Procedures available in the AEAT APP

Skip information indexIncome Tax

The "Income" section connects you to the Income services for the current campaign and previous years, the consultation of submitted returns and the request for an Income tax certificate. In addition, you have a section for the Income Virtual Assistant, to which you can ask your own questions, which will be answered in a personalized way, as well as the most common doubts about the Income Campaign. Starting March 19, you'll be able to access your tax data for the 2024 fiscal year.

-

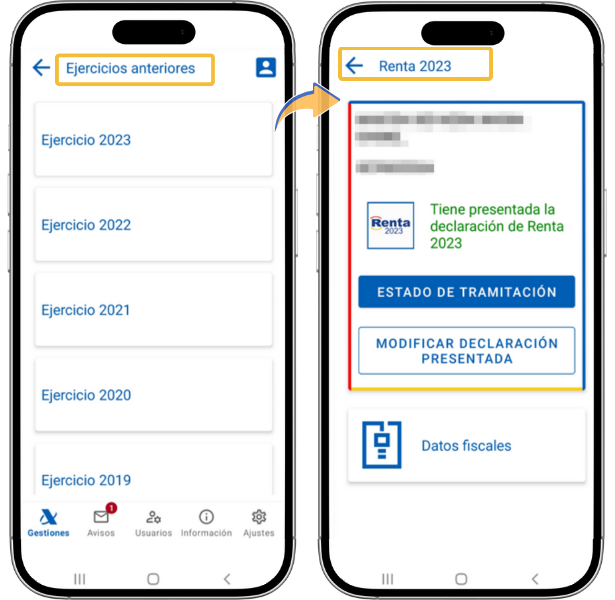

In "Previous years" you can access the Income services for previous years from Income 2018. With the options available depending on the management carried out in each fiscal year: processing status of the declaration, consultation and obtaining the PDF of the declarations submitted, processing of the declaration (if you did not submit it), modifying the submitted declaration and consulting tax data for each fiscal year.

-

You can also access the consultation and download in PDF of the declarations that you have submitted for the current year and previous years of Income by entering " Consultation of submitted declarations ".

-

In the block "Other procedures" there are the options "Income Tax Certificate", "Direct Debit" and "Income Deferral/Compensation Request".

In "Income Tax Certificate" you have access to the request for the Income Tax return certificate and information about its processing, what it certifies and frequently asked questions among other options. Click on "Request Income Tax Return Certificate" to begin the process.

-

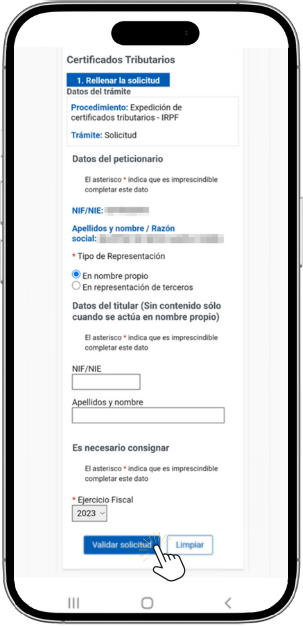

In step " 1. Fill out the application ", the details of the user with whom you have accessed will be indicated, you can request the certificate in your own name or on behalf of a third party. Select the fiscal year for which you are requesting the certificate from the drop-down menu and click "Validate request."

-

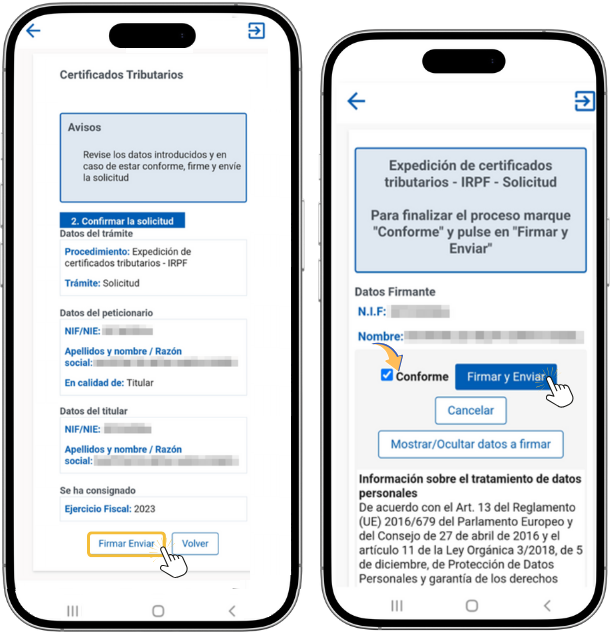

In step " 2. Confirm the request ", review the data entered and press "Sign Send" .

The information to be sent and the signer's details will be displayed. To continue, check the box " Agree " and press the button " Sign and Send ".

-

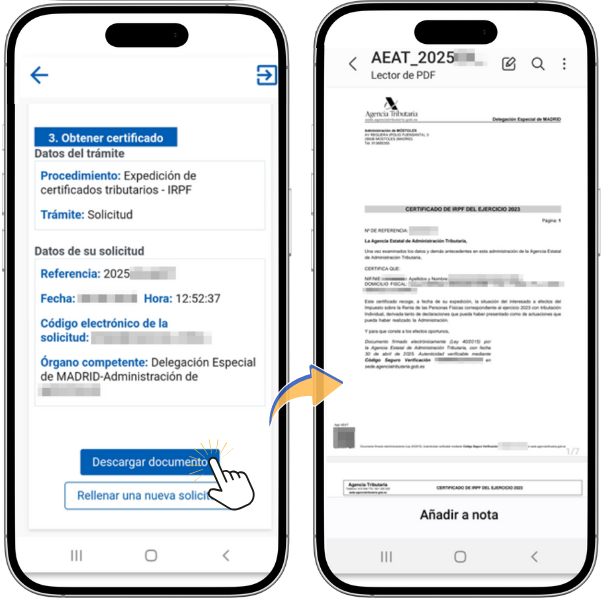

In step " 3. Get certificate " click on " Download document " and you will obtain the Income certificate in PDF that you can open and save on the device.

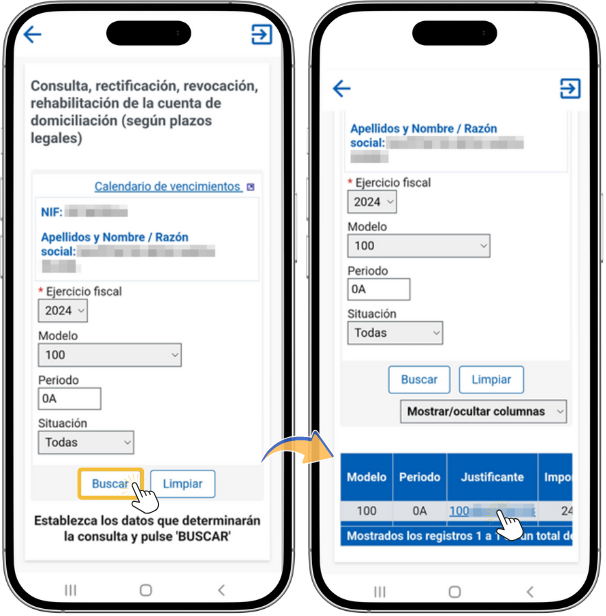

In "Direct Debit" you can check the requested direct debits and take the available actions (rectify, revoke or rehabilitate) depending on your situation and the direct debit term. Enter the fiscal year, model, period and situation, and then click "Search." Records found according to the search criteria will be displayed. Click on the number in the "Receipt" column to access it.

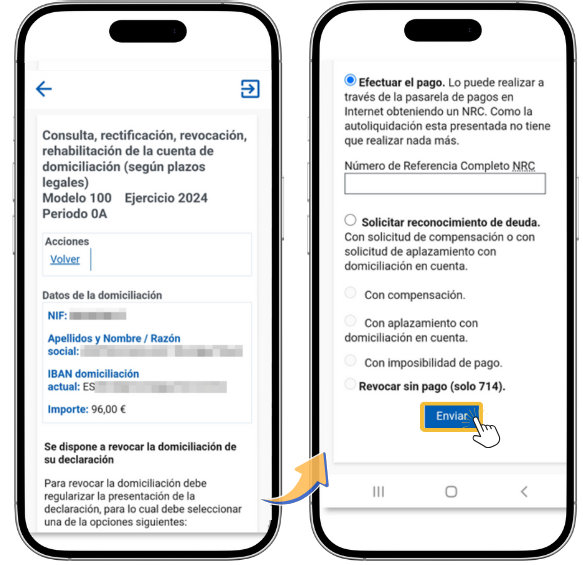

In the next window you will find the actions you can take.

If you select "Revoke," you'll need to choose between "Make Payment," "Request Debt Recognition" (in this case, you'll also need to select whether it's with offset, with deferral by direct debit, or with inability to pay), and "Revoke Without Payment," which is only available for Form 714.

If you choose "Correct IBAN" you must enter the new IBAN for the direct debit.

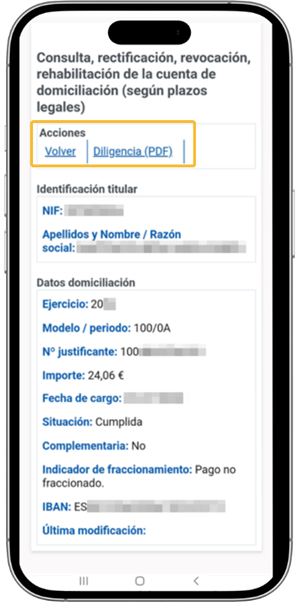

If the direct debit is no longer active, you can download the diligence in PDF.

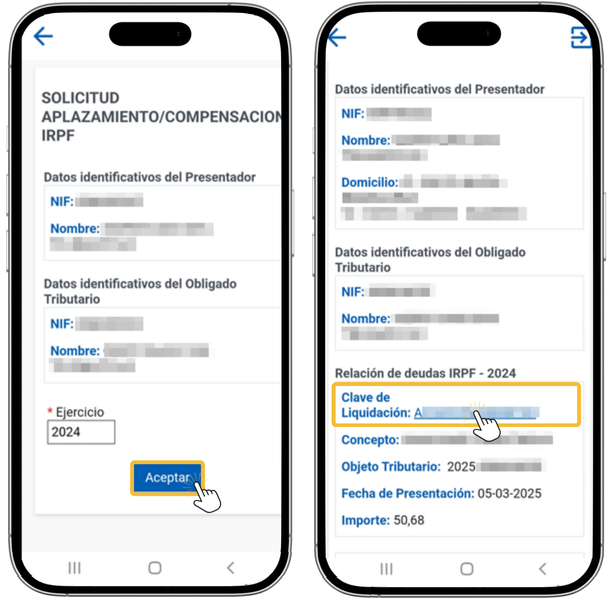

In "Request for deferral/compensation of income", when it is not possible to complete the processing of the submission of a request for deferral, installment or compensation associated with a debt resulting from the submission of a self-assessment of PIT , you can repeat the process using this option.

Access requires identification using Cl@ve Mobile, electronic certificate, DNIe or reference number of the active user in the application. Select the fiscal year to which the debt corresponds and click "Accept".

Next, select the fiscal year to which the debt corresponds. Click "Accept". The relationship of the debts of PIT of the selected fiscal year registered for the debtor and that are ready to be processed by this option. This option only works for debts PIT and that have not evolved in their management.

Click the "Settlement Key" link for each debt to access the next page.

You will obtain information on the identification data of the filer, the identification data of the taxpayer and the settlement key data. At the top are the available options: "Defer", "Offset" and "Pay".

The request for deferral, installment payment or compensation of one debt at a time can only be processed . If the debt has evolved , for example, the deadline for voluntary payment has expired or it has been forced, it is no longer possible to process the procedure using this option. In both cases, you will need to access the option located in "Management", "Pay, defer and check debts".

-