Previous years

Skip information indexAssets 2017 - Asset processing service with power of attorney

Those who have general and specific powers of attorney related to form 714, 714P or GENERALLEY58, may use the WEB Assets service corresponding to the 2017 fiscal year to submit the declaration of their principals. You can consult the list of available powers of attorney in the "Collaborators" portal, under "Power of Attorney Registry".

To access, identification with an electronic certificate is required, DNIe , Cl@ve or a Renta reference obtained for the last Renta campaign.

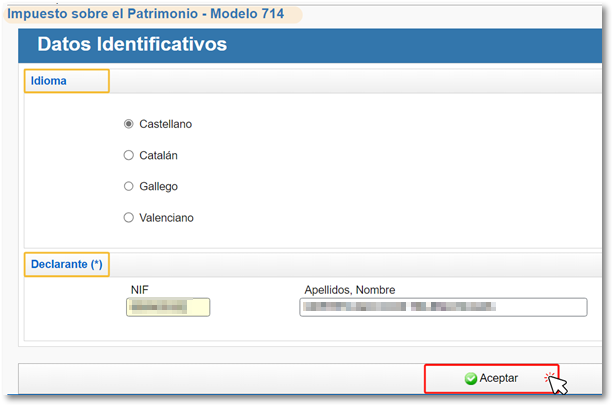

In the first window, enter the DNI or NIE of the taxpayer and click "Accept".

If this is your first access, the first page will contain identification data and the language of the declaration. You can modify it if you wish, then click "OK".

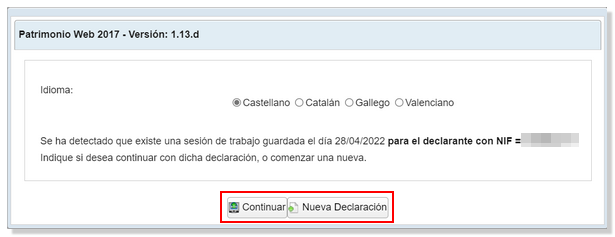

If you have already been working with the form, the system detects this and allows you to continue with that last declaration or start a new one.

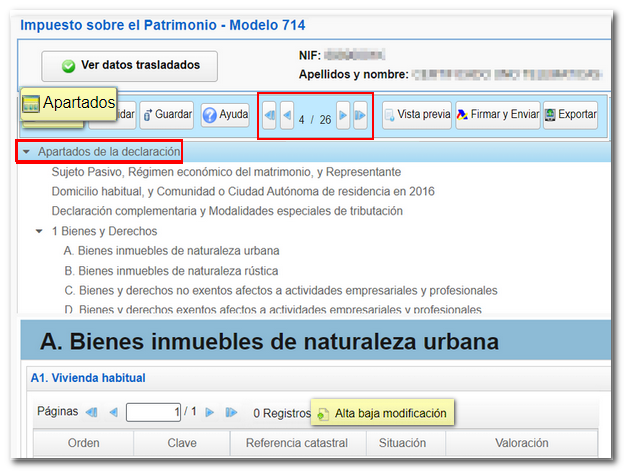

Once in the web form you can complete the declaration by browsing through the different pages that make it up or by using the "Sections" button to access the different sections.

You can save the data entered in the declaration on the server so that you can return to it later using the "Save" button.

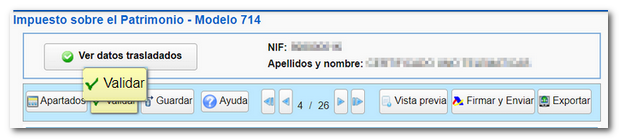

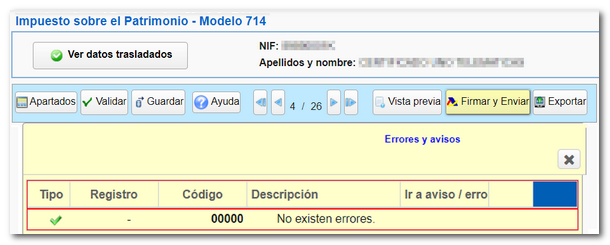

Once completed, it is recommended to verify that there are no errors using the "Validate" option.

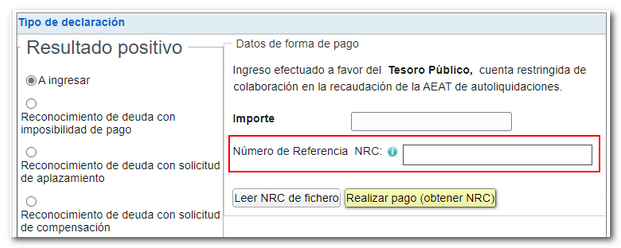

Once you have completed the form and verified the result on the last page, if the result is a payment, in the "Type of declaration" section, choose the payment method.

Direct debit not available as the voluntary submission period has ended. Therefore, you will have to make the payment using NRC or select other payment methods such as debt recognition. Please note that payment via the payment gateway will only be available if you have logged in with a certificate, DNIe or Cl@ve . Otherwise, you will have to contact the bank to provide the self-assessment details and generate the corresponding NRC , which you must enter in the "Reference Number NRC " field. If you choose to pay using NRC please note that to obtain the NRC from the "Make payment (get NRC )" button using the taxpayer account, you must have received a power of attorney to process the payment from your representatives in the PAGOAPODECCC procedure.

Finally, if there are no errors that prevent submission, click "Sign and Send."

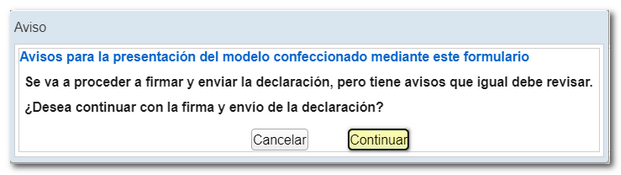

A notice will appear before the presentation window warning of the possibility of reviewing the data. Click "Continue".

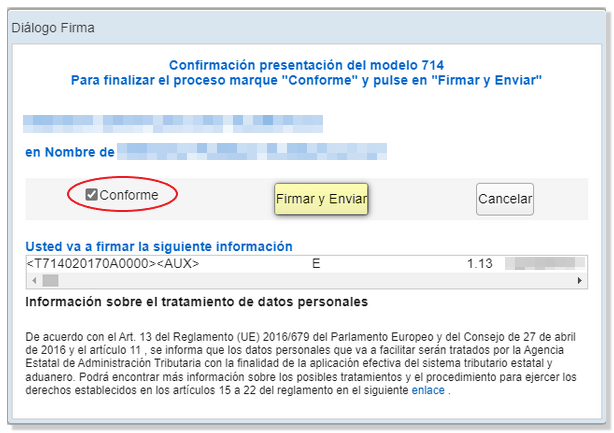

Finally, if there are no errors that prevent submission, mark "Accept" and press "Sign and Send."

If the declaration is submitted correctly, you will receive a page with the message "Your submission has been completed successfully" and the assigned secure verification code. In addition, a PDF will be displayed containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter data) and, on the subsequent pages, the submitted declaration.