Procedures available in the AEAT APP

Skip information indexPay, defer and consult: Consulting debts

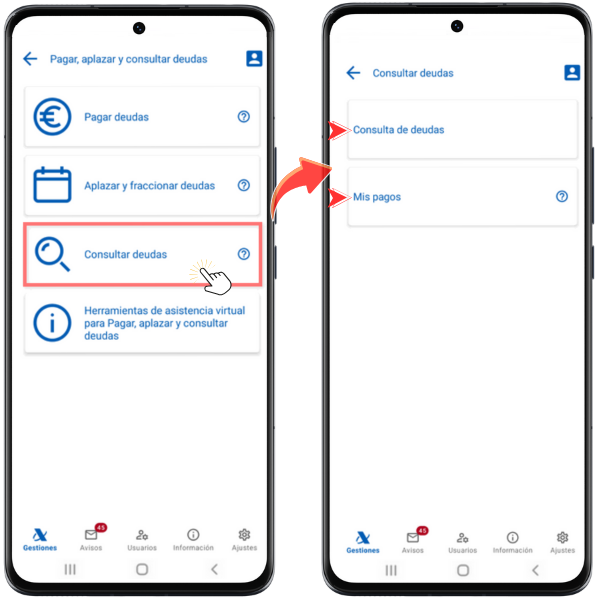

From the "Pay, defer and consult" option you can access "Check debts". In this section you have two options: "Debt inquiry" and "My payments".

Debt enquiry

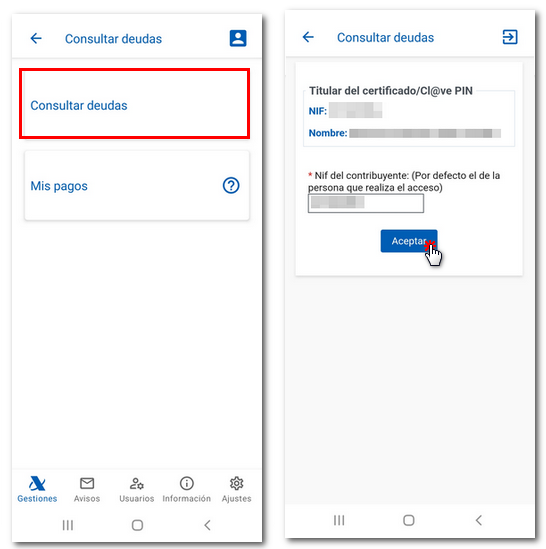

To check your debts, you must identify yourself using an electronic software certificate (Android and iOS systems), electronic DNI (Android system) or Cl@ve . You can access as the owner or as an authorized person or entity. The specific power of attorney required is RA19007, included in the general power of attorney GENERALLEY58 (General power of attorney for procedures or actions related to article 46.2 of law 58/2003). Once identified, the following window will display the NIF of the holder who is making the access and a box to enter the NIF of the taxpayer. By default, it is that of the person making the access, but you can change it to that of the grantor, if you have the appropriate authorization.

Click "Accept".

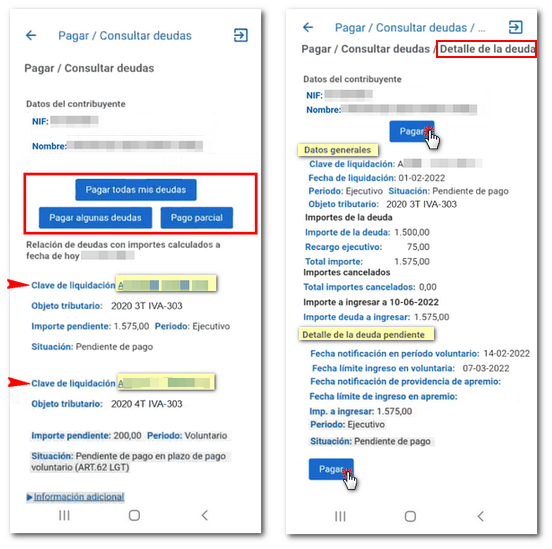

You get the list of all debts and their outstanding amounts with the settlement code, which is a code that begins with the letter A followed by 16 numbers. From this window you have three options: "Pay all my debts", "Pay some debts" and "Partial payment". If you access as a representative and need to pay the amount of the debts, you will need the power of attorney "GENERALLEY58" or the specific ones for debt payment "RA19007", "RA19008", "RA19009" and "RA19010".

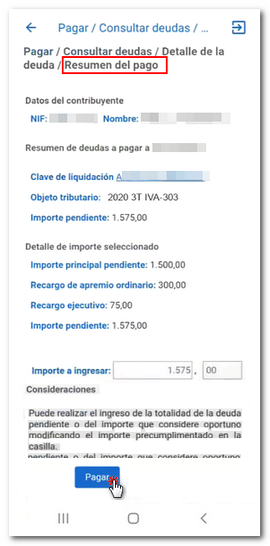

The information available in the debt query will be related to the settlement key, the tax object, the outstanding amount, the period and the current status of the debt.

In addition, if you click on the settlement code you will access the details of the debt, from where you can also access the payment using the "Pay" button located at the beginning and end of the window.

A summary of the payment will be displayed. It is advisable to verify the information accompanying this page. If you have opted for "Partial payment" you can select the specific amount you wish to pay by modifying the "Amount to be paid" field, deleting the amount in the integer and decimal boxes to indicate the amount that suits you best. It is important to know that, in the event of partial payment of a debt, it will continue to appear until it is fully satisfied. Select the payment method.

Accept the data, in the next window mark "I agree" and press "Sign and send". After payment, a NRC (Full Reference Number) of the operation is displayed.

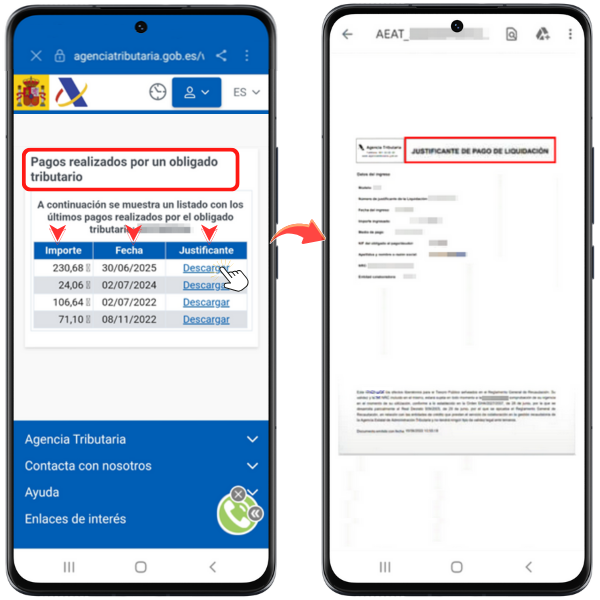

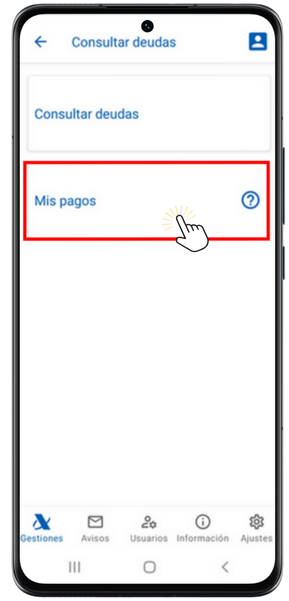

My payments

In this section you can easily find out, sorted by date, the payments you have made to the Tax Agency, as well as download the receipts for them.

To check your payments you must identify yourself with an electronic software certificate (Android and iOS systems), DNI electronic (Android system) or .Cl@ve

Once you have identified yourself, a list of the latest payments made for settlements, self-assessments and/or fees will be displayed, with the data associated with each of them, such as the amount paid and the date of payment.

Likewise, from the option "Download" , located in the "Receipt" column, you will obtain a PDF with proof of the payment made. The receipt obtained contains all the details relating to the payment: the model, the fiscal year and period in the case of self-assessments, or the receipt number in the case of settlements, date of payment, amount paid, payment method used (account charge or card/Bizum), NIF of the holder, the NRC associated with the payment and the Entity.