Procedures available in the AEAT APP

Skip information indexNotifications and checking of documents

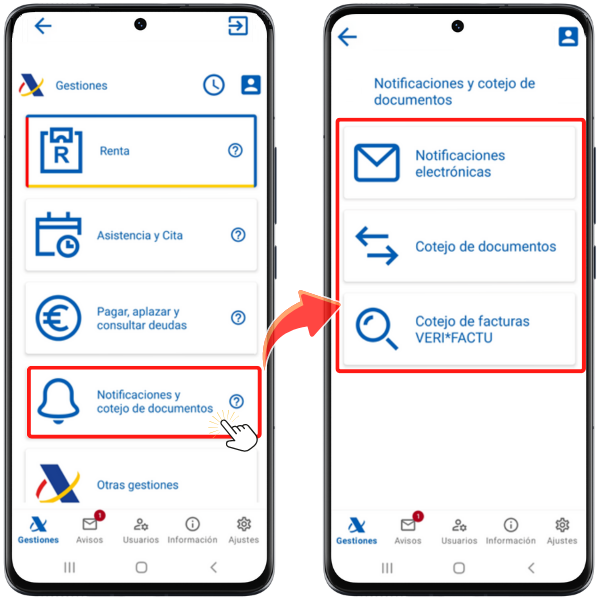

In this section, you have access to three procedures: checking your notifications using the "Electronic Notifications" option; verifying documents issued by the AEAT with CSV from "Electronic Document Comparison"; and "VERI*FACTU Invoice Comparison," which allows you to compare Veri*factu invoices.

Electronic notifications

You have two options to check notifications: In the first you will obtain a "Summary of unread notifications and communications (Appearance at Headquarters)" and in the second the "Query of notifications and communications". You can also subscribe to our "Personal Notifications Subscription" service, and in the "Information" section, you can find frequently asked questions and technical support related to electronic notifications.

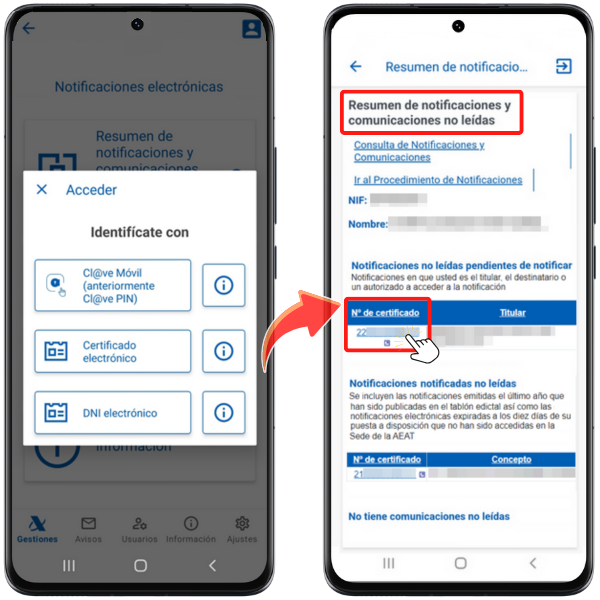

Summary of unread notifications and communications (Via e-Office)

You will be able to access those notifications and communications that, according to information from the AEAT , have not yet been accessed or read by the taxpayer. To access the consultation, identify yourself with Cl@ve , with an electronic software certificate or with DNIe (only for Android devices). In addition, you can also receive a notification in the APP- AEAT and access it directly from the notification itself.

This summary query shows " Unread notifications pending notification ", of which you are both the owner and the recipient or authorized with express power to receive said notifications, "Unread notified notifications" , which includes notifications published on the Single Editorial Board and electronic notifications expired ten days after being made available that have not been accessed on the Electronic Office and "Unread communications" which includes electronic communications not accessed and communications sent by mail in the last three weeks.

From this same window, at the top, you have access to the "Consultation of Notifications and Communications" and to the notification procedure linked on the website.

To access the notification or communication, click on the certificate number.

If it is catalogued as pending, to access its content, you will have to click the "Sign and Send" button. Check the 'OK' box and click 'Sign and Send' again. Please note that you must have a PDF document viewer installed and allow file downloads.

Once access to the notification is signed, the "View notification" button is enabled to view the document in PDF .

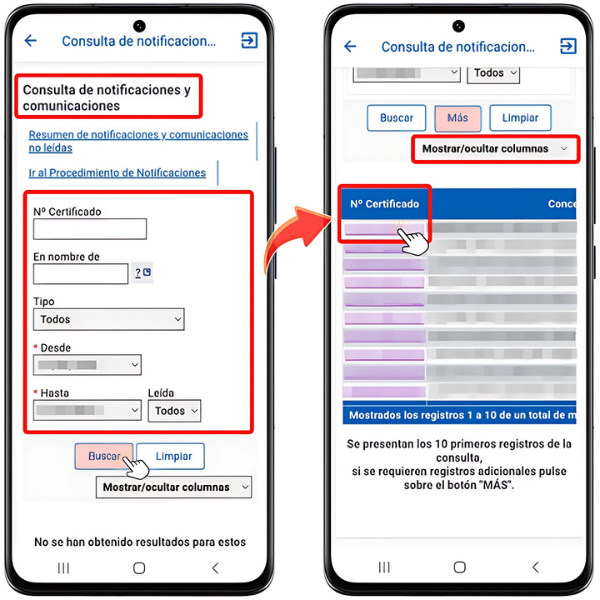

Consult notifications and communications

From this option you access a search engine that allows you to locate both the notifications and the communications of the taxpayer with which you are linked at the time of issuance as the owner of the notification, the recipient or an agent to access the notifications and communications of the owner.

The procedure requires identification with an electronic software certificate or with Cl@ve of the declarant. In addition to the owner himself, a third party acting on his behalf may also access the data. To access notifications on behalf of third parties you must have power of attorney. This empowerment may be general or specific to specific issues. The general authority to receive notifications from third parties is GENERALNOT.

The search criteria you can use are:

- "Certificate No."

- "On behalf of" , allows you to filter the results for the selected person or entity, which may be the taxpayer themselves, an entity they succeed, or a person or entity authorized by the taxpayer to access their notifications and communications. This criterion also shows all notifications and communications whose owner is the third party, including those that were issued before receiving the power or granting the succession. To facilitate the search for the third party, you can click on the hyperlink next to the box and activate the search window, for which you need an electronic certificate installed on the device or DNIe with a reader. You can search by NIF , name, type and procedure, by clicking the "Show Filters" link or selecting the taxpayer directly. To locate notifications and communications from third parties, it is essential that you indicate the NIF of the power of attorney or the entity you are succeeding in this field.

- "Type" , filters the results to notifications yes or no notified and communications.

- Date range , allows you to limit your search to the dates indicated "From/To", with no minimum or maximum range. By default, the dates of the last month appear, but they can be modified.

- "Read" , to filter notifications or communications that are read or not. The "Read" mark is activated when the taxpayer, whether the owner, recipient or authorized representative to access notifications, accesses said communication or when it is delivered by Post Office, in person or by a tax agent. In addition, to prevent old notifications or communications from making it difficult to identify more recent shipments that have not been reviewed by the taxpayer, an agreement has been adopted to consider notifications issued before the last year as read, as well as communications issued by post within three weeks.

Once you have selected the criteria, press the "Search" button. The first 10 results that meet the selected conditions will be offered. If there are more, the "More" button will be enabled so you can access them. You can select the columns you want to display from the "Show/Hide Columns" drop-down menu. If they are all visible, the columns will be: Certificate No., Concept, Type, Holder, Recipient, Date of issue, Date of notification, Notification method and Read. Depending on the size of the device you will see the first columns; To see the rest of the columns, slide the image to the left.

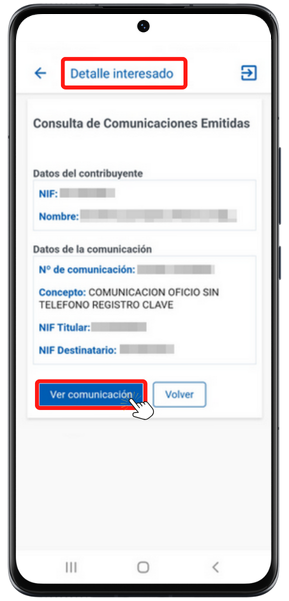

Click on the link in the "Certificate No." column to access the details of the notification or communication.

Depending on whether it is a notification or a communication, and whether it has already been notified or not, and read or not, a different access button will be displayed to download or view it. For viewing, the device will offer you the available options.

At the top, you will find a link to access the summary of unread notifications and communications, as well as access to the notification procedure linked on the website.

Subscription to personal notices

You have several services available. Under "Check your personal notification subscription," you'll find all the information about your subscription, such as the holder's identification details, the organizations to which you are subscribed, and contact channels, such as your mobile phone number and email address, as well as other information about your status and date.

In "Subscribe or modify your subscription to personal notifications," you can unsubscribe from the service or modify the agencies to which you remain subscribed, as well as your contact channels (phone number and email address).

You can find more information about subscribing to personal notifications by clicking the "Notifications" link. Subscription to personal notices".

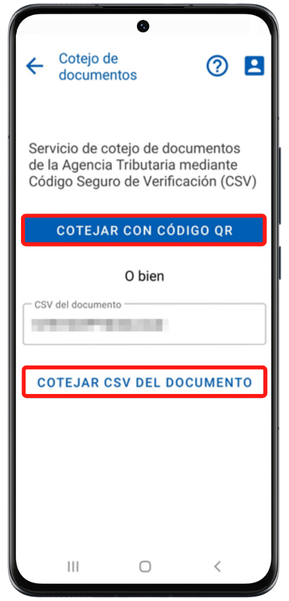

Matching documents with CSV

In this section, you can verify the documents sent by the AEAT with CSV (Secure Verification Code). It allows you to manually enter the CSV or read the QR code with your device's camera and verify the authenticity of the document. The CSV is located at the bottom of all documents issued by the AEAT .

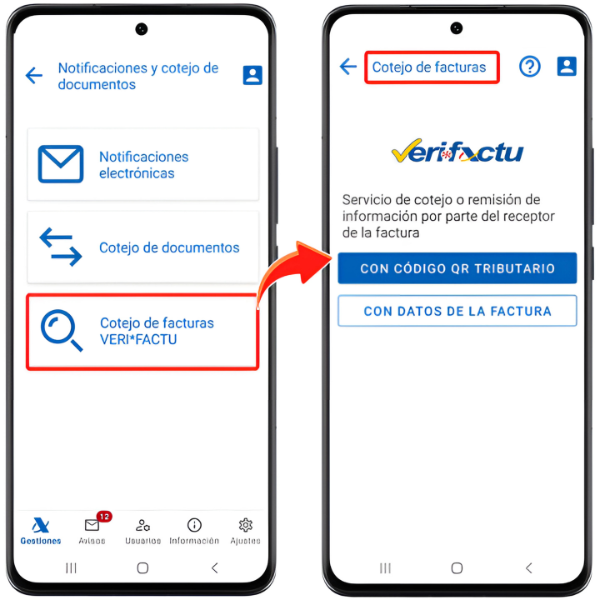

Invoice comparison

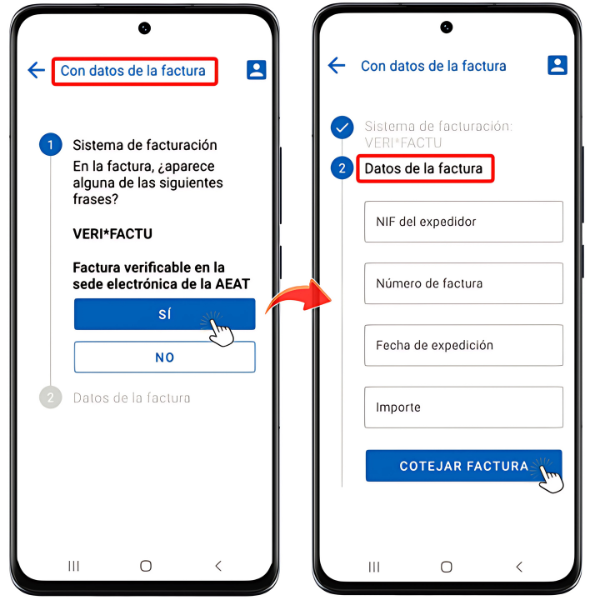

In this section, the identified user will be able to compare invoices from the VERI*FACTU system. You can perform the check by scanning the tax QR code on the invoice or by entering the invoice details.

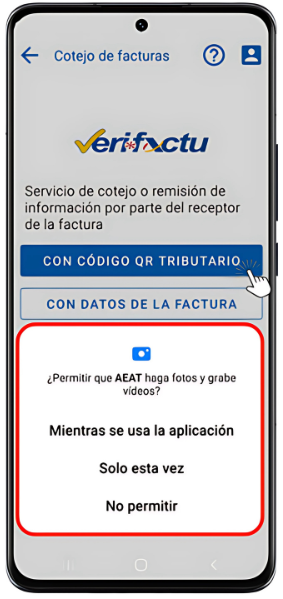

In order to use QR code reading, you will need to grant permissions to the app.

If you select "With invoice data" whether it is verifiable on the Electronic Office of the AEAT or not, you must enter the NIF of the issuer, the invoice number, the date of issue and the amount.

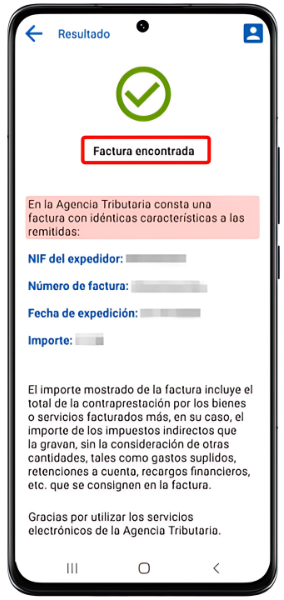

If the match is correct, you will receive a notification indicating that the invoice has been found and has identical characteristics to those sent.

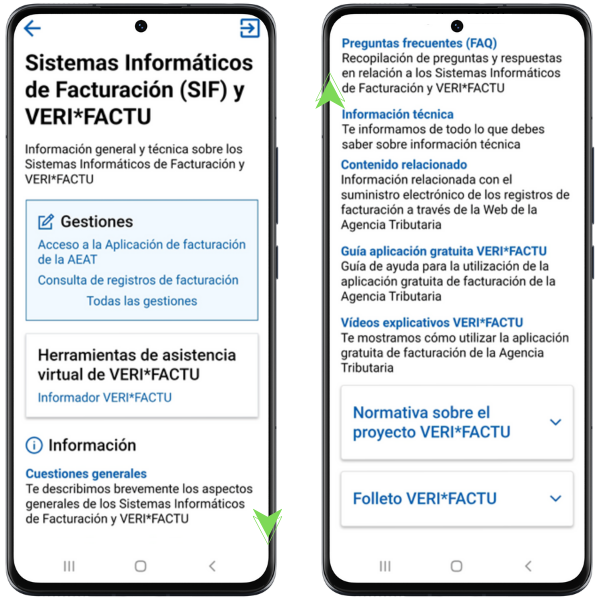

At the top of the invoice comparison window, clicking on the icon with the question mark (?) will take you to the website of the computerized billing system (SIF) and VERI*FACTU, with the available procedures, the VERI*FACTU virtual assistant, and general and technical information.