Electronic filing of Form 576

The electronic submission of form 576 is mandatory and you can access the form by identifying yourself with an electronic certificate issued in the name of the declarant, DNIe or Cl@ve . If you do not have any of the required identification systems, the person making the submission must be authorized to submit declarations on behalf of third parties, either by being registered as a social collaborator, or by being authorized by you to carry out this procedure.

Furthermore, to carry out any procedure over the Internet, it is necessary that the NIF is identified by the AEAT , that is, that it is registered as a taxpayer. It is possible to check whether a NIF is registered through the option "Checking a NIF of third parties for census purposes" located in all the procedures of form 030. If you do not appear as a registered taxpayer in the AEAT, it will not be possible to carry out any procedure through the WEB page until the 030 form is submitted.

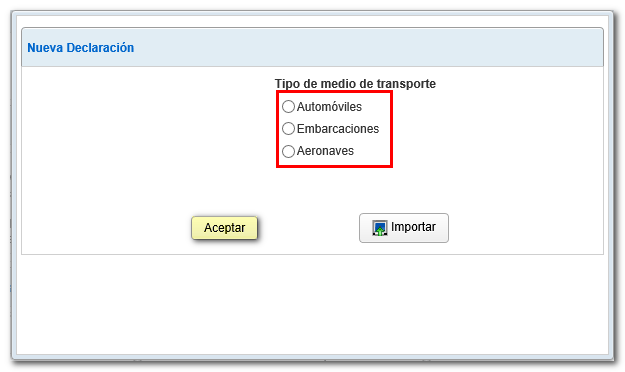

In the pop-up window, select the type of transport and press "Accept".

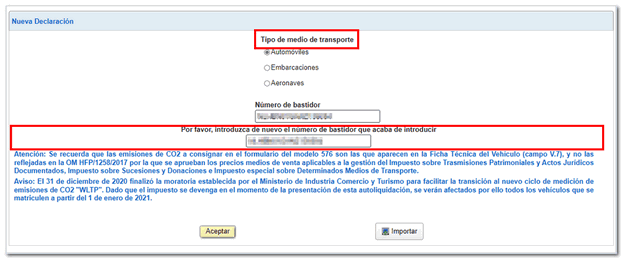

If you select the "Cars" option, you must complete the field "Vehicle number". It will ask you to enter the chassis number again and make sure it is correct. Pay special attention to the data indicated since, once the declaration has been submitted, it will not be possible to modify it . Then, press "OK".

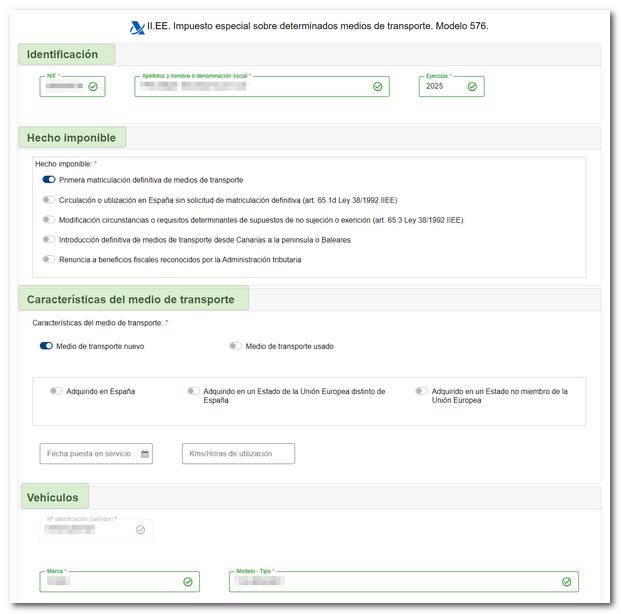

Fill out the form, fields marked with an asterisk are mandatory.

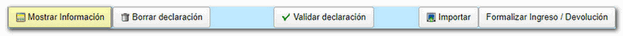

At the bottom of the form you will find the available buttons:

-

Show or hide information on errors or completion warnings.

-

"Delete return" deletes the data of the return you are working on in order to start a new one.

-

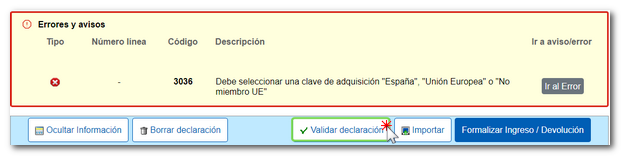

Using the "Validate declaration" button you can check if you have any warnings or errors. If you detect errors you will have to correct them in order to make the presentation.

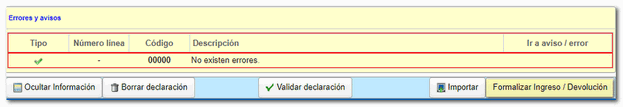

If no errors are detected in the declaration, the description will state that there are no errors.

-

You also have the "Import" button if you have a file generated by an external program or previously saved from the form itself (using the "Export" button that appears in the last window when you click "Formalize Payment/Return", before confirming the submission). If you have not used the form provided by the Tax Agency to obtain the file, you must ensure that it complies with the registration design approved for model 576 and published on the website.

-

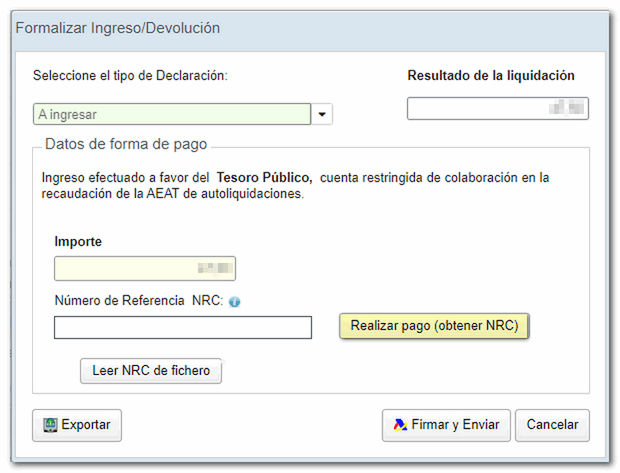

Use the "Formalize Income/Refund" button to submit the declaration once it has been completed and validated without errors.

If the result is a positive amount, that is, to be paid, you must first pay the amount resulting from the declaration. The NRC (Full Reference Number) is the payment proof code. If you have an electronic certificate, DNIeeither Cl@veYou can make the payment from "Pay, defer and consult", "All procedures", "Pay self-assessments" or within the procedures of the model from "Model 576 - Payment of registration tax". You also have the option to connect to the payment gateway on the form itself, using the "Make payment" button.NRC)". Enter the required data and the application will return a NRC (proof of payment). You can also obtain the NRC through the bank's website or telephone banking, if the bank has these services, or in person at one of its offices. Please note the NRC for later inclusion on the submission form.

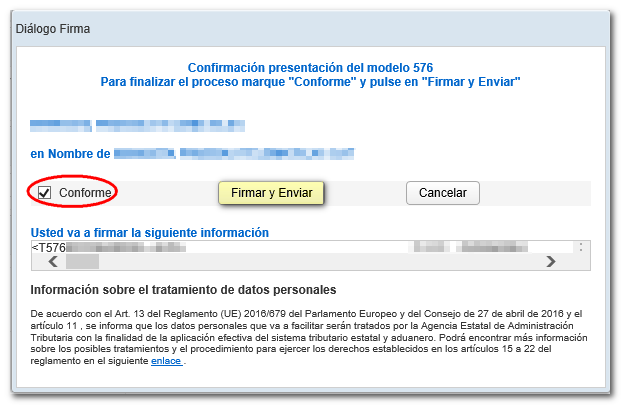

Finally, if the declaration contains no errors, click on "Sign and Submit". In the next window, check the "Agree" box and click "Sign and Send" to complete the submission.

A response sheet for filing the declaration will be displayed with an electronic validation code. You may save or print this answer sheet as proof of submission.