Model 380 - Technical assistance

Skip information indexElectronic filing of form 380

Access and presentation of this model can be done with a certificate, electronic DNI or Cl@ve . In addition to the holder of the declaration, it may also be submitted by a third party acting on his or her behalf, whether a social collaborator or a representative to carry out the procedure.

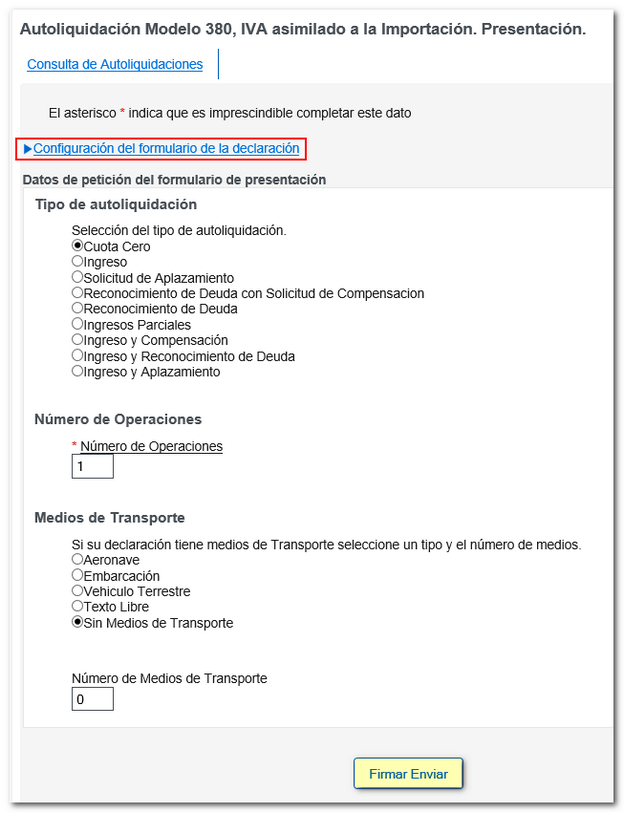

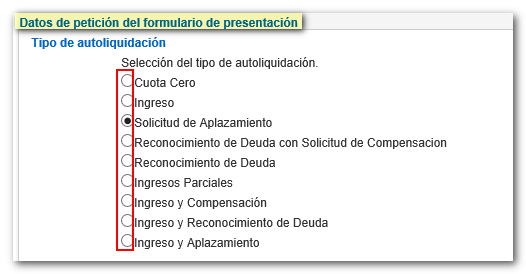

When accessing the form, a "Zero Fee" type self-assessment will be displayed by default, with a single operation to settle and without means of transport. If the declaration requires a different form, modify the necessary data in the "Submission form request data" box.

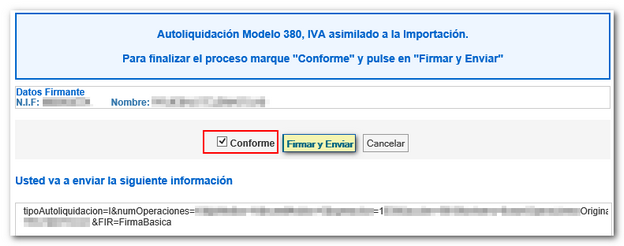

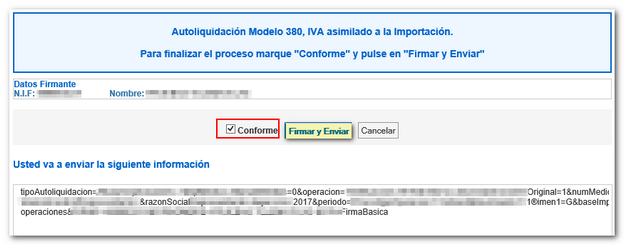

Then press the "Sign and Send" button at the bottom of the form, check the "I agree" box and press "Sign and Send" again to get the new form.

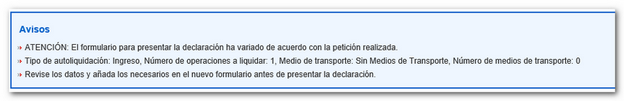

At the top, "Notices", the type of form selected will be specified.

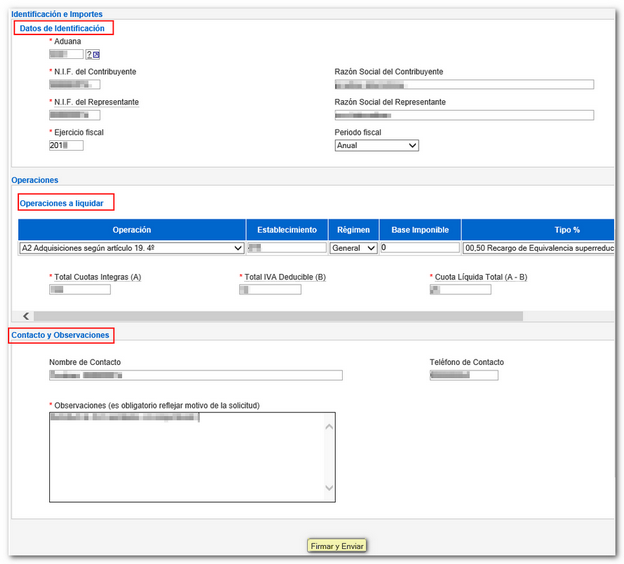

Complete the rest of the sections of the form: "Identification data", "Operations to be performed", "Means of transport" (if applicable) and "Contact and Observations". Those marked with an asterisk are mandatory.

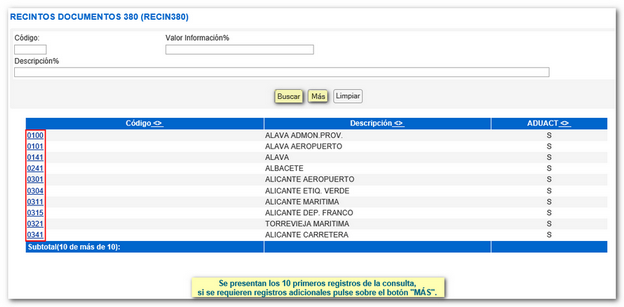

If you do not know the code for the Customs department, click on the question mark icon next to the box. You can search by code, value, information or description. Click "Search" and the first 10 records of the query will be displayed. Click "More" to continue. To enter the customs code in the corresponding box, click on the number in the "Code" column.

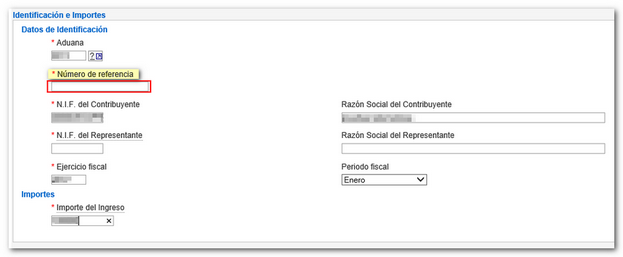

If the return results in income and none of the deferral or debt recognition options are selected, it will be necessary to obtain a NRC (proof of payment) prior to filing. Enter the 22-digit NRC code , provided by the bank, in the "Reference number" box.

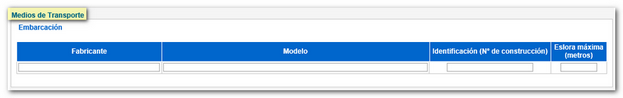

If the declaration has means of transport, select a type and the number of means. Then, fill in the details in the corresponding section that will be enabled in the form.

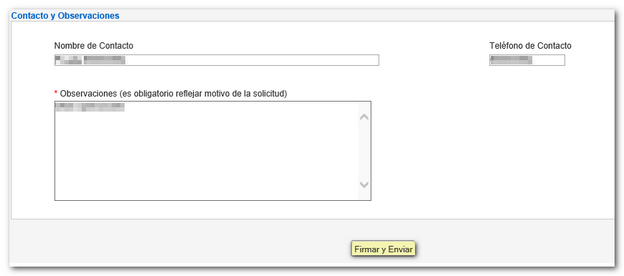

Finally, enter your contact details and any relevant comments and click "Sign and Send", tick the "I agree" box and click "Sign and Send" to complete the submission.

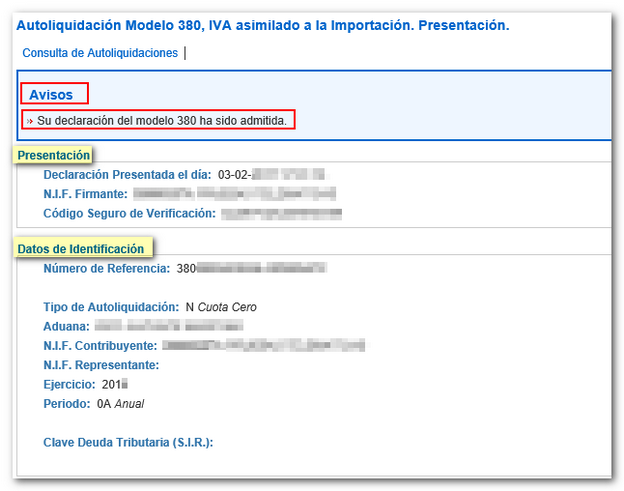

The result of the submission will be a web page with the notice "Your declaration of model 380 has been accepted", with the submission data: Date and time, NIF of the signer and CSV (Secure Verification Code), and the identification data of the presentation: Reference number, Customs, NIF of the taxpayer and the representative, fiscal year and period, etc.