Forms 038 to 180

Skip information indexForm 179. Filing

The presentation of form 179 requires identification by electronic signature (certificate or electronic DNI ) or by Cl@ve Mobile (only natural persons).

For the 2024 financial year, this model is no longer valid.

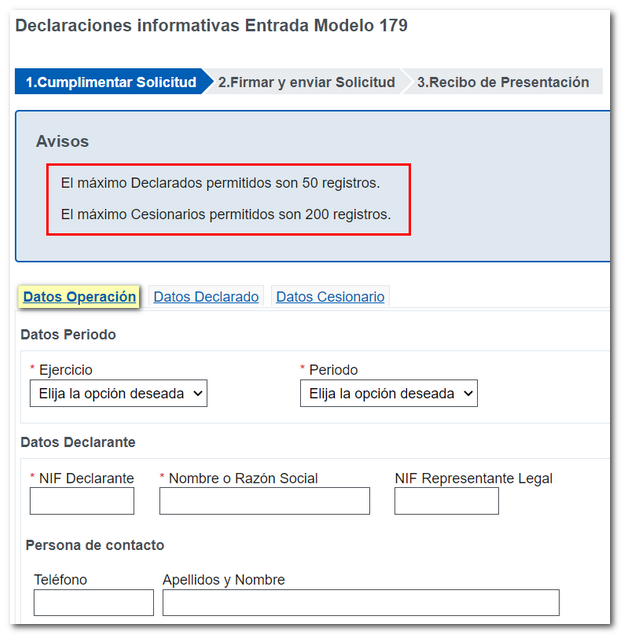

If you need to submit a form from a previous year, when you access the declaration submission service, a notice appears at the top informing you of the limits of permitted records; For those declared, the limit is 50 records and for those assigned, the limit is 200 records.

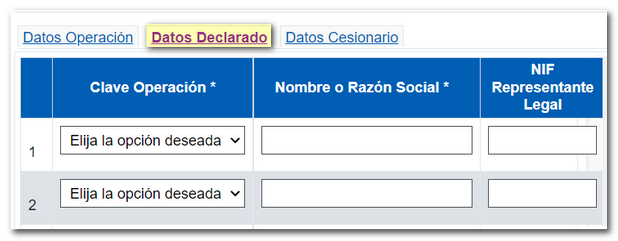

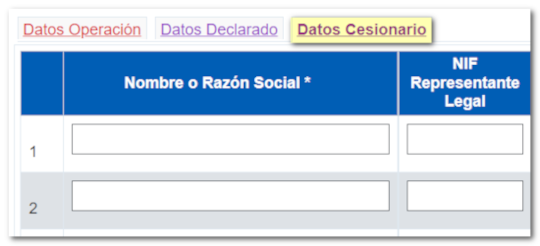

The form consists of three tabs: "Operation Data", "Declared Data" and "Assignee Data".

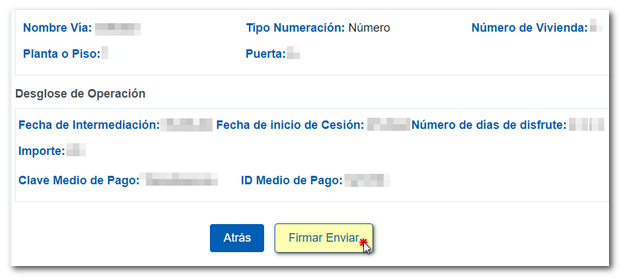

In the "Operation Data" tab, identify the fiscal year and period and fill in the declarant's data, the declared registry data, the property data and the transaction breakdown.

In the "Declared Data" and "Transferee Data" tabs, the owners or transferors of the home and the transferees will be identified. If you have NIF , you will have to be identified in the taxpayer census of the AEAT .

To minimise identification errors and obtain a correct identification of those declared, the "Tax Identification" service is available, which allows you to check a NIF of third parties for census purposes, returning the surnames and first names that appear in the Tax Agency Census associated with the NIF consulted, if these coincide in a certain percentage with the surnames and first names indicated.

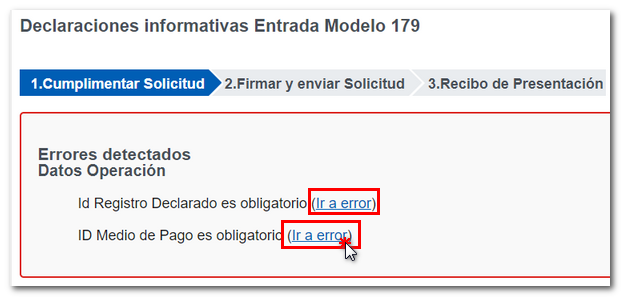

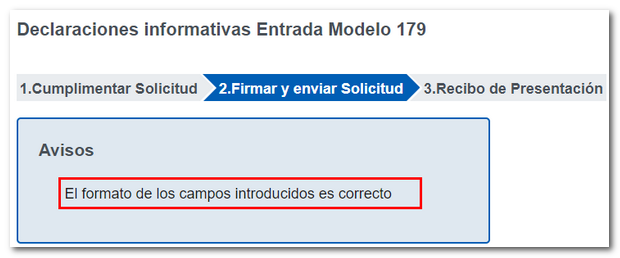

Once you have completed the form, in the "Operation Data" tab, click "Validate". Depending on the result of the validation, the "Notices" box will indicate whether the information provided is correct or whether there are errors that need to be corrected. In the latter case, the "Go to error" link directs you to the field or box where the error is located and which you must modify.

Once the validation is successful, click "Sign and Send".

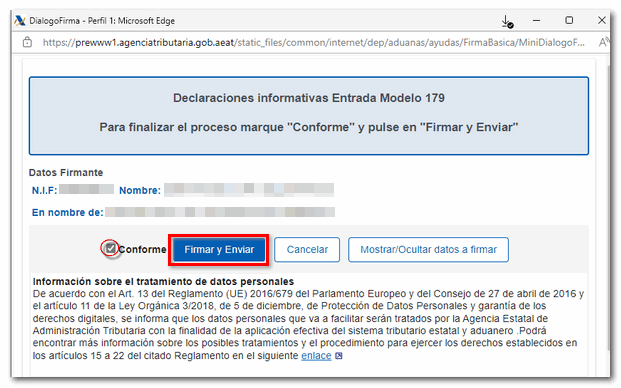

Finally, confirmation of shipment is requested. Check "I agree" and press "Sign and Send".

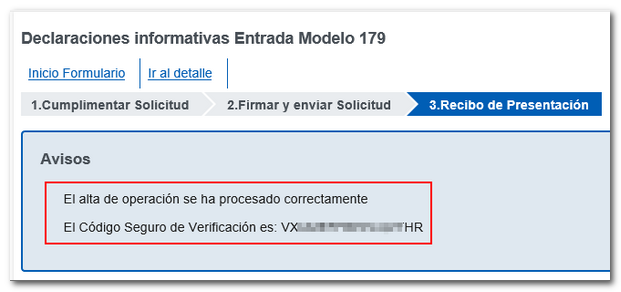

If the presentation is correct, you go to tab 3 "Presentation Receipt" with the CSV (Secure Verification Code) associated with this presentation.

To register new transactions, click on "Start Form", which takes you to the "Operation Data" tab of Form 179, with the declarant's data already filled in.

To check the submission made, as well as to modify or cancel submitted records, you have the option "Form 179. "Consult submitted declarations", in the procedures section of form 179.