Models 291 to 347

Skip information indexModel 296 Submission by file

The presentation of model 296 by file is done through TGVI online. This submission method is available for files with more than 40,000 records, although submission of files with any number of records will be permitted.

Using this option, if the file contains correct records along with other incorrect ones, you can partially submit the correct records and download the incorrect records, as well as the reason for the error in a text file, and then, once the errors have been corrected, send them through supplementary declarations.

Filing form 296 requires identification with an electronic certificate, electronic DNI or Cl@ve of the declarant.

We recommend that you clean up your taxpayer registry using the Tax Identification service before submitting your tax return to avoid identification errors. To do this you can use the option available on the website: "Checking a NIF of third parties for census purposes" located in "Help", "Tax Identification" of the section "2025 Informative Declarations Campaign". You will also find this option in the procedures for Form 030.

Remember that the file with the declaration that you are going to transmit must conform to the published registry design.

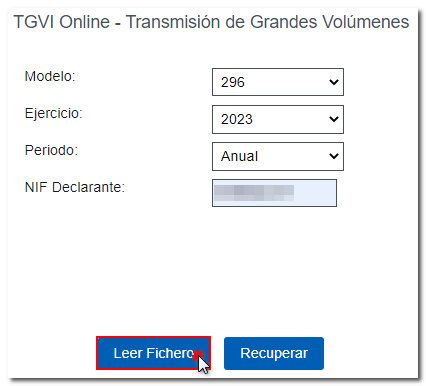

Fill in the required data in the initial window.

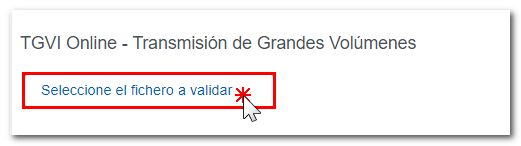

To send a file press "Read file" and then "Select file to validate" to select the file. Using the "Recover" button the information of the last validated file for the same NIF , fiscal year and period will be displayed.

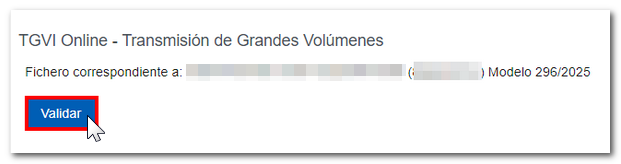

Verify that the declarant's identification data, the model and the fiscal year are correct and click on "Validate" to transmit the file.

During the transmission, two progress bars will appear indicating the validation percentage of both the file and the records.

At the end of the transmission, a summary of the validation result will be displayed.

Note: In this step of the process only the file is validated. The presentation can be done in later steps.

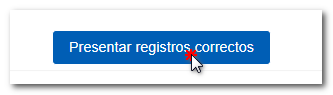

If the validation is correct, you will be able to submit the application and obtain the corresponding receipt. If errors are detected, a breakdown of correct and incorrect records will be included, and the options will be available. "Submit accurate records", "Download erroneous records", "Download error messages" and "Download notifications".

Submit correct records

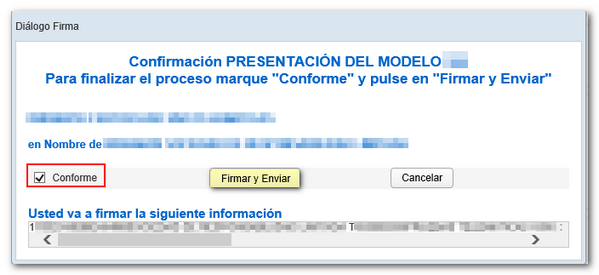

Select this option to display only the correct records. In the next window, select "I agree" and click "Sign and send."

You will get the filing receipt only with the correct records submitted in an embedded PDF , which you can save and print. The document contains the presentation information: registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details.

Erroneous records that have not been submitted must be corrected later in order to be submitted by means of a supplementary declaration.

Download erroneous records

A file will be downloaded with the current registration design format and the total number of erroneous records.

Click "Download Error Logs" and you will be able to open or save the file to your computer.

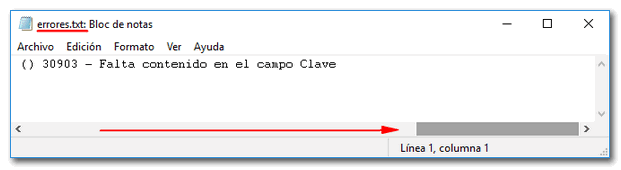

Download error messages

The downloaded text file contains the details of the errors detected for each type 2 erroneous record (Declared). An erroneous detail record will be displayed on each line with its corresponding error message. You need to move the scroll bar to the end of the lines to view the error codes and descriptions.

This file is for informational purposes only. It will be useful to identify the errors detected and proceed to correct and present them.

Download notices

Select this option to download the text file with the logs that contain warnings or alerts and that should be reviewed. Click on "Download Notices" and you will be able to open or save the file on your computer.

The downloaded text file contains the details of the detected warnings. The type 2 record that generated the warning will be included, followed by a separator and finally the warning message.

The file will include one line for each type 2 record. If a record contains more than one warning condition, then the same type 2 record may appear on multiple lines of the same file, each with a different warning message.