Forms 038 to 180

Skip information indexForm 170

The presentation will take place from February 1st to March 2nd, 2026. ANNUAL of the 2025 fiscal year, regarding those informative declarations of the operations carried out by entrepreneurs or professionals subscribed to the payment management system via credit or debit cards.

The presentation with periodicity MONTHLY For the 2026 fiscal year and subsequent years, it will be carried out via WebService, based on message exchange XML with a maximum number of records per submission of 10,000, for this purpose the link "Model 170" will be used. Web Service Client. Fiscal Year 2026 and following. Monthly submission (up to 10,000 records). This will apply to those submissions of informative declarations of transactions carried out by entrepreneurs or professionals. attached to the collection management system through any type of card and through payments associated with mobile phone numbers. The submission may be made by the taxpayer, an authorized representative for this procedure, or a social collaborator, who must have a recognized electronic certificate.

Access to the presentation of form 170 for the year 2025 requires identification with an electronic certificate of the declarant or of a person or entity authorized to make submissions on behalf of third parties: social collaborator or representative.

Since submission of incorrect or unidentified records will not be accepted, we recommend that you allow sufficient time to correct erroneous records. Likewise, to avoid identification errors, purify the taxpayer census of each company beforehand using the Tax Identification service.

In addition, it will be necessary to have a file with the declaration that you are going to transmit, with the data adjusted to the published registry design. For electronic filing, it is necessary to have a file of the declaration you are going to transmit, with the data adjusted to the updated registration design. All alphanumeric and alpha fields are to be left justified and padded with blanks to the right, in upper case with no special characters, and with no accented vowels. For language-specific characters, use ISO-8859-1 encoding.

All numeric fields will be presented right-aligned and left-padded with zeros without signs and without packing.

All fields will have content, unless otherwise specified in the field description. If there is no content, numeric fields are to be filled with zeros and both alphanumeric and alphabetic fields with blanks.

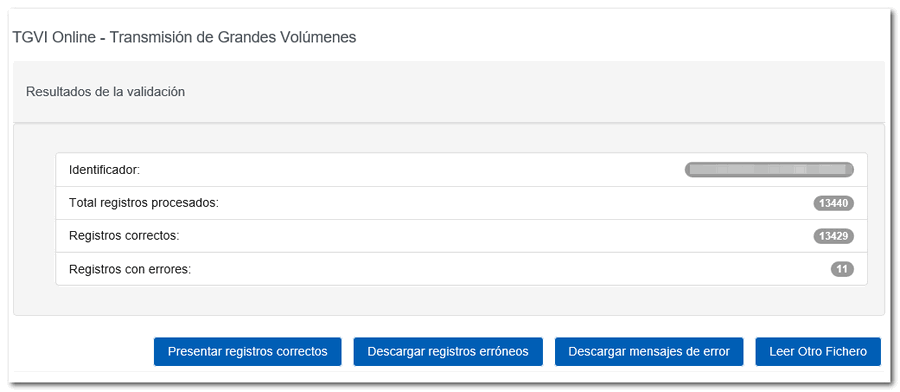

After identification, complete the NIF of the declarant and checks the fields "Model", "Exercise" and "Period".

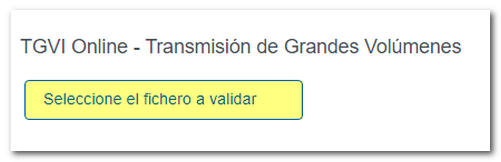

To send a file, press "Read File" Then, click on "Select the file to validate" to choose the file.

From the option "Recover" you can reload the last file validated by the application for that model, fiscal year and NIF . If you choose to validate a new file using the "Read file" option, any previous submissions for the selected combination will be lost since only the last validation is recovered.

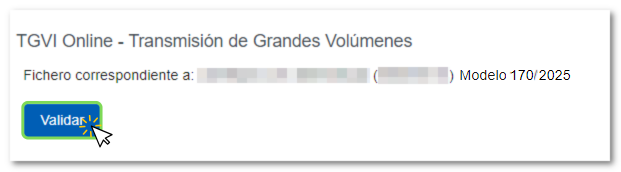

The name or company name of the declarant, NIF and model/year are reported. Verify that the data is correct and click "Validate" to transmit the file.

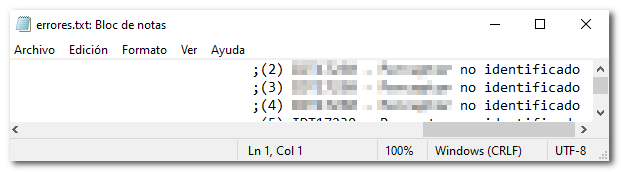

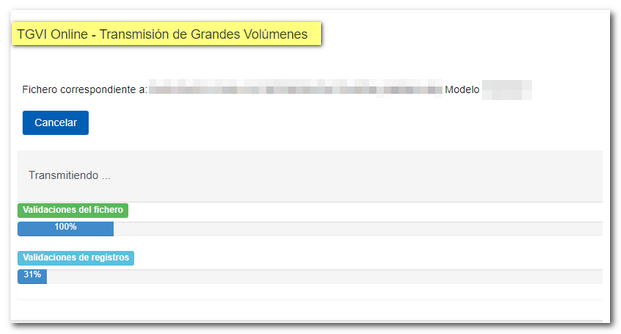

Once the file transmission and validation is complete, a summary of the result will be displayed; Please note that validation does not imply the submission of the declaration.

If the file is completely correct, you can proceed to submit the full declaration.

In the event that erroneous records are found, a breakdown of correct and erroneous records will be included.

From that moment on, the presenter will have several options:

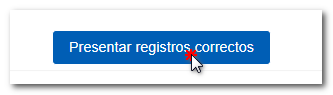

Submit correct records

Select this option to display only the correct records. In the next window, select "I agree" and click "Sign and Send."

You will get the filing receipt only with the correct records submitted in an embedded PDF , which you can save and print. The document contains the presentation information: registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details.

Erroneous records that have not been submitted must be corrected later in order to be submitted by means of a supplementary declaration.

Download erroneous records

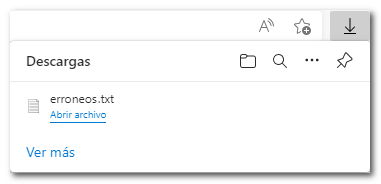

Using this option you can download a text file (adjusted to the published design) with all the erroneous records. Click "Download Error Logs" and you will be able to open or save the file to your computer.

The downloaded file will be updated to be consistent with the number of records included. In addition, the type 1 registry (declarant and summary) will include its own identification number, the complementary mark and proof of the previous submission.

This file is for your correction and presentation. It does not contain information about detected errors.

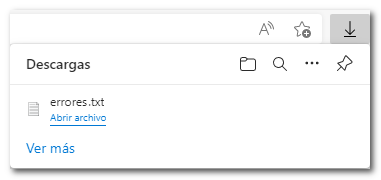

Download error messages

The downloaded text file contains the details of the errors detected for each type 2 erroneous record (Declared). An erroneous detail record will be displayed on each line with its corresponding error message. You need to move the scroll bar to the end of the lines to view the error codes and descriptions.

This file is for informational purposes only. It will be useful to identify the errors detected and proceed to correct and present them.