Check the processing status of an Income Tax refund

To obtain information on the processing status of your 2024 Income Tax return, access the banner 2024 Income Tax Campaign and enter your file through the option "Draft / declaration processing service (Direct Income Tax and Web Income Tax)" .

Currently, you can log in to check the processing status in several ways:

- With certificate or electronic ID

- With Cl@ve

- With the reference number of the draft or 2024 Income Tax return and consisting of 6 characters

- With access to EU citizens eIDAS )

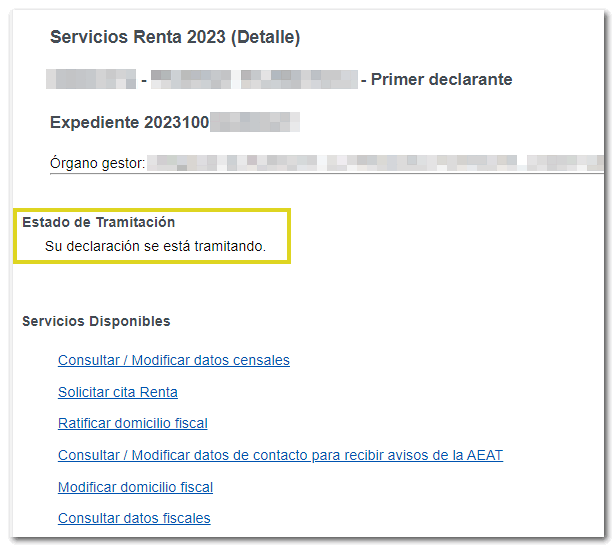

Depending on the status of the file, one of the following messages will appear in the "Processing Status" section of the file: "Your declaration is being processed", "Your declaration is being verified", "Your declaration has been processed by the Tax Administration bodies, estimating the refund requested by you", etc.

Once the appropriate checks have been made and the declaration is correct, a message will appear indicating when the refund will be issued.

For more information about the deadlines for a tax return, we recommend that you consult the Practical Manual for Tax Return 2024 , specifically "Chapter 1. 2024 Income Tax Return Campaign", in the section "Refunds derived from the regulations of the PIT".