Procedures available in the AEAT APP

Skip information indexPay, defer and consult: Deferring and paying in instalments

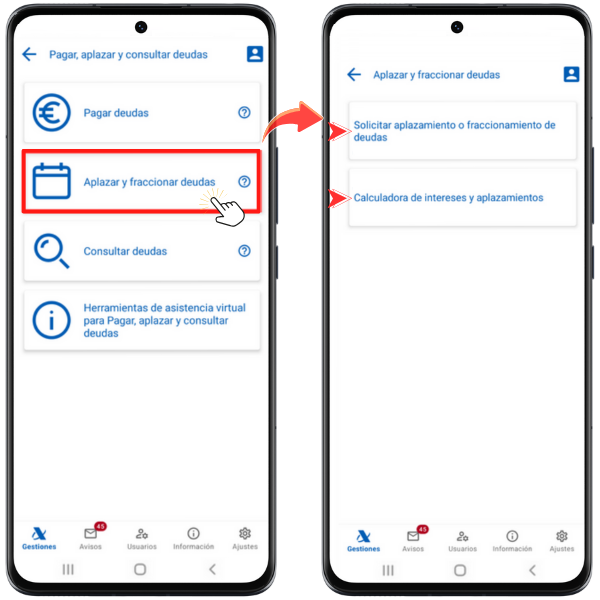

In the "Defer and split debts" section you have two options: "Request deferral or splitting of debts" and "Interest and deferral calculator".

Request the deferral/payment by instalments of debts

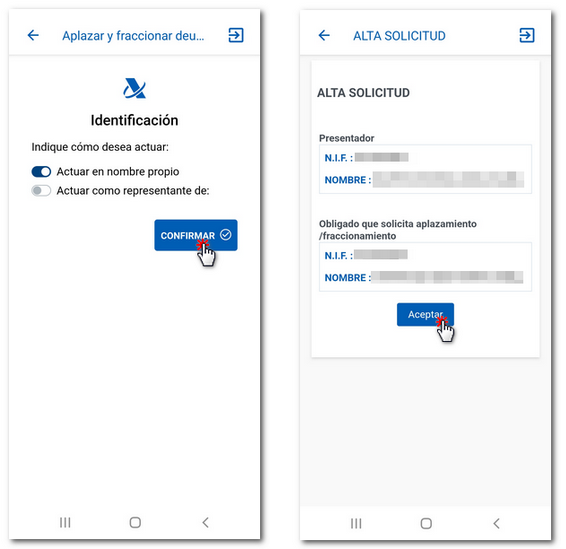

To access the submission of the deferral request, it is necessary to be registered in the Cl@ve system, have an electronic software certificate (Android and iOS systems) or electronic DNI (Android system). It is possible to access in your own name or as a representative; Confirm the selected option and, in the next window, if you are accessing as a representative, fill in the box for NIF of the person obliged to request the deferral or installment payment and click "Accept".

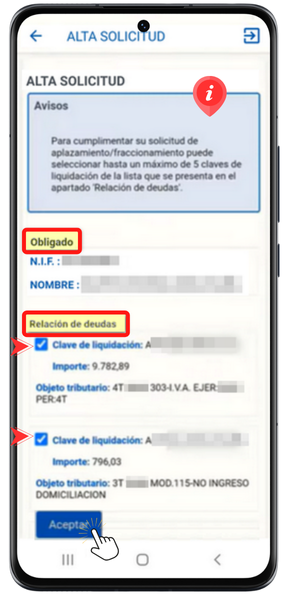

You will enter the application form where you can select up to a maximum of 5 debts with their settlement code from the "List of debts" section. Select the ones you consider appropriate and click "Accept" at the end of the window.

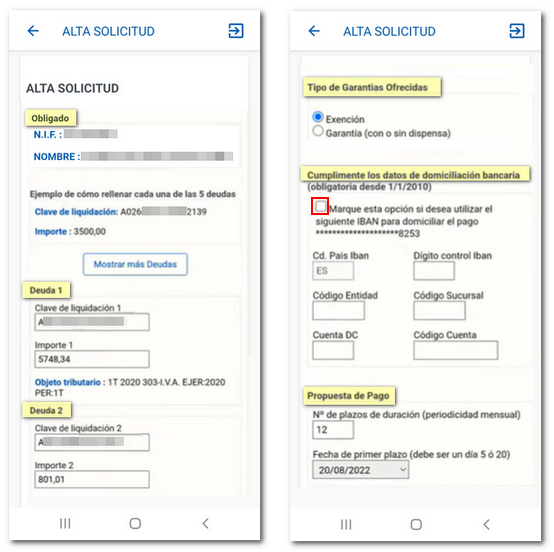

Below are the debts you have selected for the deferral request. Choose the type of guarantee between "Exemption" and "Guarantee (with or without waiver)". Then fill in the direct debit details; The application shows the last account that was used in any previous payment with the Tax Agency; Check the corresponding box if you want to use this account.

Check the payment proposal: the number of terms of duration (monthly periodicity) and the date of the first term.

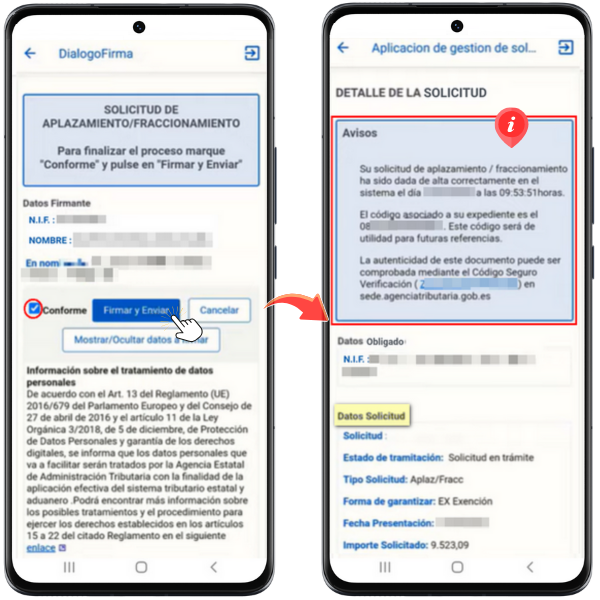

At the end of the window click "Sign and Send"; Then, check the "I agree" box and then "Sign and Send" again.

You will receive the details of the submitted application with the date, the code associated with your file, the CSV (Secure Verification Code) and the debts and amounts included in the application.

Interest and payment deferment calculator

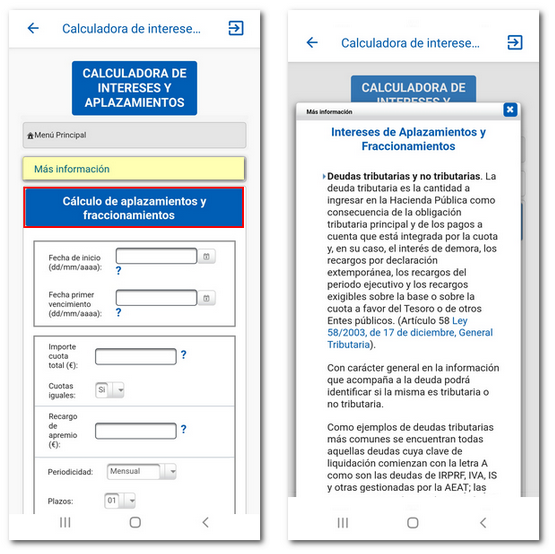

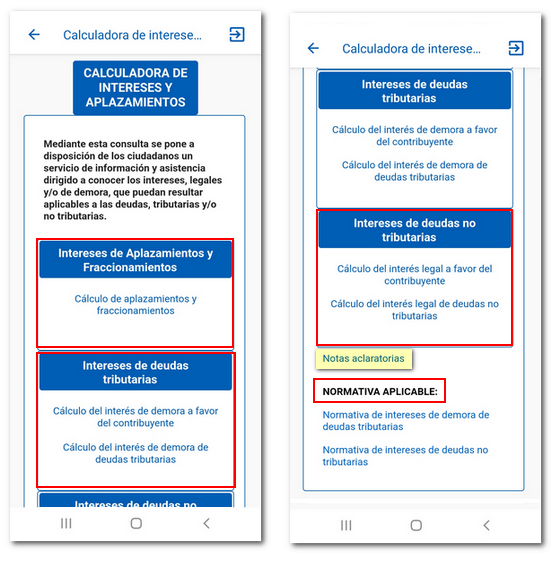

The interest and deferral calculator is a tool that allows you to know the legal and/or late payment interest that may be applicable to tax and/or non-tax debts.

When accessing, by default, we find the application for the "Calculation of deferrals and fractional payments". Please see the "More information" button for information on interest on deferrals and installments.

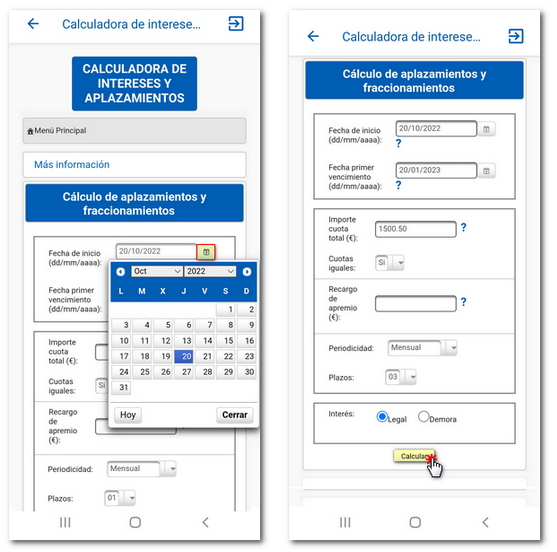

The first block is intended for the start and first due dates, which you can fill in using the dd/mm/yyyy format or using the calendar. The start date is the deadline for payment in the voluntary payment period so that the interest is calculated from the day after the start date and the first due date is the 5th or 20th of each month, unless it is a non-business day, in which case it will be moved to the next business day.

If you have any questions about filling in any box, click on the question mark "?".

In the second block, enter the total amount of the fee, only digits and without a thousands separator. Also choose whether the rates will be equal or not in the drop-down menu. If you select "No" you will need to enter the amounts below. Next, indicate the surcharge for enforcement, if any. Next, select the frequency from the drop-down menu between these options: monthly, bimonthly, quarterly, four-monthly, half-yearly, annual and aperiodic. Indicate the number of installments and choose between legal or late payment interest.

Once all the data has been entered, click "Calculate" at the bottom of the window.

The number of installments, the due date, the amount of each installment, the number of days (between the payment date and the due date) and the interest applied will be displayed. At the top you have a link to export the calculation result to "Excel".

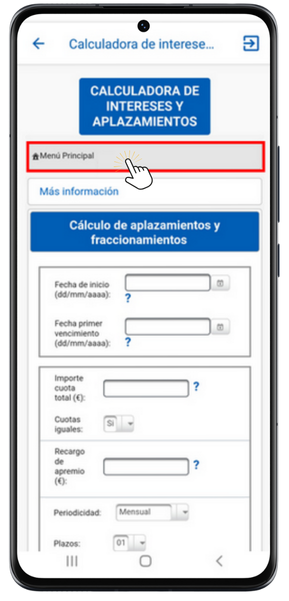

In the "Main Menu" located at the top you will find, in addition to the "Interest on Deferrals and Fractional Payments" calculator, the "Interest on Tax Debts" and "Interest on Non-Tax Debts" calculators, which may be in favor of the taxpayer or late payment interest on tax and non-tax debts. These calculators work in the same way as those used to calculate deferrals and fractional payments.

Also in the main menu, at the bottom of the window, you will find the applicable regulations and explanatory notes.

NOTE 1: If you have several debts, both tax and non-tax, you will have to calculate the interest on each block according to its category.

NOTE 2: If you have several debts to which the same interest concept applies, you can calculate the interest on all of them at once. Even if these have partial income, in which case, you must enter in the breakdown of each specific debt with income (in the "income made on account" field), the date of that income and its amount.