Form 030

Skip information indexElectronic submission of form 030

To submit Form 030 electronically, select the procedure "Form 030. Modification or presentation".

You can identify with Cl@ve Mobile Cl@ve or with certificate or ID card electronic. If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

Access may be on your own behalf or on behalf of third parties (social collaboration, power of attorney or succession).

After selecting the identification system, complete the declaration by first selecting the "Reasons for filing"; You can select one or more options and mark whether it is for the interested party, the spouse, or both.

To use a single model for both spouses, you must provide proof of representation to carry out this procedure. In this case, you have access to the power of attorney between spouses for the submission of joint applications for form 030.

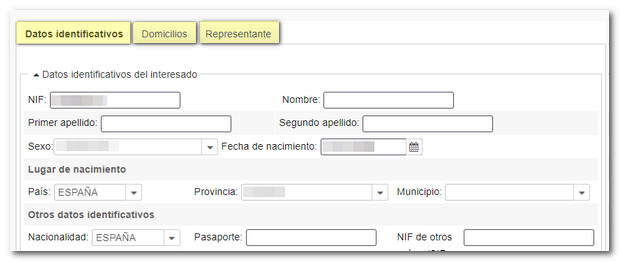

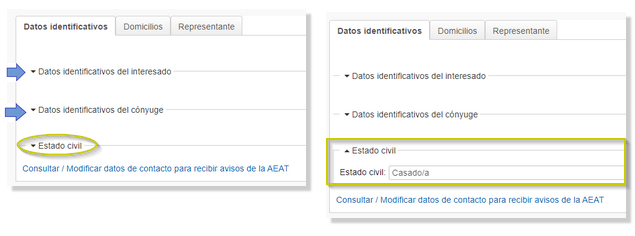

In the second block you will have three tabs: "Identification data", "Addresses" and "Representative". Depending on what is selected in the "Reasons for submission" section, the boxes on each tab will be activated or not.

Each section of the declaration has an arrow to display or hide the boxes that compose it; You can press the arrows as you wish to make it easier to complete.

If you have any questions about completing the form, you can get online assistance from the form itself by clicking on the option " ADI Do you need help?", located at the bottom right of the form. Through this service, you can consult tax information related to this form, start a chat conversation about specific questions about completing the form, or you can request a phone call to help you complete the form. You can also access technical support by clicking the "Computer Help" link.

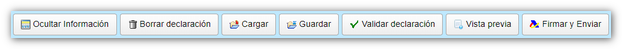

At the bottom of the form are the access buttons to the different functions:

-

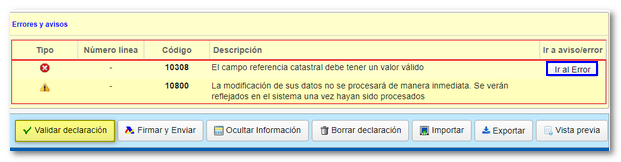

"Validate declaration", to check if there are any warnings or errors when completing the declaration. Remember that it is advisable to review the notices, although they do not prevent the filing of the declaration. If the declaration contains errors, these must be corrected.

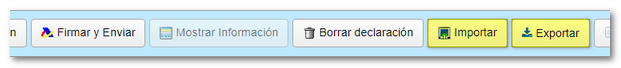

- "Export" It allows you to obtain a file of the declaration in BOE format, which complies with the specifications of the published record design. In order to export, the declaration must be validated without errors. Can "Matter" to the declaration a file in BOE format, previously obtained from the option "Export" from the same form, or generated with an external program.

-

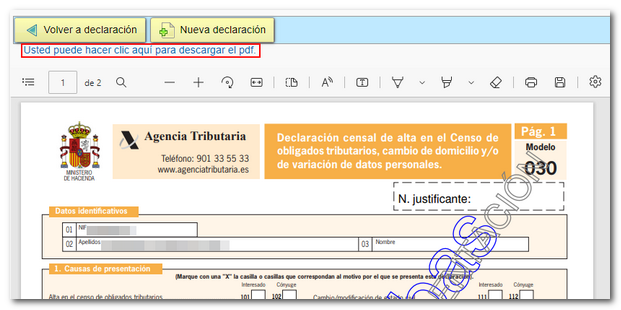

"Preview" , to obtain a draft in PDF with the data already filled in. Remember that it is not valid for filing the declaration.

-

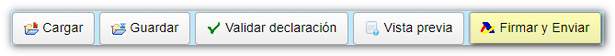

Once you have completed the declaration, click on "Sign and Send" . In the notifications window, click "Continue" if you do not need to review the notifications.

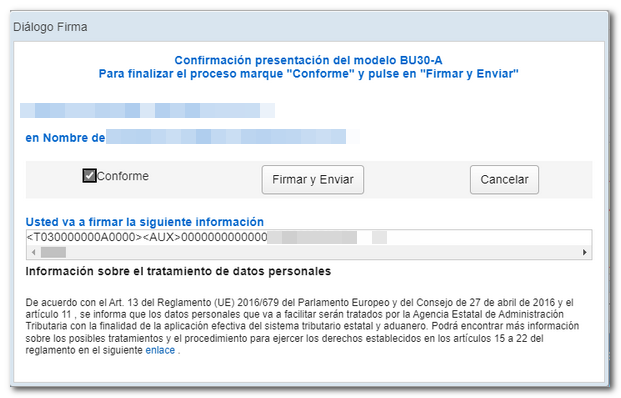

In the presentation window, check the "I agree" box and click "Sign and Send" again to finish the presentation.

The result of a correct submission will be the response sheet with the CSV (Secure Verification Code), the submission data and the copy of the declaration.

The modification of the data will not occur immediately and will be reflected in the system once they have been validated.