Payment of Vehicle Registration Tax

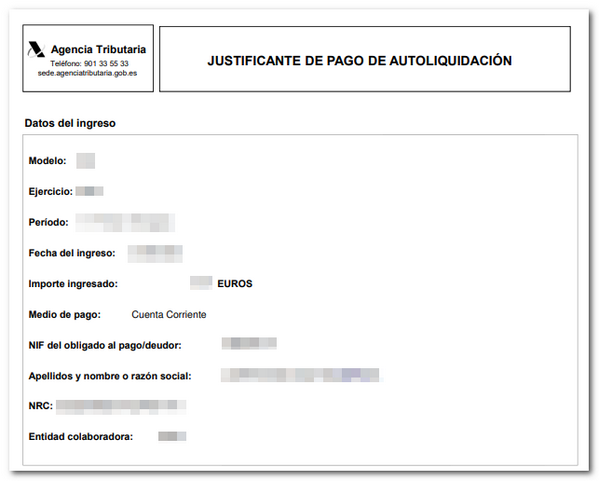

If the result of the declaration is to be paid, payment of the amount resulting from the declaration must be made. The proof of payment is code NRC (Full Reference Number) generated by the Collaborating Entity that managed the collection.

You can make the payment from the option Payment of registration tax, available on the page for managing form 576.

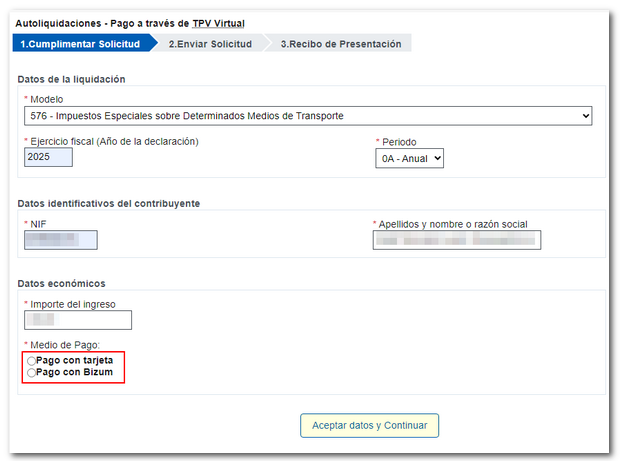

Select one of the available payment options : Payment by debit from account either Pay by card or with Bizum.

In it payment by debit from accountYou will need to identify yourself with Cl@ve Mobile Cl@ve or with certificate or ID card electronic.

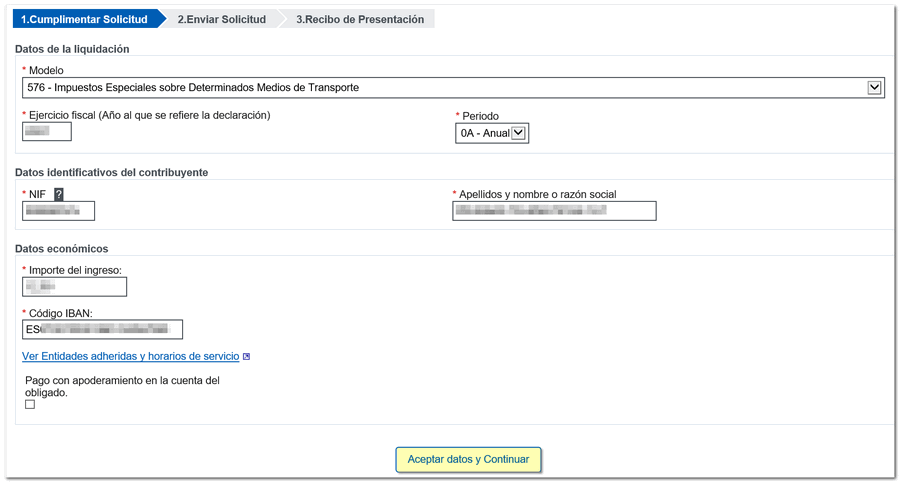

Fill in the form details and check that they are correct and match those indicated on form form. To make the payment and obtain the NRCThe electronic certificate must be that of the account holder, except in the case of being authorized to order charges on an account owned by the obligated party.

If the electronic signature you used to identify yourself has previously made a payment, it will give you the option to use the same one. IBAN, by checking the corresponding box. If you prefer to use a different account, you can specify it in the "Code" field. IBAN"

Remember that you must use an account belonging to a Partner Entity affiliated with the system to make the payment. You can check which entities these are by clicking on the link "View Entities adhering to this service".

Once you have completed the data, click on "Accept data and Continue".

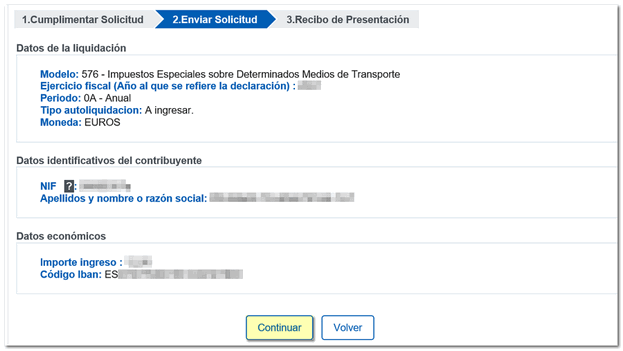

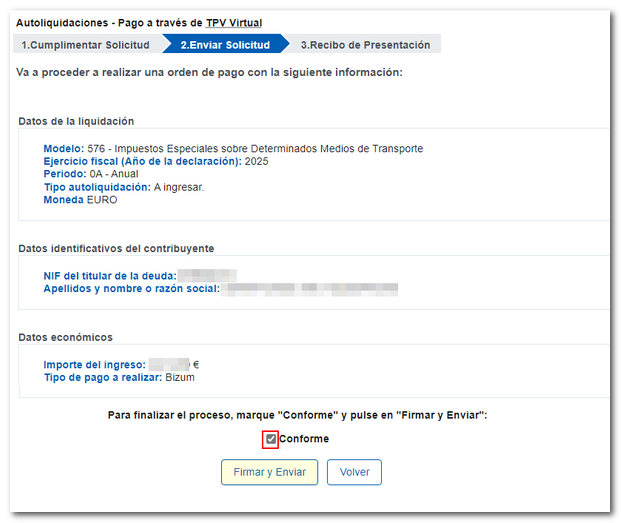

A summary of the data entered will be displayed. Check that they are correct and, if so, tick the "Agree" box and click the "Sign and Send" button to confirm the payment.

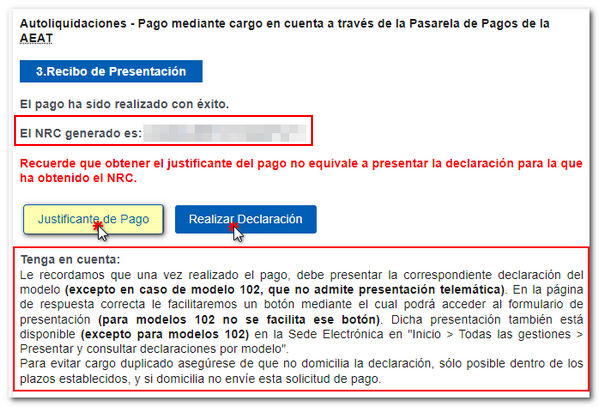

If everything is correct, the assigned NRC will be displayed on the screen. It is a 22-character code provided by Collaborating Entities as proof of payment for online tax return filings. On this page you will have 2 options:

-

'Print Payment Receipt': It allows you to view and print the account charge receipt with a summary of the payment details.

-

'File Tax Return': This option links you to the procedure at the Headquarters for which you have obtained the NRC to conclude the presentation.

If you have opted for the card payment or BizumThe process is quite similar. Once you have filled in the model details, select one of the two options, card or Bizum, and press "Accept data and continue".

Next, select "Agree" and click "Sign and Send".

If you select card payment, continue with the instructions provided by your Financial Institution to make the payment. If everything is correct, the assigned NRC will be displayed on the screen. If you choose Bizum as your payment method, you will need to enter the phone number registered with Bizum and press the "Continue with purchase" button. Please note that you must have your mobile phone nearby to complete the payment, as you have 4 minutes to complete the transaction.

Once the payment is made, you will see the following on the screen: NRC assigned.

Remember that if you do not have an electronic certificate, ID card electronic or Cl@veIt is also possible to make the payment by going to a bank office and providing all the data related to the self-assessment. It is not necessary to provide any model, only the data used for the generation of the NRC and which are the same ones requested to make the payment through the website of the AEAT (model, exercise, period, NIF declarant, surname and exact amount of income).

If the bank has an electronic banking service, it is also possible to request the NRC through its website.

If you are making the payment on behalf of another person, please note that in order to obtain the NRC through the payment gateway of the AEATThe certificate holder and the account holder must be the same person as the payer, but the NIF that is provided to the Collaborating Entity to obtain the NRC It will always be that of the declarant or taxpayer.

For payment operations by direct debit, since the entry into force of the Resolution of June 3, 2009, it is possible to make the payment through the website of the AEAT in an account owned by the obliged party and that the debit order is made by a person other than the latter.

If you are making the payment on behalf of a third party using the bank account of the holder of the declaration (obligated to pay), you must be authorized by the obligated party as the orderer of the payment to carry out this operation.

This power of attorney can be registered online provided that the grantor (who must be the taxpayer) has an electronic certificate and is a natural person. The specific power of attorney to carry out this type of procedure is AEAT - Payment by direct debit, which is included in the "Other specific procedures" section of the "Catalogue of procedures enabled for the power of attorney".

To make the payment on behalf of a third party, you must check the "Payment with power of attorney on the account of the obliged party" box on the form.

If you need to cancel a generated NRC , you can use the "Cancellation of NRC 's (models 576, 696)" option.