Previous years

Skip information indexAssets 2017 - Asset processing service for collaborators

Social collaborators adhering to the corresponding agreement may submit the 2017 Asset Declaration of third parties by identifying themselves with the electronic certificate of social collaborator. If you are not registered as a collaborator or an error appears, you can consult the information related to Social Collaboration.

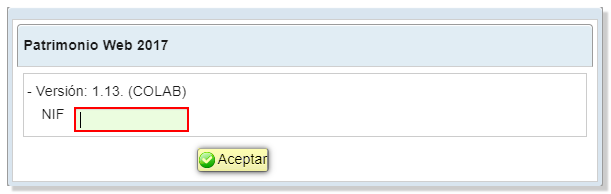

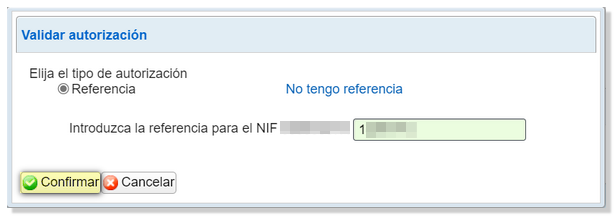

In the first window, enter the DNI or NIE of the taxpayer. Then, by clicking "Accept" the system will request the reference number of the holder if you wish to incorporate the declarant's tax data directly into the different sections of the declaration.

In the event that it is not possible to obtain the reference due to the particular conditions of the declarant, by clicking the " Cancel " button in the "Validate authorization" window, form 714 can be completed from scratch, without automatic incorporation of tax data.

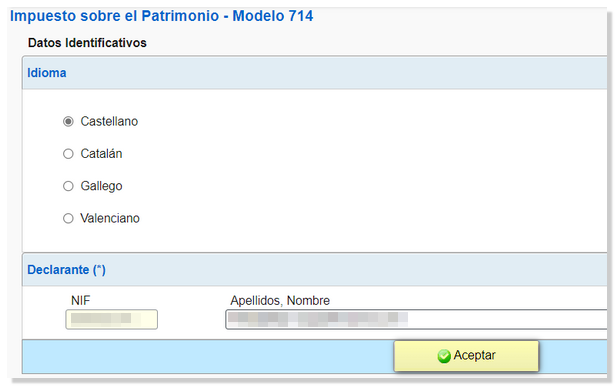

The home page will contain identification data and the language of the declaration. You can modify them if necessary. If a previous session of Patrimonio WEB is recognized, you can recover the declaration or start a new one.

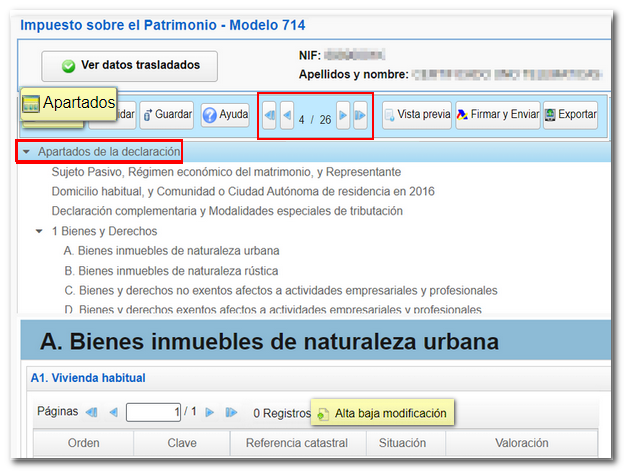

Once in the web form, you can complete the declaration by browsing through the different pages that make it up or by using the "Sections" button to access the different sections.

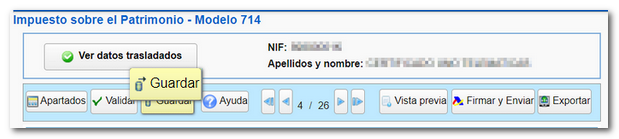

You can save the declaration on the server to return to later if you wish by using the "Save" button.

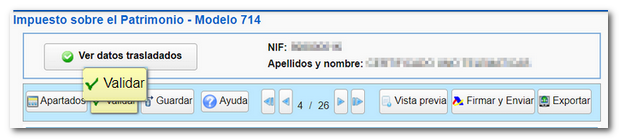

Once completed, it is recommended to verify that there are no errors using the "Validate" option.

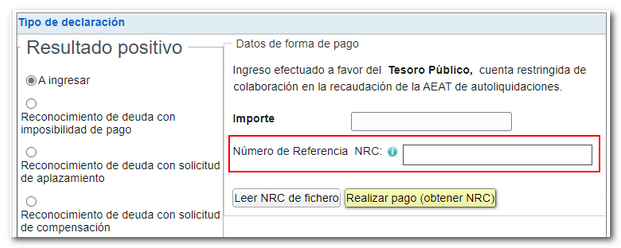

Once you have completed the form and verified the result on the last page, if the result is a payment, in the "Type of declaration" section, choose the payment method.

Direct debit not available as the voluntary submission period has ended. Therefore, you will have to make the payment using NRC or select other payment methods such as debt recognition. Please note that payment via the payment gateway will only be available if you have accessed with a certificate, DNIe or Cl@ve . Otherwise, you will have to contact the bank to provide the self-assessment details and generate the corresponding NRC , which you must enter in the "Reference Number NRC " field.

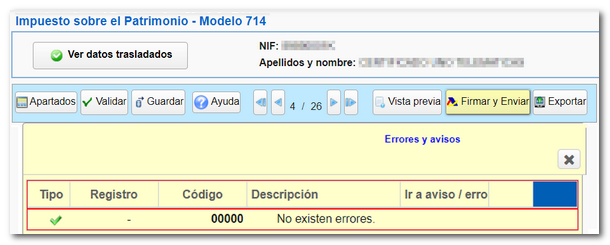

Finally, if there are no errors that prevent submission, click "Sign and Send."

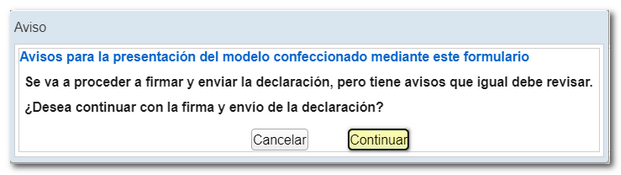

A notice will appear before the presentation window warning of the possibility of reviewing the data. Click "Continue" to proceed with the filing or "Cancel" to return to the declaration.

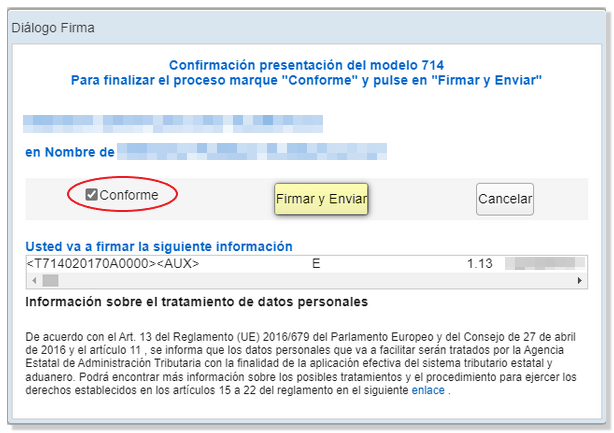

In the next window, check the "I agree" box and click "Sign and Send."

Once the return has been submitted, you will see the message "Your submission has been completed successfully" and the assigned secure verification code. In addition, a PDF will be displayed containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter data) and, on the subsequent pages, the submitted declaration.