Form 210

Skip information indexAuthorization between spouses for the submission of joint declarations of form 210

In the event that the presentation of form 210 corresponds to a self-assessment by two spouses of income derived from the transfer of real estate who choose to submit it jointly, access to the form and the signature of the declaration will have to be done with the electronic certificate or Cl@ve of one of them. The other spouse must, prior to sending the declaration, issue a power of attorney in favor of the declarant who is going to send the form.

The second holder can carry out the power of attorney with an electronic certificate, DNIe or Cl@ve . If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

The power of attorney that allows the filing of form 210 is the specific power of attorney "210P" (also included in the general power of attorney) "GENERALLEY58").

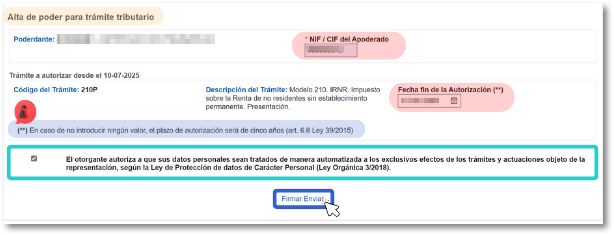

When the spouse agrees to register the 210P power of attorney, he/she will have to indicate the NIF of the declarant who will submit the 210 form and the expiration date of the power of attorney. The maximum duration of this power of attorney is 5 years from the day the power of attorney is registered. If no date is entered for the end of the authorization, it will be 5 years. The box authorizing the processing of personal data must also be checked.

Press "Sign Send".

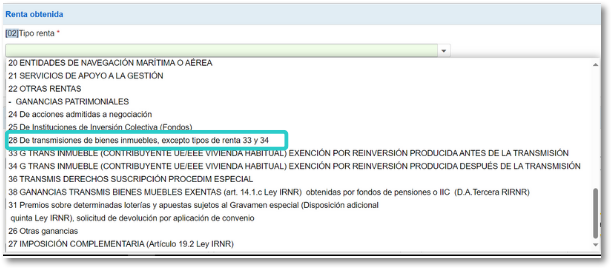

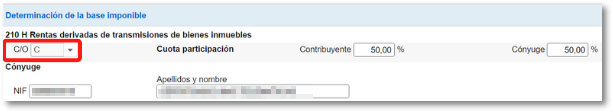

Once the power of attorney has been issued, the declaration can be submitted jointly, making sure to provide the following information: type of Income, key 28 and in the section "Determination of the impossible base", Key C (spouse), the participation quotas of the taxpayer and spouse, plus the identification of the spouse with NIF , surnames and name.

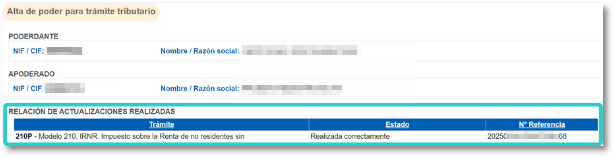

Once the takeover is complete, the reported data will appear.