Procedures available in the AEAT APP

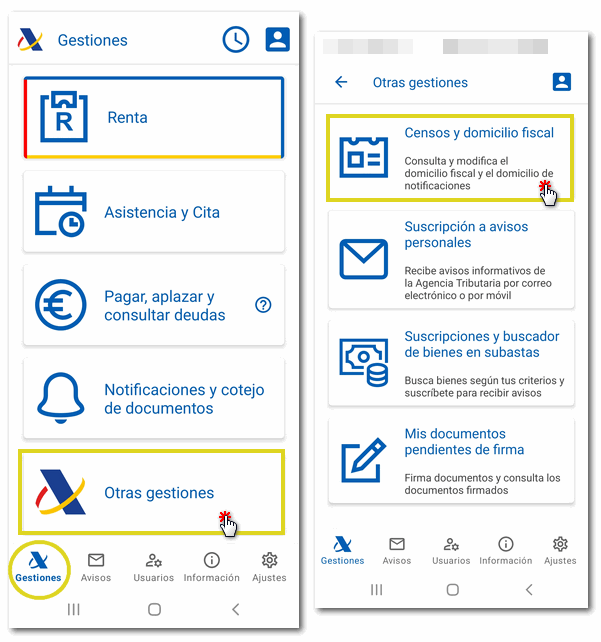

Skip information indexOther procedures: Census and tax domicile

In the "Other procedures" section you will find access to "Census and tax address" so that you can consult and, if necessary, modify the tax address and the notification address.

You will find two options "Consultation and modification of the tax address and the notification address" and "Virtual assistance tools for Census and IAE ".

Consultation and modification of the tax address and the notification address

Access is available with Cl@ve and with a certificate or electronic DNI .

Depending on the NIF you use to log in, whether or not you have economic activities, your obligations, etc., the system will offer some options or others.

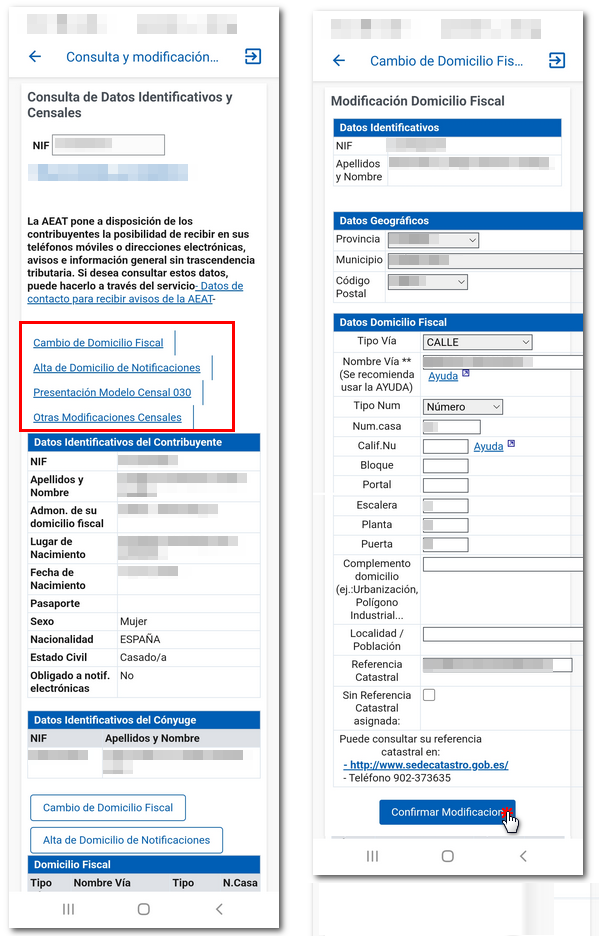

When you log in, at the top you will find a box with the NIF and the name and surname of the user with whom you have logged in, followed by the taxpayer's identification and census data.

In the case of accessing the consultation of a person without economic activities, the consultation and modification options will be the following:

-

Change of tax address : allows you to modify the tax domicile data that appears in the census. Once the modification is confirmed, the receipt of the procedure is displayed with the date and time of submission as well as the CSV associated with the submission and a link to the "Document Comparison" to view the receipt.

-

Registration (or Modification) of Notification Address : Through this option you can add an address for notifications. Allows you to add a postal address or a PO Box.

-

Presentation of Census Model 030 : This option links directly to the procedures of model 030.

-

Other Census Modifications : links with the management of models 036 - 037.

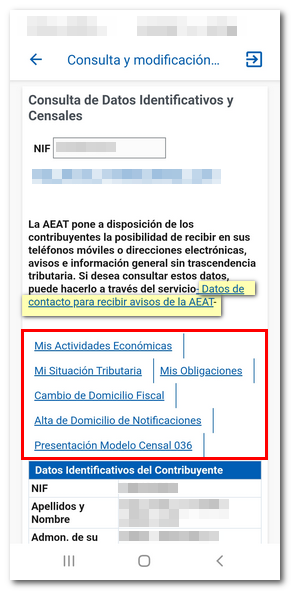

In addition to the above functionalities and depending on the situation in the census of economic activities, you will have the following options:

-

My Economic Activities : displays information about the taxpayer's activities and premises: the status it is in, start date, termination date, etc.

-

My Tax Situation : provides a summary of the tax situation in the regimes of VAT, of the Corporate Tax, of the , Personal Income Tax of the Non-Resident Income Tax in addition to other taxes and special regimes.

-

My Obligations : shows the list of tax obligations, type of periodicity and their status.

-

My Representatives : shows the list of your representatives and their status (will only be displayed if you have them).

-

My Representatives : shows the relationship of your represented and their situation (it will only be shown if you have them).

-

Change of Tax Address : allows you to modify the tax domicile data that appears in the census. Once the modification is confirmed, the receipt of the procedure is displayed with the date and time of submission as well as the CSV associated with the submission and a link to the "Document Comparison" to view the receipt.

-

Registration (or Change) of Notification Address : Through this option you can change an address for notification purposes. Allows you to indicate a postal address or a post office box.

-

Cancellation of Notification Address : Using this option you can cancel your address for notifications (only if you are registered).

-

Presentation of Census Model 030 : This option links directly to the procedures of model 030.

-

Other Census Modifications or Presentation of Census Model 036 : links with the management of models 036 - 037.

In addition, at the top, the AEAT makes available to you the possibility of receiving on your phone or in your email the notices and general information without tax implications of the AEAT .

Census Virtual Assistance Tools and IAE

The APP- AEAT offers you several help tools, in this section you will find the " Activity search engine and its tax obligations ", where you will find information on the groups or sections in which the economic activities included in the IAE Rates are classified, and the " Census Informant " which offers information on how to request the AEAT , the different models of census declarations, form, place of presentation and reasons for presentation, as well as documentation to be attached in each case.