Previous years

Skip information indexHeritage 2016 - Presentation by file

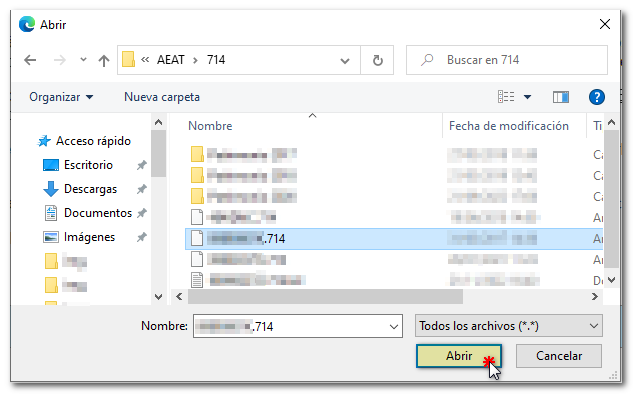

If you have a file that complies with the specific registration design for model 714 of 2016, or that has been previously saved with the 2016 Asset Processing Service available on the Electronic Office, you can submit the declaration.

To access, identification with an electronic certificate is required, DNIe , Cl@ve or Income reference obtained from the RENØ service corresponding to the last Income campaign.

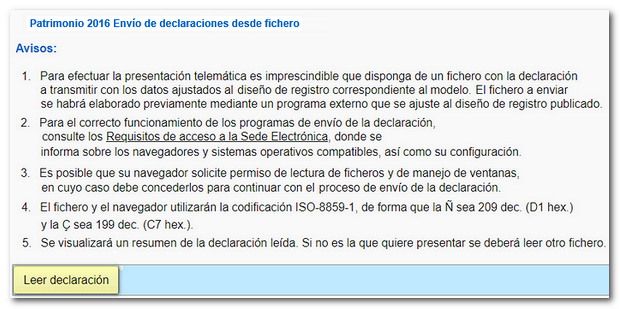

After identification, the requirements for submission and the "Read declaration" button to select the declaration file appear.

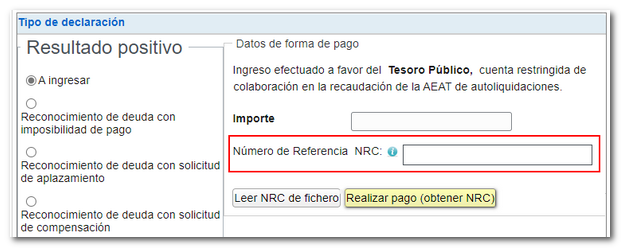

A summary of the declaration will be uploaded with the identification data, the economic data and the result of the declaration. If the result is an income, you must include the NRC (proof of payment). You can get it immediately by clicking the "Make Payment" button. Get NRC " or select one of the debt recognition options. Once all the details have been filled out correctly, click "Sign and Send" to submit the application.

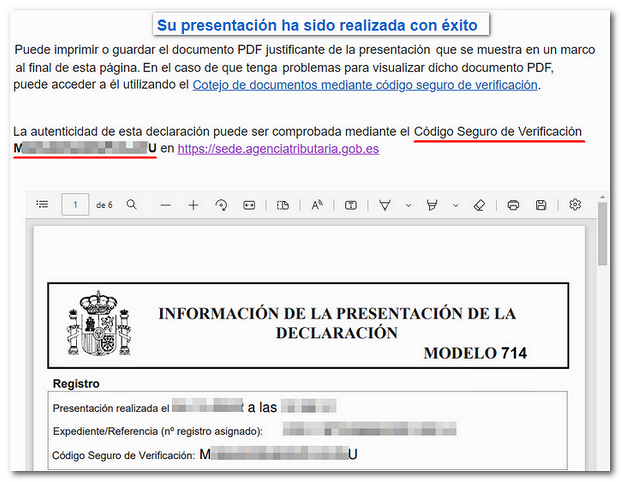

The result of a successful submission will be a page with the receipt, the assigned CSV , the link to the "Document Matching..." option and an embedded PDF with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and submitter data) and the complete copy of the declaration.