Procedures available in the AEAT APP

Skip information indexPay, defer and consult: Paying debts

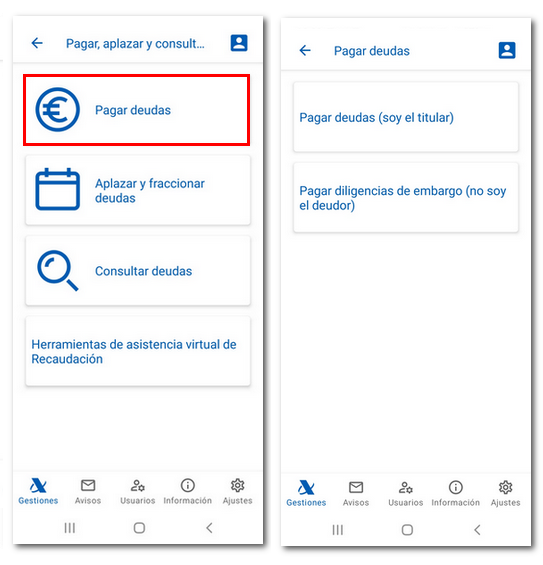

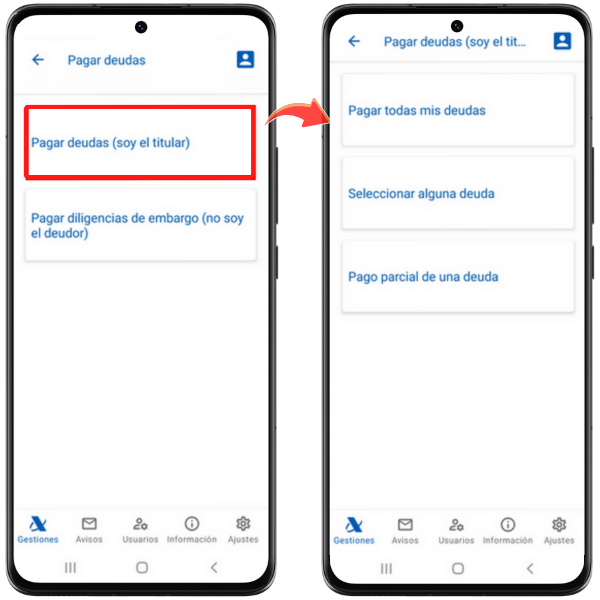

In the "Pay debts" section there are two options: "Pay debts (I am the owner)" and "Pay seizure proceedings (I am not the debtor)".

In addition, from the initial block "Pay, defer and consult debts" you have available the Collection virtual assistance tools for calculating payment terms and the calculation of interest and deferrals.

Paying debts (I am the holder)

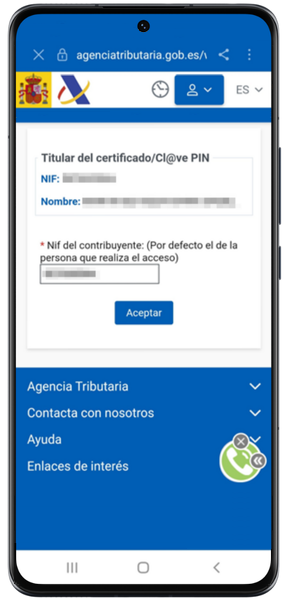

To access you must identify yourself using Cl@ve , electronic software certificate (Android and iOS systems) or DNI electronic (Android system). You can access as the owner or as an authorized person or entity. The specific power of attorney required is RA19007, included in the general power of attorney GENERALLEY58 (General power of attorney for procedures or actions related to article 46.2 of law 58/2003). Once identified, the following window will display the NIF of the holder who is making the access and a box to enter the NIF of the taxpayer. By default, it is that of the person making the access, but you can change it to that of the grantor, if you have the appropriate authorization.

You have three options:

-

Pay all my debts . Select this option to pay all outstanding debts at once and in the same transaction. Check the taxpayer's NIF and click "Accept".

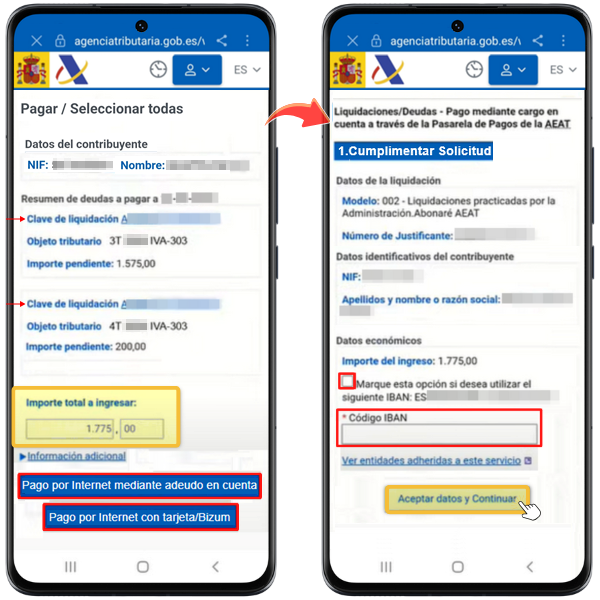

The list of outstanding debts is displayed, each with its settlement code, tax object and outstanding amount. If you click on the settlement code you will enter the details of each of them.

The total amount and the options "Pay by direct debit" and "Pay by credit/debit card" are displayed at the bottom.

If you choose to make the payment by direct debit, enter the account IBAN where the charge will be made. The application will show you by default, if there is one, an account already used on another occasion in AEAT so that, if it matches the one you want to use now, it will be easier and faster for you to select it. Click "Accept data and Continue".

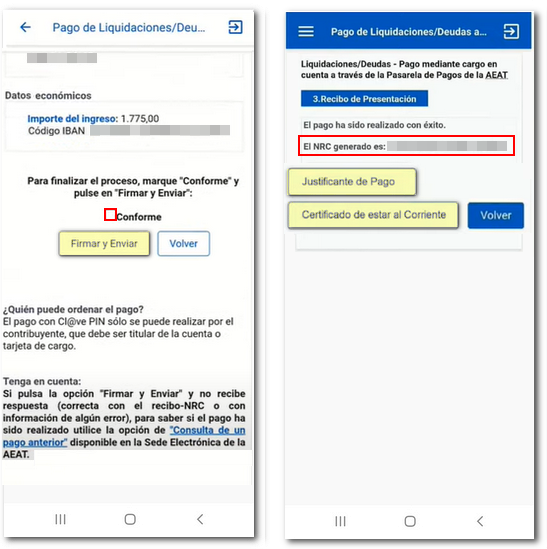

In the next window, check the "I agree" box and click "Sign and Send." After making the payment by direct debit, at a collaborating entity, or with a card/Bizum you will get the NRC generated and you will be able to download the proof of payment, along with the option to obtain a tax certificate of being up to date.

-

Select any debt. This option allows you to view the list of your outstanding debts and select those you wish to pay. Check the taxpayer's NIF and press "Accept"; The list of outstanding debts will appear, each with its settlement code, its tax concept and the outstanding amount. Check the box for the debt or debts you want to pay . The number of selected debts and their total amount will be calculated. You can select all the debts or delete the selection and make a new one.

Once the corresponding debts have been selected, reviews the total of the selected debts and the total amount and press "Pay" .

A summary of the selected debts, the total amount to be paid and the payment options will be displayed. After making the payment, you will receive the NRC generated and you will be able to download the proof of the transaction.

-

Partial payment of a debt . You can view the list of your outstanding debts and select those you wish to pay. After identification, check the taxpayer's NIF and press "Accept".

The list of outstanding debts will appear, each with its settlement code, its tax concept and the outstanding amount. Click on the settlement key of the debt for which you are making a partial payment. Review the information and status of the debt and click "Pay."

In the next window you can modify the amount to make the partial payment for the corresponding amount. After entering the amount, review the information in the "Considerations" section and click "Pay."

You will be able to see the total amount of the debt (including interest) and the partial amount that you are going to pay on this occasion.

You can make the payment electronically by direct debit or by credit/debit card. After making the payment you will receive the NRC generated and you will be able to download the proof of the transaction.

Pay for seizure proceedings (I am not the debtor)

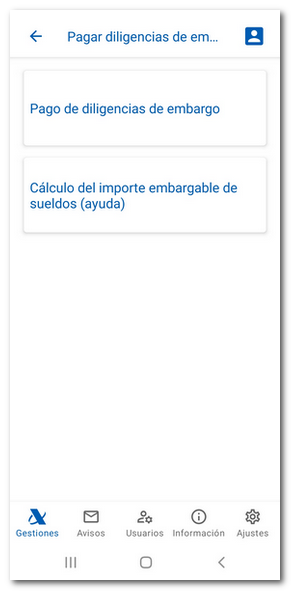

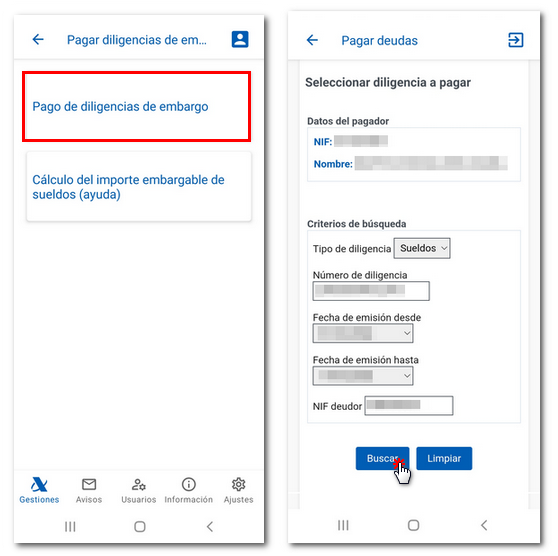

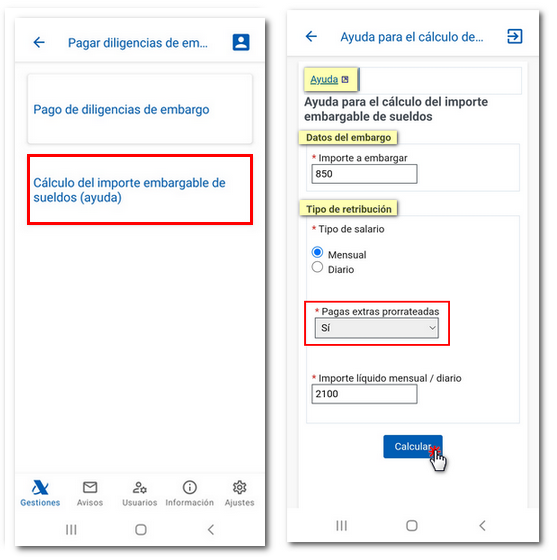

You have two options, "Payment of seizure proceedings" and "Calculation of the amount of salary that can be seized (aid)":

-

Payment of seizure proceedings. To access you must identify yourself using an electronic certificate or Cl@ve . At the top will be the payer's data, which will be that of the holder who makes the access.

Select the diligence in the drop-down menu between the options "Wages and salaries", "Credits (commercial and tenants)" and "Point of sale terminals (POS)"; Then, enter the diligence number, set the issue dates from/to, NIF of the debtor and press "Search". If you access as a representative, fill in the box with the NIF of the principal.

Click on the number of the document and you will access the details of the outstanding debt. You'll receive a summary and can make your payment directly from "Online payment by direct debit" or "Online payment by card/Bizum." You can also obtain the payment letter through the Entity Collaborating Entity Income Doc. (PDF).

-

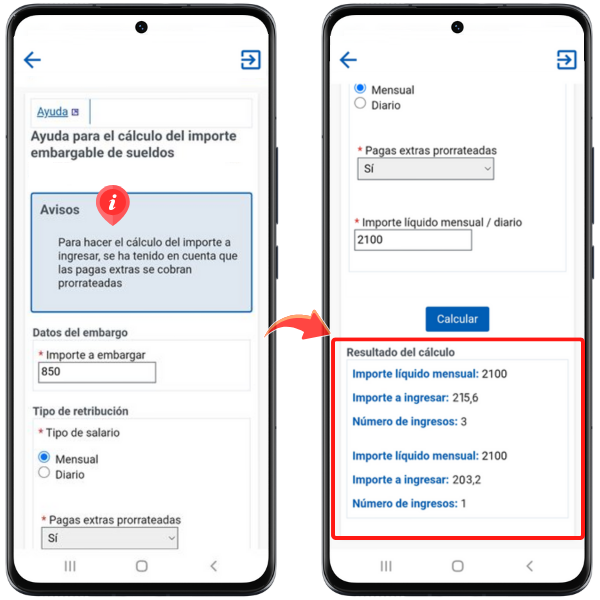

Calculation of the amount of wages that can be seized . This tool allows you to calculate the amount to be seized from a salary, pension, remuneration or its equivalent. At the top you will find a help link to consult the applicable regulations and information on calculating the amount to be seized, along with an explanation of the application and how it works.

Enter the amount to be seized and select the type of salary or remuneration, "Monthly" or "Daily"; If you select "Monthly" choose from the drop-down menu whether the extra payments are prorated or not and, finally, fill in the net amount, monthly or daily. Press "Calculate".

You will get the result at the bottom with detailed information about the monthly or daily net amount (depending on your selection), the amount to be deposited and the number of deposits.