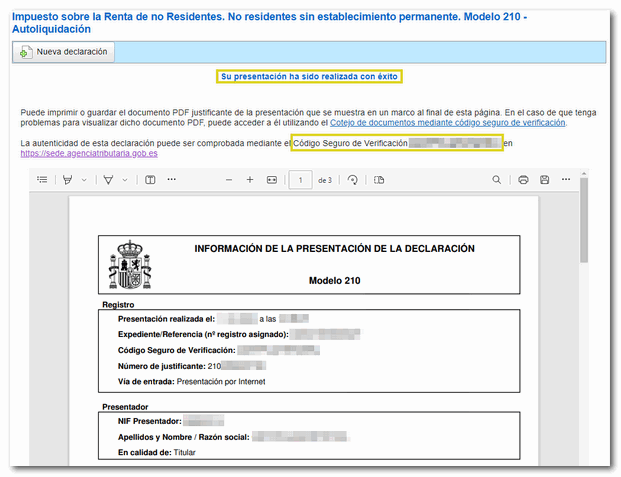

Finally, if everything is correct, the response sheet will be generated with the message "Your presentation was successful." and a PDF embedded that contains a first sheet with the information of the presentation (registration entry number, Secure Verification Code, receipt number, date and time of presentation and presenter details) and, on subsequent pages, the complete copy of the declaration.