Models from 199 to 289

Skip information indexForm 233 Filing of the declaration

Access to the filing of form 233 can be done with an electronic certificate or DNIe and, if the taxpayer is an individual, also with Cl@ve.

In addition to the holder of the declaration, the presentation may be made by a third party acting on his/her behalf, whether a social collaborator or a representative to carry out the general procedure or the specific procedure, GI45P.

When accessing the procedures for model 233, a notice informs that this information declaration is for the exclusive use of the owners of educational centers and should not be submitted by parents or guardians.

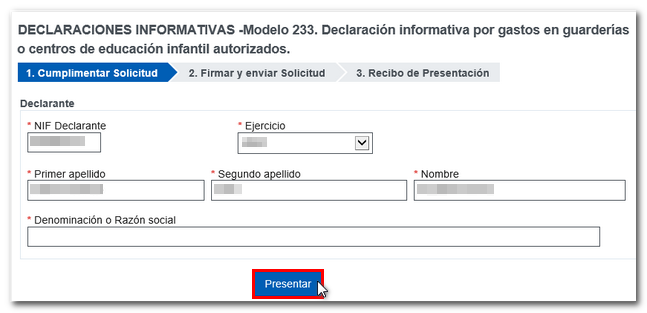

In the initial window " Fill out the application" enter the NIF of the declarant and the year of the declaration.

If the taxpayer is a natural person, fill in the surnames and first name. If it is a legal person or an entity under an income attribution regime, complete the "Name or Company Name". Press the "Introduce" to continue with completing the declaration.

The declaration contains the following sections:

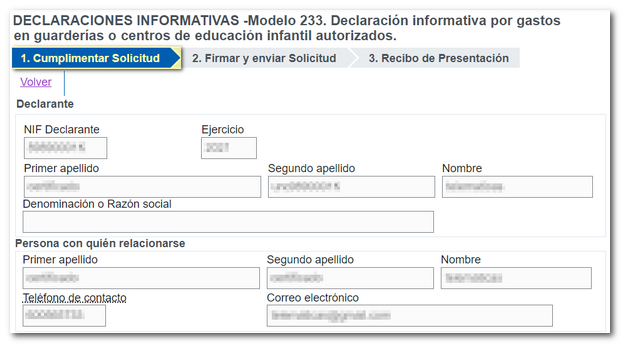

Filer

The declarant's data, previously entered (not modifiable at this point), and the contact details of the person to whom to relate and to whom to direct any type of information relating to the processing of the declaration are loaded.

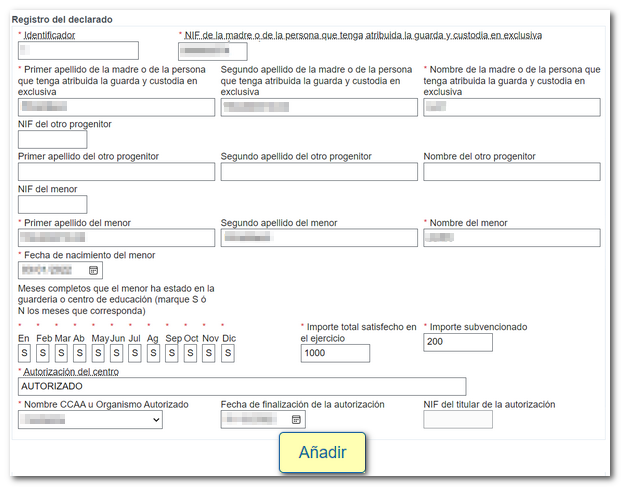

Record of the declared

You can choose to include those declared through the form, completing the data in all the fields marked with an asterisk.

The "Identifier" is a field chosen by the declarant, which must be unique, since, once used, it cannot be used again in the fiscal year to which the declaration refers. In addition, NIF and the name and surname of the mother or person who has custody of the minor must be entered, and, optionally, the same data of the other parent. It is not permitted to indicate the passport number instead of DNI or NIE .

The minor's details will then be indicated.

In the section "Full months that the minor has been in the nursery or early childhood education center", mark Y (Yes) or N (No), taking into account that Y (Yes) will only be entered if the minor has been there for the entire month.

Next, you will need to enter the total amount paid, including pre-registration fees, registration fees, attendance during general and extended hours, food, and the subsidized amount. Under no circumstances will these fields include amounts paid by the company or employer of the mother, father, guardian or foster parent of the minor.

Finally, in the "Type of authorization" field (mandatory completion) you will have to indicate a if the declarant has an authorization issued by the competent educational authority or a 2 if the declarant has another authorization.

The field "NIF of the holder of the authorization" will be completed if it is different from the one stated in the field NIF of the declarant.

Also indicate the name of the Autonomous Community or the Authorized Body.

To continue adding declared records, press the "Add" button . You will be able to see that the data will be loaded into the "Content" box of the file import section, located at the bottom.

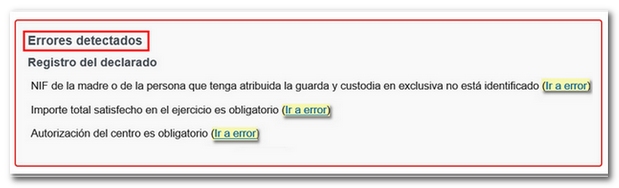

If errors are detected in the entered data when "Add" or "Submit", their description will be displayed in the box. "Errors detected", along with links to the fields you should review or correct.

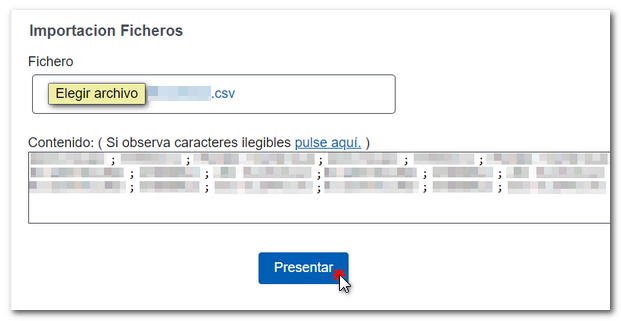

Import Files

The other alternative to incorporate declared is to import a file with format CSV separated by ";" with the data adjusted to the record design published for model 233 (allows editing of the imported data). Click the "Browse" button and locate the file containing your return data.

Please note that if you have entered the records manually using the "Declarant's record" option and then import a file, you will lose the data already entered and only the records from the file will remain. However, after importing a file, you can manually add records to aggregate them.

If some characters appear incorrectly encoded, click "click here" to fix it.

To prepare the file, the Tax Agency (AEAT) offers taxpayers a template consisting of a spreadsheet in .xlsx format which, once filled in, you must save in .csv (comma delimited) format. This template contains all the columns with their names (what we call the "header") made up of 36 fields and instructions on the format of the fields. This template can be found in "Technical Help" within the model procedures, "Documentation for the presentation of model 233", "Fiscal Year 2025 and following" with the name "Help template for the presentation of model 233 from fiscal year 2025 onwards".

If the imported file contains a header, manually remove that header from the "Content" box after reading the file in the form and removing any unreadable characters.

Once all the relevant records have been completed or the file has been imported, press the button "Introduce".

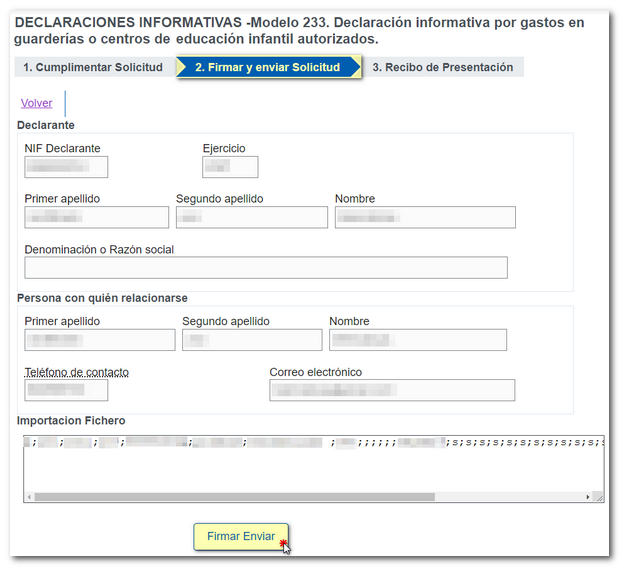

In the next step, "Sign and submit application"Review the information and click "Sign and Send".

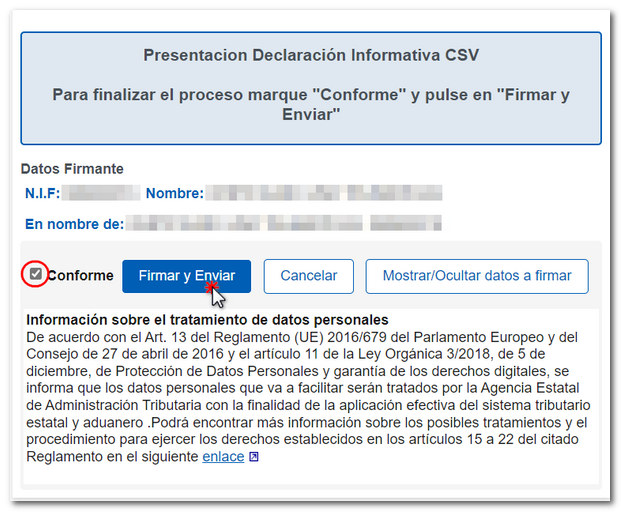

A new window will appear with the encoded data of the declaration. Brand "According" and press "Sign and Send".

If the presentation is correct, the system will display the following message:Process completed successfully along with the presentation details (date and time, code) CSV and NIF (from the presenter).