Forms 038 to 180

Skip information indexForm 180. How to issue certificates

Model 180 for the 2025 fiscal year allows the issuance of individual certificates (one single recipient) or collective certificates (several recipients) from the web form of the model available on the Electronic Office. You will be able to obtain the certification models proving withholdings and income on account of the PIT, of the ES and of the IRNR.

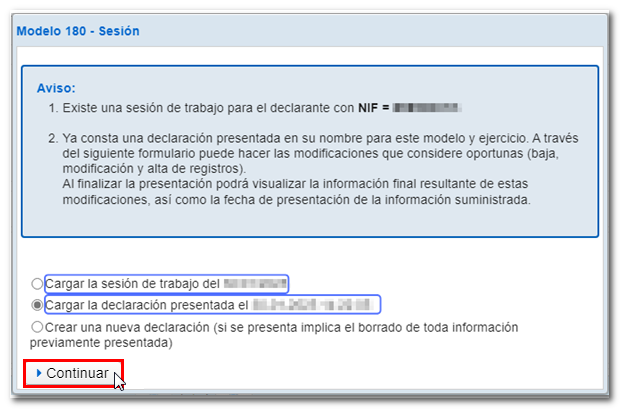

Access form 180 and complete the declaration on the form. Once you have entered the NIF of the declarant, you can also retrieve a previously saved session on the server or upload a declaration already submitted in the form. Another alternative is to import a file in BOE format that you have generated with an external program or using the "Export" button available in the form itself.

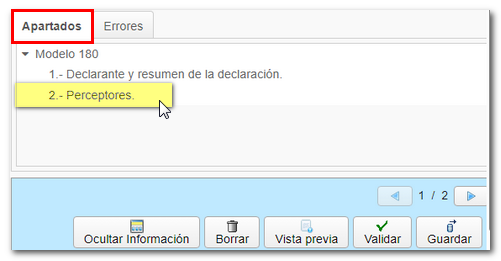

Next, in the "Sections" tab, select the "Recipients" option to view the recipients panel.

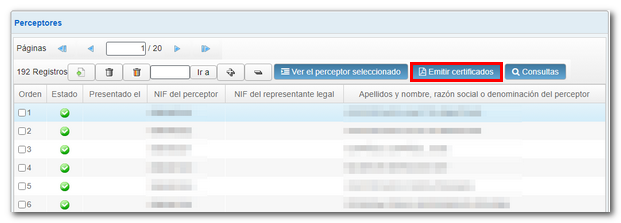

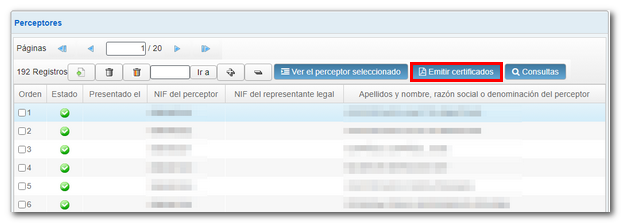

Mark one, several or all recipients; To select them all, click on the "+" symbol (for the reverse operation, to clear the selection, click on the "-" symbol) and press the "Issue certificates" button at the top. In the model preferences you can select the order in which the certificates are generated: by NIF or by Surname and First Name or Company Name.

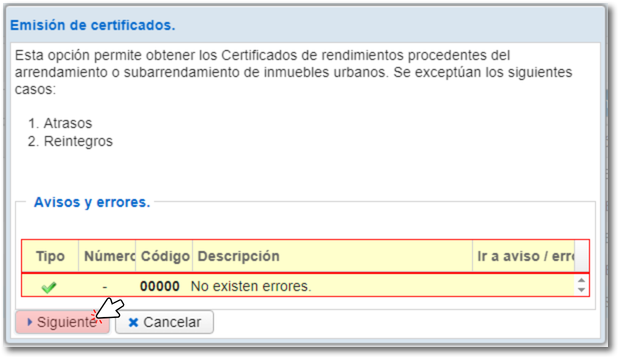

Follow the wizard's instructions to obtain it. Please note that in order to issue certificates, the declaration must not contain errors. Click "Validate" and correct the errors before issuing the certificates. In the wizard, click "Next."

Below is a list of the previously selected recipients; Re-mark one, several or all recipients using the "+" symbol. In addition, it is possible to enter the date and place of signature, although this is not mandatory. It will be necessary to complete the start and end dates when the lessor or sub-lessor is a taxpayer of Corporate Tax or a taxpayer of Non-Resident Income Tax (permanent establishments) and the tax period does not coincide with the calendar year. In this case, select the recipient for whom you are going to issue the certificate and click on the "Enter dates" tab.

Click "Next" to continue or return to the list of certificates.

You can select the language of the certificate from among the co-official languages. Click "Issue Certificates".

The certificate is displayed on the screen; If you wish to save it to your computer, use the link "You can click here to download the pdf" Please note that to correctly view the certificate you need a PDF viewer; We recommend the latest version compatible with your operating system. To return to the declaration, click on "Return to declaration" located at the top of the certificate window.

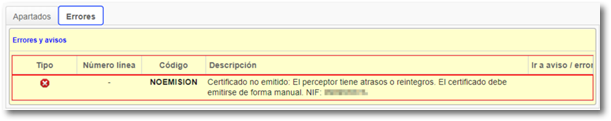

There are cases in which the certificate cannot be issued using this help form. In these cases, a notice will appear in the "Errors" section indicating that the certificate will have to be generated manually and the reason.

The form in PDF to fill out and print the certificate directly is also available in the "Information" section, "Withholding certificate" within the procedures for model 180.