Previous years

Skip information indexAssets 2018 - Asset processing service with power of attorney

Those who have general and specific powers of attorney related to form 714, 714P or GENERALLEY58, may use the WEB Assets service corresponding to the 2018 fiscal year to submit the declaration of their principals. You can consult the list of available powers of attorney in the "Collaborators" portal, under "Power of Attorney Registry".

To access, identification with an electronic certificate is required, DNIe , Cl@ve or a valid Income reference obtained for the last Income campaign.

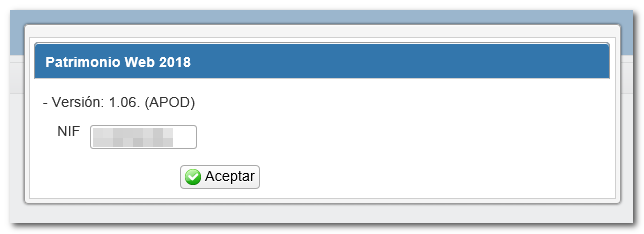

In the first window, enter the DNI or NIE of the taxpayer and click "Accept".

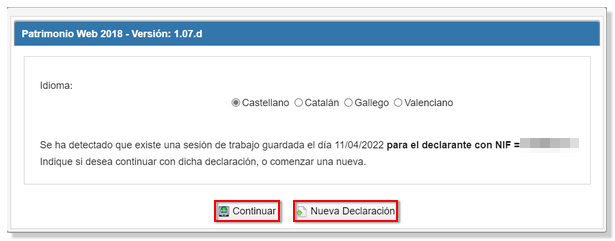

If you have already been working on the form, the system detects this and allows you to continue with that last declaration or start a new one.

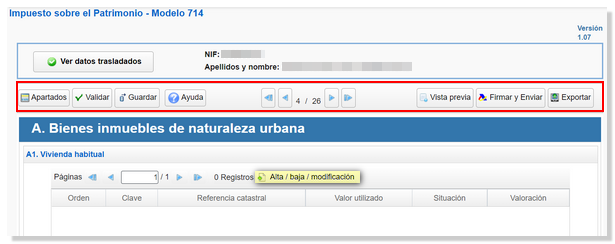

Once in the web form you can complete the declaration by browsing through the different pages that make it up or from the "Sections" button to access the different sections.

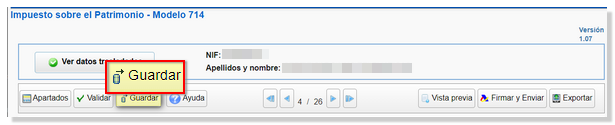

You can save the declaration on the server to return to it later if you wish, using the "Save" button.

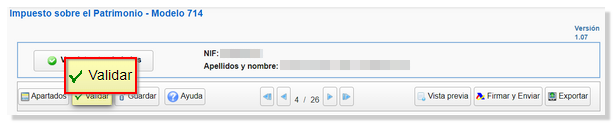

Once completed, it is recommended to verify that there are no errors using the "Validate" option.

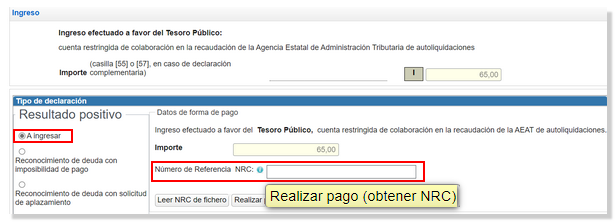

Once you have completed the form, check the result on the last page. If the result is a payment, in the "Type of declaration" section, choose the payment method.

Direct debit not available as the voluntary submission period has ended. Therefore, you will have to make the payment using NRC or select other payment methods such as debt recognition. Please note that payment via the payment gateway will only be available if access has been made with a certificate, DNIe or Cl@ve . Otherwise, you will have to contact the bank to provide the self-assessment details and generate the corresponding NRC , which you must enter in the "Reference Number NRC " field.

If you choose to pay using NRC , you must keep in mind that to obtain the NRC from the "Make payment (get NRC )" button, using the taxpayer's account, you must have received a power of attorney to process the payment from your representatives in the PAGOAPODECCC procedure.

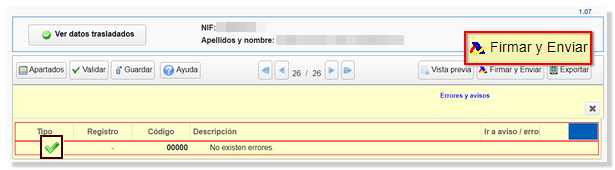

Finally, if there are no errors that prevent submission, click "Sign and Send."

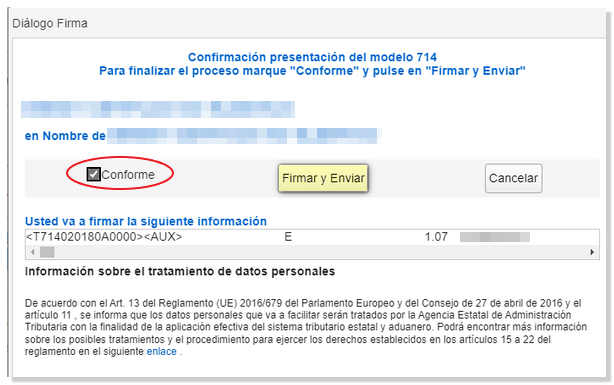

Then check the "I agree" box and click "Sign and Send."

Once the return has been submitted, you will see the message "Your submission has been completed successfully" and the assigned secure verification code. In addition, a PDF will be displayed containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter data) and, on the subsequent pages, the submitted declaration.