Models from 199 to 289

Skip information indexModel 232

The presentation must be made with an electronic certificate or DNIe of the declarant, also with Cl@ve in the case of collaborators or representatives. If the declarant does not have an electronic certificate, it is necessary that the certified person who makes the submission be a social collaborator or be authorized to submit declarations on behalf of third parties.

The deadline for submission is the month following the ten months after the conclusion of the tax period to which the information to be provided refers.

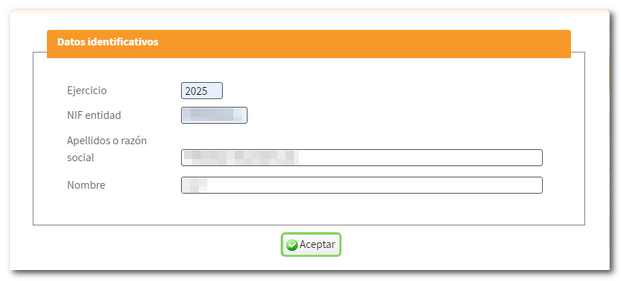

Enter the initial exercise data, NIF and the full name of the holder.

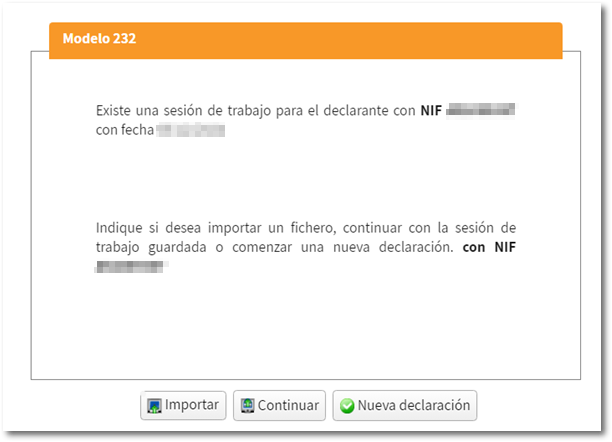

If there is a session started and saved on the servers of the AEATA window will appear informing you whether you wish to continue the saved declaration, start a new declaration, or import a file generated previously or with an external program following the record design.

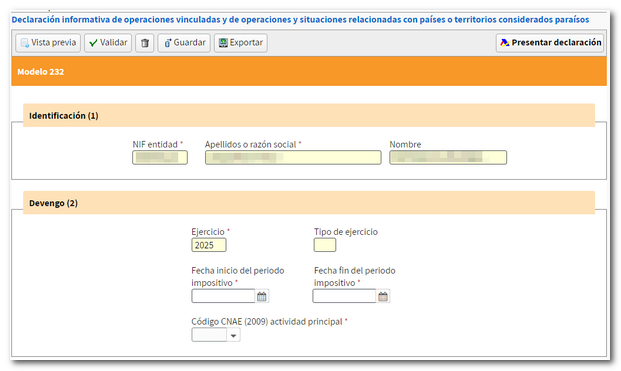

Once in the form, fill in the identification and accrual data on the form. Fields marked with an asterisk are required. The boxes for the fiscal year and type of fiscal year will be automatically filled in with the selected start and end dates for the tax period.

The type of exercise will be automatically calculated taking into account the following details:

-

Financial year lasting 12 months, coinciding with the calendar year.

-

Financial year lasting 12 months, which does not coincide with the calendar year.

-

Financial year lasting less than 12 months.

Then, complete the sections of the operations that are the subject of the presentation: 3. Information on transactions with related persons or entities, 4. Transactions with related persons or entities in the event of application of the reduction of income from certain intangible assets, 5. Operations and situations related to countries or territories classified as tax havens.

In each of them, you will find a button panel from which you can register, deregister and navigate between records. To create a record, click on the "New record" icon, identified by a blank sheet of paper with a green "+" sign.

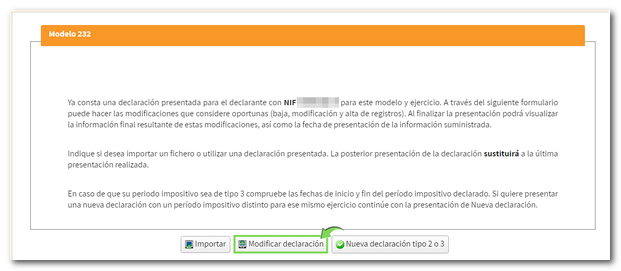

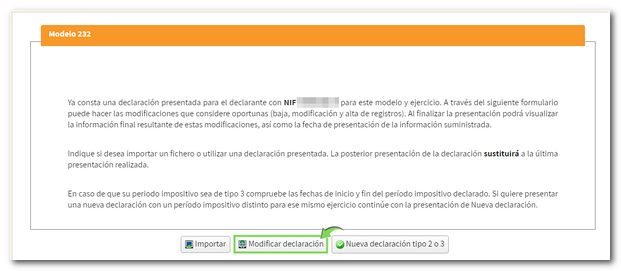

If a previously submitted declaration exists and you wish to delete and modify existing records or register new records, accessing the form will display the following screen:

Select "Modify declaration" and then choose the desired option, "Complementary" or "Substitute".

In both cases, the form will show the option "Supplementary Declaration" or "Substitute Declaration", depending on the previous choice, and the receipt number of the previous declaration.

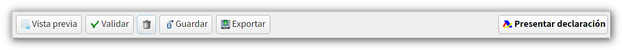

Once the form is completed, the buttons with the functionalities are located at the top of the form.

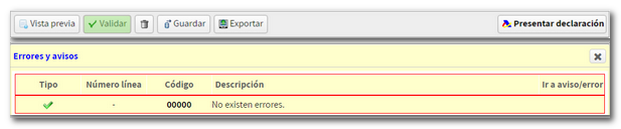

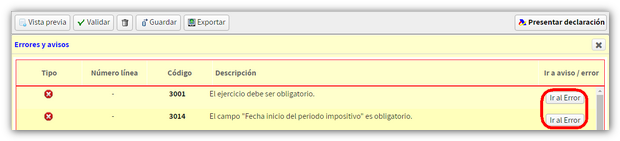

Check if you have any warnings or errors from the "Validate" button. At the bottom you will see the "Errors" tab with any warnings or errors detected. Remember that the notices provide relevant information to take into account, but do not hinder the filing of the declaration. If the declaration contains errors, these must be corrected.

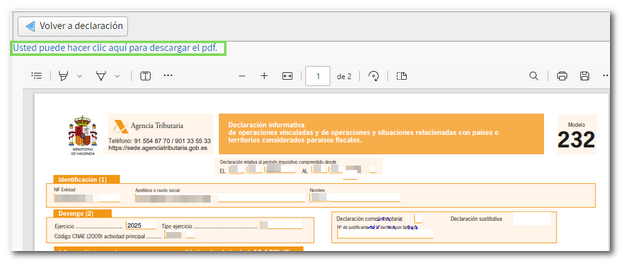

If you want to obtain a draft to review the data before filing your return, you have the "Preview" tool that generates a PDF , not valid for filing, with the return. The PDF is displayed on the screen, however, from "click here to download the pdf" you can download it to your computer, keep in mind that to correctly view the draft you need a PDF s viewer, we recommend the latest version compatible with your operating system. To return to the declaration, click on "Return to declaration" located at the bottom of the draft window or create a new declaration from the "New declaration" button.

Using the "Export" button you can generate a file with the format of the published logical design, provided that the declaration does not contain errors, and save it in the path you want. By default it is saved in the "Downloads" folder according to the browser options. This file has the name NIF , fiscal year, period and extension .232. The "Save" button allows you to generate a declaration in the cloud that can be retrieved when you re-enter the presentation. When you access it, the system will tell you if there is a declaration in progress or if one has already been submitted.

After validating the declaration, you can submit it by clicking the " Submit declaration " button.

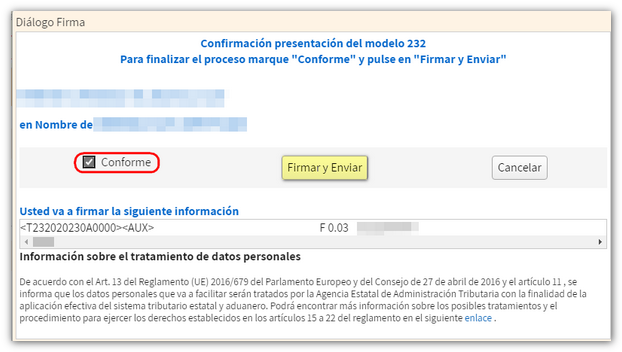

In the new window, check the "Accept" box to confirm the filing of the declaration. The text box will display the encoded content of the declaration. Finally, press "Agree" and "Sign and Send" to continue with the presentation.

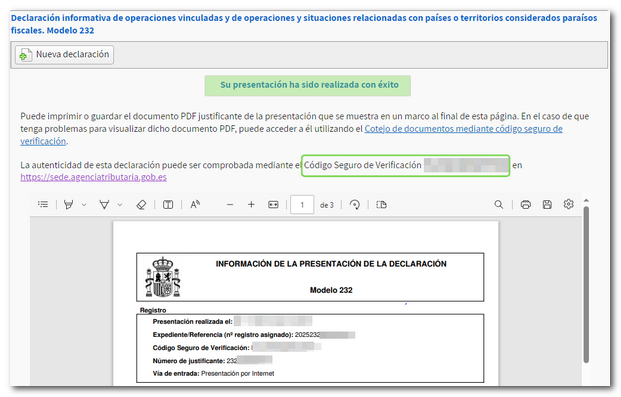

The result of a successful filing will be a response page with an embedded PDF containing a first page with the filing information (registration entry number, Secure Verification Code, receipt number, filing day and time, and filer details) and, on subsequent pages, the full copy of the return.