Models 181 to 189

Skip information indexModel 187 Submission by form

Filing form 187 is available for declarations with fewer than 40,000 records and requires identification with an electronic certificate or Cl@ve of the declarant. For larger files you must use the file presentation.

The presentation requires that you identify yourself using an electronic certificate, DNIe or Cl@ve .

In addition to the holder of the declaration, it may also be submitted by a person or entity acting on his or her behalf, whether a social collaborator or a representative to carry out the procedure.

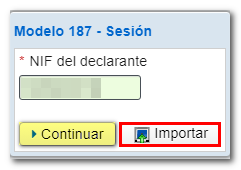

You will access an initial data capture window. Enter the NIF of the declarant and select one of the available options.

The button "Matter" It allows you to retrieve a file previously generated with the form itself from the "Export" option or with an external program, as long as it conforms to the published logical design.

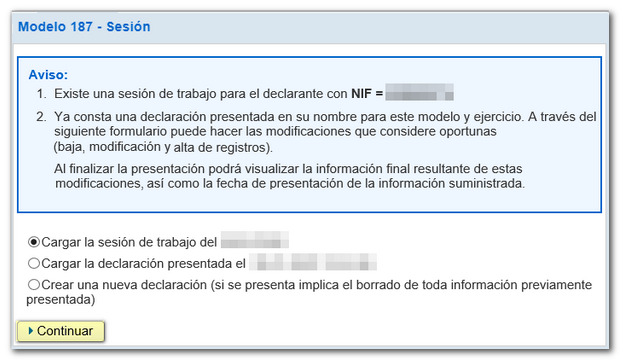

The "Continue" button provides access to the form for online completion and submission. You can offer 3 options:

-

"Load work session from...": Using this option you can recover data from a session that you had previously saved.

-

"Upload the declaration submitted on...": If you have already submitted a declaration for the same NIF , model, fiscal year and period, you can recover it and make changes, add or delete records from the "Operations" section.

-

"Create a new statement": Select this option if you want to complete the form from the beginning, without recovering data.

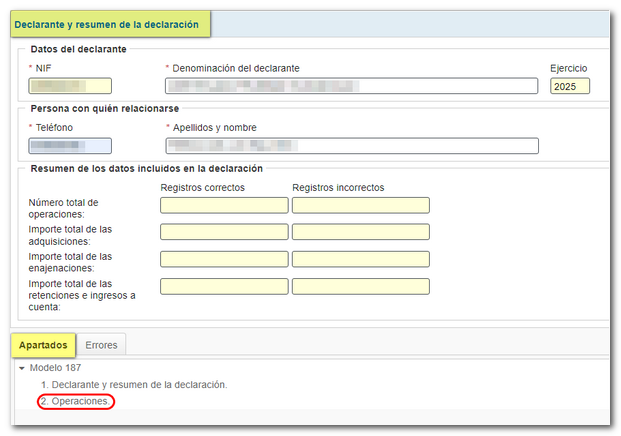

After the initial window you will access the form. Fields marked with an asterisk are mandatory.

The section "Summary of the data included in the declaration" is automatically filled in with the data entered in "Operations". Access the "Operations" section from the "Sections" tab.

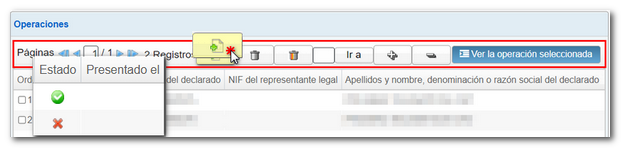

In " Operations " you will find a top button bar from which you can add the different records, as well as delete and consult them. To create an operation, click on the icon "New record" identified by a blank sheet with a green "+" sign.

To view the details of an operation or modify the data, select the record and click "View the selected operation".

In the " Status " column you can check the correct and incorrect records or those with warnings. In the column named " Filed on ", if you have uploaded a previously filed return, the date and time that record was filed will be displayed, with the option to modify or delete it if necessary.

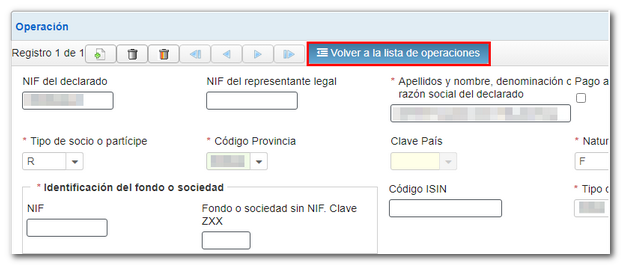

From the details of an operation you can add more records or "Return to the list of operations".

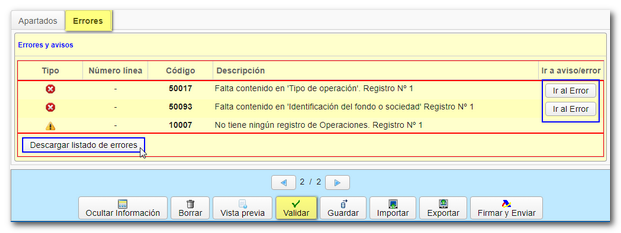

Press " Validate " to check for errors. If the statement contains no errors you will get the message "No errors exist". If you have errors or warnings, a description of them appears and the option "Go to Error" or "Go to Warning" to solve them. Using the "Download error list" option, a file in XML format will be generated with all the errors detected, which you can open or save on your computer.

Using the "Save" option you can save the data completed up to that point on the server, even if the declaration is not validated (it may contain errors or be incomplete). This way you can exit the form without losing any information. Likewise, if the form were to close after the inactivity timeout period, you could recover the data entered up to the time of saving. If a tax return has been saved previously, it will be overwritten.

To retrieve the saved information, access form 187 again. In the initial window, after indicating the NIF of the declarant and clicking "Continue", select the option "Load the work session for dd/mm/yyyy".

Before filing your return you can obtain a " Preview ", which consists of a PDF with your return, this document is not valid for filing.

The button "Export" generates and saves a file in the format BOE with the published registration design. This option requires that the declaration contains no errors.

You can recover the exported file, or generated from an external program according to the published record design, using the "Import" button.

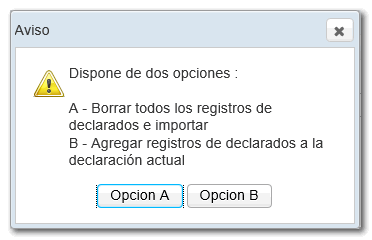

If the return already contains data, you will be offered 2 import options after selecting the file:

- A. Delete all declared records and import (all existing declared records will be deleted before importing the file).

-

B. Add declared records to the current declaration (imported records will be added to existing ones)

After validating and saving the declaration, click " Sign and Send ".

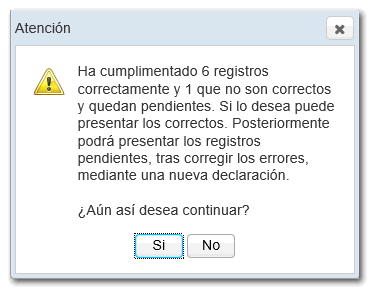

A notice will be displayed informing you of the number of correct and incorrect records that have been completed. If you want to return to the declaration to correct errors before filing, click "NO". If you prefer to submit the correct records now and then correct the errors and file a new return later, click "Yes."

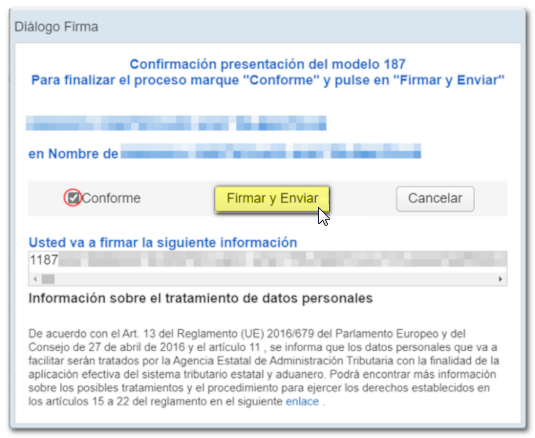

Check the "According" box. Below you will be informed about data processing. To finish, click "Sign and Send."

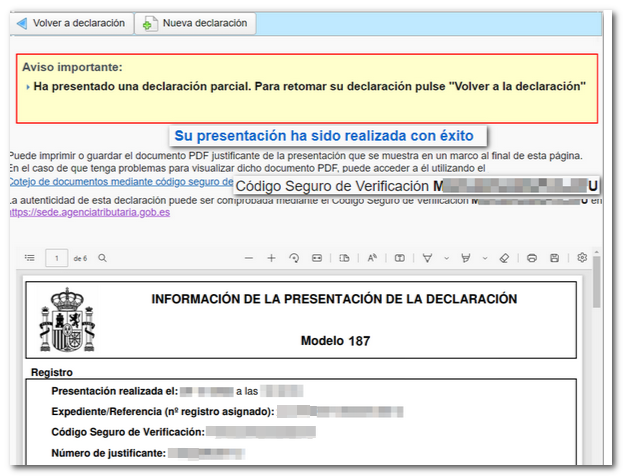

The screen will display the PDF of a successfully submitted submission, the CSV that verifies the authenticity of the document and the possibility of returning to the declaration or generating a new one.

If you have submitted a declaration with some valid records and some incorrect ones, the correct ones will be presented and you will be notified that you are going to send a partial declaration. Retrieve the submitted declaration, make the corresponding additions or deletions and submit a new declaration.

Note: Please note that the usual complementary and substitute options do not exist in this form. Once the necessary corrections have been made, you must submit the complete return, including all records that must be declared.